The normally staid ocean shipping industry was recently upended by the flare-up of military activity in the Middle East. Consequently, long-established shipping lanes were suddenly closed or bottlenecked in the wake of Houthi militia missile attacks and other Mid-East incursions. Additionally, disruptions to the global supply chain during the Covid years haven’t been fully alleviated—all factors contributing to a revenue resurgence among major transoceanic shipping stocks.

Providing a backdrop to this comeback, consider that earlier this year, several major ocean carriers halted ships from entering the Red Sea in response to the heightened military activity in the region. Moreover, recent months have witnessed a startling 50% drop in the number of cargo vessels transiting the Suez Canal.

[text_ad]

Since then, many shippers are still going out of their way to avoid Houthi attacks in the Red Sea. And while “a semblance of normality” is now returning to ocean freight container supply chains (in the words of industry publication The Maritime Executive), longer shipping routes—and subsequently increased shipping speeds and fuel consumption—are resulting in higher prices for both shipping providers and the goods they carry, resulting in a drastically improved revenue and earnings outlook.

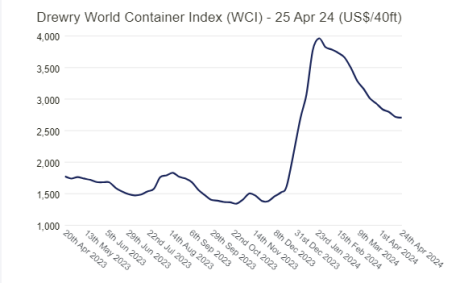

One indication of how much freight rates have increased since last year can be seen in the World Container Index (WCI) provided by the supply chain advisory firm Drewry. The latest Drewry composite index shows that global freight rates are over $2,700 per 40-foot container. And while this is down from the multi-year highs in January, it’s still up 55% from a year ago. (It’s also 90% more than the average rate of $1,420 that prevailed in pre-pandemic 2019!)

Unsurprisingly, especially given historically high freight rates, ocean shipping stocks are outperforming other segments of the broader transportation industry. This is clearly visible in the Marine Shipping stock index from Yahoo! Finance, shown below, which has risen by a head-turning 31% year to date—and comparing favorably with the 6% YTD performance for the S&P 500.

With that said, let’s take a closer look at a couple of these shipping stocks.

2 Shipping Stocks Worth a Closer Look

Star Bulk Carriers (SBLK) is the world’s largest publicly listed dry bulk carrier, operating over 120 vessels of various sizes that carry grain, iron ore, alumina, minerals and fertilizers all around the world. The company recently completed a merger with Eagle Bulk Shipping, creating a $2.8 billion dry bulk shipping giant in the process.

According to a recent investor presentation, Star Bulk is currently focused on investing in upgrading its fleet with the latest operational technologies available, with an aim at improving overall fuel consumption and further enhancing the commercial attractiveness of its entire fleet.

Management said the outlook for the dry bulk market remains positive “due to favorable supply dynamics, geopolitically driven inefficiencies in trade and a recovery of demand supported by large global infrastructure investment needs.” As an added attraction, the company is also actively engaged in repurchasing and retiring shares, having recently bought back 20 million shares (28% of the float!).

Navios Maritime Partners (NMM) owns and operates dry cargo vessels in several continents, including Asia, Europe, North America and Australia. The company offers seaborne transportation services for a range of liquid and dry cargo commodities, including petroleum, chemicals, iron ore, coal, grain, fertilizer and containers.

As the world continues to experience disruption in normal trade routes due to regional conflicts ranging from Ukraine/Russia to Israel/Palestine, another factor impacting global shipping involves recent droughts that have severely limited traffic in the Panama Canal. As a result of this, what is normally a seasonally slow first quarter witnessed a “surprisingly strong” start to the year for Navios, according to management.

Going forward, Navios sees shipping giant China leveraging its export strength, along with projected world GDP growth of 3.1% for 2024, contributing to a “strong” environment for the industry for the full year. Additionally, the firm’s total contract revenue amounts to a solid $3.3 billion (mainly for tankers and container fleets), around 50% of which is expected to be earned in the next two years.

Here at Cabot, we can help you navigate the market by selecting the most promising candidates in retail and many other sectors via Mike Cintolo’s weekly Top Ten Trader. Expert stock picking is paramount for navigating the market’s current challenges, which is why Top Ten Trader is ideal for participants who want to focus mainly on the strongest companies with the best short-to-intermediate-term growth potential.

[author_ad]