I’ve previously highlighted Key Demographic Trends that I believe will provide the next great investing profits. And today, I’ll focus on Environmental, Sustainable and Governance Investing (ESG), also called Impact or Socially Responsible Investing (SRI). Socially responsible investments are made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return.

Impact investing is becoming increasingly interesting to investors. A recent report from the Morgan Stanley Institute of Sustainable Investing noted that 85% of individual investors and 95% of millennials say they are interested in sustainable options. However, only about one-half of them really invest in companies whose mission is to positively impact society or our environment—and make money too!

[text_ad]

And lest you think that socially responsible investing is a new fad, you would be wrong. The concept actually dates back to biblical times, when Jewish law mandated ethical investing. In the U.S., the Methodists—in the 18th century—were advised to resist investing in companies manufacturing liquor or tobacco products or promoting gambling. Today, many religions advocate some sort of socially responsible investing, but the idea has expanded well beyond religious teachings.

In the 1960s—the Vietnam War era—protesters called on universities to cease investing in defense contractors. As the antiapartheid movement in the late 1960s and early 1970s geared up, there was a global outcry to halt investing in South Africa, and that led to the establishment of the first SRI fund—Pax World Fund, created in 1971.

The concept has evolved to include companies that fight against climate change, advocate renewable resources, want to create a more equitable world, eschew ‘sin’ stocks (gambling, alcohol, tobacco, guns, even marijuana), and those that promote ethical work practices, a diverse Board of Directors, and gender equality.

How to Invest in ESG

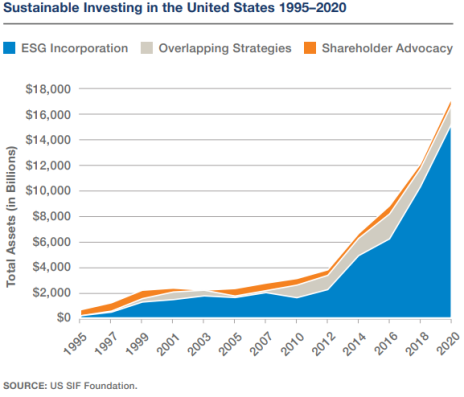

According to U.S. SIF Foundation, 33% of the $51.4 trillion in total assets under management are now invested in socially responsible investments. You can see in the graph below the growth of the category—SRI expanded by 42% just from 2018-2020.

Alternative ESG assets (as of the end of 2020) had grown to $716 billion (venture capital and private equity funds, property funds and REITs, and hedge funds) focused on SRI.

Socially responsible investments can also be very focused, for example, in the renewables/clean energy sectors, which cover:

- Water Stocks

- Wind Power

- Solar Stocks

- Pollution Controls

- Green Transportation

- Waste Reduction

- Organics

- Aquaculture

- Geothermal

In addition to funds and ETFs, there are hundreds of individual stocks that are dedicated to SRI.

How do SRI Returns Stack Up?

You’ve probably heard that returns from SRI are just so-so. But, as it turns out, that’s not true. In Morningstar’s 2021 sustainable investing report, results indicated “Nearly three of every four sustainable funds with records that long [three- and five-year] place in their Morningstar Category’s top half, driven mainly by the performance of sustainable equity funds.”

Some Socially Responsible Investments to Consider

As you can see, you have many choices in ESG investing, but today, I’d like to focus on ETFs and funds, as they make it easy to diversify your investments within any category, and they are a great way to begin your socially responsible investing.

However, just as with any investment, investors still need to make sure they don’t get caught up in the excitement and forget their basic investing tenets. With funds and ETFs there are a few rules to live by:

Performance/returns should be better than peer averages.

Limit Costs & Expenses. These include:

- Loads—front-end and back-end

- Expense ratios

- 12b-1 (marketing) fees

- Taxes

- Turnover of investments

Know the Risk, which may be higher in certain categories than others.

Fortunately, etf.com provides an excellent screener that allows you to control for fund performance, strategy, assets under management (AUM), and a whole host of other important criteria.

After screening through over 100 funds and narrowing focus to only those rated highest by analysts, we were left with 10 “A-rated” ESG-focused funds with manageable expenses, good liquidity, and at least a five-year performance track record. Here the top four by performance for your consideration.

| Fund | Ticker | Five-Year Return | Expense Ratio | AUM (MM) |

| iShares MSCI KLD 400 Social ETF | DSI | 74.40% | 0.25% | $3,510 |

| iShares MSCI USA ESG Select ETF | SUSA | 73.90% | 0.25% | $3,530 |

| iShares ESG Aware MSCI USA ETF | ESGU | 68.95% | 0.15% | $22,740 |

| Global X S&P 500 Catholic Values ETF | CATH | 68.59% | 0.29% | $574 |

As I said, there are many more socially responsible investments to choose from, but these are a good start.

[author_ad]

*This post has been updated from an original version, published in 2019.