My Favorite Investment Today

Stocks Most Heavily Owned by Top Hedge Funds

An ETF Gem!

One of the early discussions at our recent Cabot Investors Conference (August 15-16) was titled “My Favorite Investment Today.” In that session, each Cabot editor described one opportunity (or a few) that he or she believed to hold particular promise for the months ahead.

As Cabot’s ETF analyst, I was happy to describe an unusual ETF that has a potent logic and a strong performance.

I didn’t pick one of the Favored sector ETFs in my advisory, Cabot ETF Investing System, because I would not be able to give the audience regular monthly updates on the sector.

In the Cabot ETF Investing System, our “Favored” sector ETFs are reviewed and updated monthly in the context of current economic conditions.

In fact, each sector ETF candidate has to re-qualify in each cycle. If it doesn’t re-qualify, it slips to non-Favored status and is sold. In Cabot ETF Investing System, updates are scheduled for the fourth Tuesday every month, so I don’t worry much about selections going “stale.” But for the Conference’s discussion of favorites, I wouldn’t be able to give those periodic updates.

So for my favorite investment, I wanted to offer something with a longer shelf life, something with a more enduring attraction rather than simply being well suited to the month’s economic conditions.

---

Back in June, I had been intrigued by a story in Barron’s about a couple of novel ETF offerings: AlphaClone Alternative Alpha (ALFA), and Global X Top Guru Holdings (GURU). These funds invest in stocks that are most heavily owned by top hedge fund managers. It’s a follow-the-leader strategy that’s somewhat similar to the various replication strategies that attempt to mimic the policies or holdings of individual managers (“Invest like Warren Buffett,” so to speak).

But in these funds, the portfolios are a blend of high-concentration holdings across multiple hedge fund managers.

ALFA and GURU aren’t really equivalent, however.

The biggest difference is that the ALFA fund can turn defensive, investing up to half its assets in “inverse” ETFs—going neutral on the market, in effect—whereas GURU is always invested on the long side.

Also, the ALFA fund has a varied mix of equity weightings, depending on concentrations among the hedge funds they’re following. GURU is equal-weighed across stocks (each stock from the pilot funds is either “in” GURU if it meets the concentration threshold, or “out” if it doesn’t).

Also, the expense ratios differ, with ALFA at 0.95% per year and GURU at 0.75%.

I like the GURU fund better than the ALFA fund for several reasons.

First of all, I always avoid higher expense ratios if I can. The difference between 0.95% and 0.75% isn’t big, but it does bias my appreciation toward GURU.

More important, I’m skeptical of ALFA’s hedging capability until I see evidence that management actually has timing talent.

Lastly, it seems to me the equal-weighting strategy is superior to the scaled variation. Although there is good evidence that manager’s heaviest concentrations do better than the others, I don’t know of studies showing returns are scaled proportionally along a whole continuum of concentration.

Anyway, it’s GURU that I’ve followed up on—and recommended at the Conference. The fund is pretty impressive so far. Although its history is short, (GURU was only founded in June 2012), it’s been consistently positive.

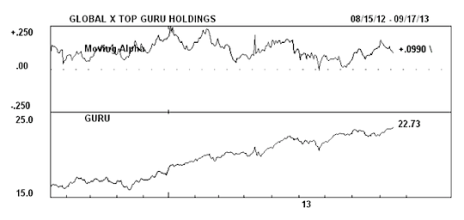

My favorite performance metric is “moving alpha” (which I originated back in the 1990s). Alpha is an estimate of a fund’s non-market-driven returns, and “moving alpha” just means the alpha is estimated and re-estimated successively through time (daily in this case) … so we can see it evolve.

Here is a picture of GURU’s moving alpha (along with its daily price in the lower frame).

GURU’s moving alpha has averaged about 10%, which happens also to be about what it’s running right now (mid-September). And it’s consistently positive (so far). 10% alpha is a really impressive rate of return that’s (nearly) exclusive of market trend.

The fund has returned 36% over the past 12 months, compared with 17% for the S&P 500.

The fund is slightly more volatile than the S&P, with beta running about 1.15 (which will change over time as holdings change).

And GURU is pretty well diversified, with daily fluctuations about 85% dependent on S&P fluctuation (R2 = .85).

GURU is a little offbeat, and it’s still quite young—but the concept makes sense, and they’ve made the strategy work impressively so far. Lastly, it’s still small enough ($122 million in assets) to possibly continue generating excess returns for some while.

GURU won’t be immune to market decline when that comes, and I wouldn’t make it the centerpiece of a portfolio, but it definitely deserves strong consideration for the “offbeat” portion of your investment portfolio. It’s really a little gem.

Sincerely,

Robin Carpenter

Analyst, Cabot ETF Investing System

[author_ad]