The key to long-term investing success starts with being able to answer the following question: What makes a good long-term investment?

Part of the answer lies in the quality of the management team. And within the management team, companies with a seasoned chief financial officer (CFO), one who has been on the job for a long time, produce much better results than companies with high turnover in the CFO office.

During the past 10 years, shareholders of companies with the longest-serving CFOs outperformed the 500 companies in the Standard & Poor’s 500 Index by a wide margin. Most long-tenured CFOs have been efficient stewards of capital and have helped lead their company to prosper through good times and bad. Jeff Julien, CFO of brokerage Raymond James Financial for the past 30 years, partly attributes his company’s success to “consistent, long-term focus instead of overreacting to the crisis du jour.”

[text_ad]

The chief financial officer is one of the most important positions in any company. The CFOs must be operational experts, strategic partners to the CEO (chief executive officer) and the conduit between investors and management. Successful CFOs are proactive and provide the analysis and insight that help frame the company’s most important decisions. CFOs also collaborate with the CEO on medium- and long-term planning. All of this is a tall order, requiring a diverse set of leadership capabilities and finance and business experience.

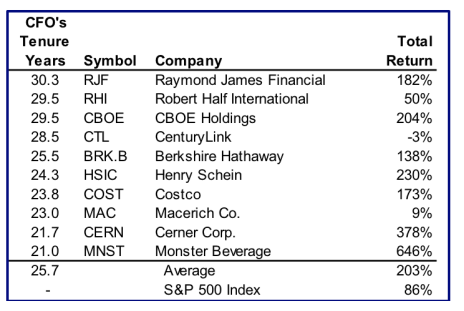

In late July, executive recruiters Crist/Kolder Associates conducted an analysis for The Wall Street Journal to look at the connection between CFOs with the longest tenure and the performance of the stock price of each CFO’s company. Seven of the 10 most-tenured chief financial officers help run companies whose investors reaped significantly better returns during the past decade than the S&P 500 index.

During the past decade, total shareholder returns (appreciation plus dividends) at mid- to large-cap companies with the longest serving CFOs easily outperformed the S&P 500 Index. Crist/Kolder Associates’ research for the decade through July 25, 2017, revealed that the 10 companies with the longest CFO tenure rewarded investors with an average total return of 203% compared to the S&P 500 Index return of 86%.

The clear-out performance of the companies with long-serving chief financial officers is intriguing. Ever in search of long-term investing opportunities, I researched my leading recommendations in my Cabot Benjamin Graham Value Investor to find the companies with the longest-tenured CFOs on board. The top three companies with CFOs on board for the longest time are Berkshire Hathaway, FedEx and Home Depot. How did these companies perform over the past year through August 14? All three out-performed the S&P 500 with gains of 20.4%, 24.7% and 13.2%, respectively, compared to the S&P increase of 13.2%. I recommend purchasing each of these stocks, because they are very likely to outperform again during the next 12 months, and should help you achieve long-term investing success for years to come!

3 Stocks for Long-Term Investing Success

Berkshire Hathaway (BRKB) is a complex holding company with renowned value investor Warren Buffett at the helm as chairman and chief executive officer. Berkshire directly owns 100% of 62 businesses. In addition, several insurance companies owned by BRKB hold parts of 52 businesses; these businesses were attained primarily through purchases of marketable common stocks.

Any excess capital within Berkshire’s insurance companies is used to buy stocks. Berkshire’s businesses and stock investments make up a well-diversified array of investments, with a significant over-weighting in the insurance sector.

The 10 largest common stock holdings held by Berkshire’s insurance subsidiaries are: Kraft Heinz (KHC), Wells Fargo (WFC), Apple (AAPL), Coca-Cola (KO), International Business Machines (IBM), American Express (AXP), Phillips 66 (PSX), U.S. Bancorp (USB), Charter Communications (CHTR) and Moody’s (MCO). Stock holdings are managed by a team of investment professionals at Berkshire who use a buy low, hold forever approach.

Mr. Marc D. Hamburg, 67, is chief financial officer and senior vice president at Berkshire. Mr. Hamburg has served in both capacities for more than 25 years.

BRKB shares will likely rise faster than the S&P 500 Index during the next 12 months, because of the heavy weighting in financial assets which will benefit from higher interest rates. In addition, the income tax rate for Berkshire is 30%, which could drop noticeably if tax reform is enacted.

At 1.38 times conservatively stated book value, BRKB shares are undervalued. The company has built up a cash hoard of $79 billion, which provides flexibility to take advantage of investment opportunities quickly. Buy.

FedEx (FDX), based in Memphis, Tennessee, provides transportation, e-commerce and business services to businesses and individuals. The company offers domestic and international shipping services for delivery of packages and freight via ground or air transportation. FedEx Office, formerly Kinko’s, provides business services such as printing, copying and sign and banner making to customers and serves the company’s own needs.

FedEx’s purchase of TNT Express, the Netherlands based carrier with operations throughout the world, is benefiting FedEx. The acquisition is providing a pan-European road network that will greatly expand FedEx’s share in Europe’s growing cross-border e-commerce market. Strong e-commerce sales in the U.S. continue to significantly bolster FedEx’s sales and earnings results.

The company will retire 15 aircraft and modernize its fleet. FedEx will buy 50 additional 767-300F aircraft from Boeing. The purchase will upgrade the company’s aircraft fleet and expand its capacity in anticipation of higher growth.

Alan B. Graf Jr., 62, is chief financial officer and executive vice president at FedEx. Mr. Graf has held both positions for 19 years.

At 18.2 times latest 12-month EPS, and with current cash flow exceeding 23.00 per share, FedEx offers investors a great opportunity to participate in the escalating e-commerce shipping segment. The company’s dividend, recently increased, provides a respectable 1.0% yield. Buy.

Home Depot: (HD) is this nation’s largest home improvement retailer. The company sells building materials, home improvement products and lawn and garden products, and provides many other services. Home Depot serves do-it-yourself homeowners as well as professional builders, contractors and repair people. The company operates 2,278 retail warehouse-type stores in the U.S., Canada and Mexico.

The U.S. housing market is expected to strengthen during the remainder of 2017, and older homes need repairs and upgrades. Low mortgage interest rates will help the home improvement boom expand into 2018.

Carol B. Tomé, 60, is chief financial officer and executive vice president of Home Depot. Ms. Tomé has served as chief financial officer since May 2001 and was named executive vice president of corporate services in January 2007.

At 23.6 times current EPS and with a dividend yield of 2.6%, HD sells at a reasonable price. Home Depot is a blue-chip company with a proven track record and exceptional management. Buy.

Until next time, be kind and friendly to everyone you meet.

[author_ad]