Technical indicators aren’t normally my area of expertise. I started my career as a die-hard value investor. My dad was a value investor portfolio manager, and he’s always been my role model. So I absorbed everything that he taught me.

The mantra to buy low P/E stocks was one that resonated with me. Usually, investors think growth companies will grow forever and pay accordingly. Usually (there are exceptions like Amazon (AMZN)!) growth eventually disappoints and growth stocks suffer from two problems: 1) lower estimates and 2) multiple contraction.

The downside can be gut wrenching (check out Ark Innovation (ARKK)). After all, it’s a long path down from being a growth stock to a value stock.

[text_ad]

I used to believe that it’s a much safer path to buy boring, crappy value stocks that are trading at cheap P/E multiples. Crappy value stocks are priced as if they are going to be crappy stocks forever. Eventually, something good might happen and when it does, the upside can be explosive.

Like most investors, I’ve learned a lot from reading investment books and invested my own personal money. Over time, I’ve come to appreciate that there is no one correct way to make money in the market.

The Stock Market Wizard books convinced me in an undeniable way that there is an infinite number of ways to make money in the market. There is no “right” approach—just a right approach for you and your personality.

In truth, I look back at myself and cringe at my arrogance.

There are good value investors, good growth investors (just look at my colleague Tyler Laundon’s performance in his Cabot Small-Cap Confidential advisory!), good momentum investors, good macro investors and good technical investors.

One approach that I’ve come to appreciate recently is technical analysis.

I know very little about technical analysis, but I have respect for those that do.

And thanks to Twitter, I now have access to some of the experts.

These 3 Technical Indicators are All Bullish

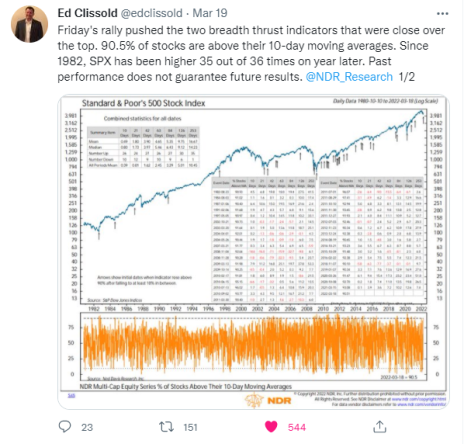

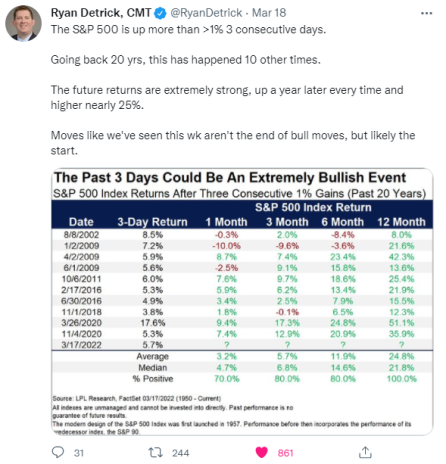

You can check out the charts below for yourself, but in summary, the behavior of the market last week was extremely bullish.

The key point that I take away from the above is that last week’s move in the market is typically not associated with bear markets, but with bull markets.

To be clear, I’m a bottom-up investor. I’m not buying an S&P 500 ETF or S&P futures based on this insight.

My approach is to look for individual stocks (usually micro-caps) that look compelling.

My ideal set-up is a stock with the following characteristics:

- Growing

- Cheap (absolute/relative)

- Positive momentum

- Not overextended (at or near 50-day moving average)

- Illiquid

- Bonus points:

- Recent insider buying

- Underfollowed on Twitter, Seeking Alpha, and Value Investors Club

But I do find it comforting to know that the market looks constructive from a technical perspective. According to the technicians, the market is about to rip. Invest accordingly!

[author_ad]