I had lunch with a colleague last week. He’s way smarter than me and younger too. He’s 30, putting him right in the tail end, age-wise, of the Millennial investors. He told me about the great education he received in 2022. Having begun investing in the middle of a historically long bull run, this was a new experience for him.

He told me about learning, the hard way, that “buying the dip” doesn’t always have a happy ending. In fact, a number of his go-to investing strategies didn’t behave last year.

Many Millennial investors’ first experiences with investing came during the early stages of the pandemic when they were contending with lockdowns and flush with stimulus cash.

[text_ad]

That cash was then funneled into cryptocurrencies, meme stocks, NFTs and a whole world of highly speculative assets.

Now, he’s a pretty serious investor and he knows that in the long run that’s the best way to beat inflation. So, he’s staying in the market with a renewed focus on investing in fundamentally strong companies.

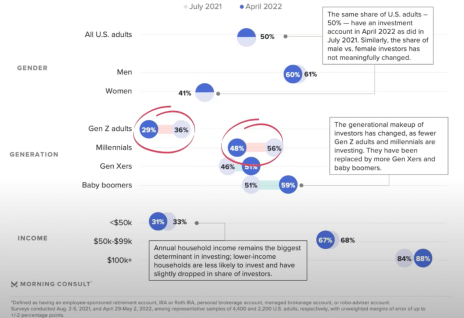

But today, I saw the chart below from Morning Consult, showing changes in who has investing accounts. Overall, the percentage of adults with investing accounts (50%) stayed the same from July 2021 to April 2022, but the makeup of the 50% changed.

While gender wasn’t a factor, age was. The time period saw a 7-8% drop in the number of Gen Z and Millennial investors. These were likely the young investors that, when faced with strategy failures, opted out of investing instead of evolving their tactics. In the same period, the number of Gen-X and Boomers who have investment accounts grew 4-5%.

The bottom part of the chart shows people making less than $50K reduced their investing from the already low rate of 33% to 31%. The “easy money” days were gone, and inflation and high gas prices were eating into their investable income. Those making $50-100K held pretty steady. And those making more than $100K showed a 4% increase in the number of people investing.

Of course, for many of those under the age of 40, 2022 was the first time they encountered an extended down market in their investing life. What had been fun and seemed easy with minimal downside risk suddenly changed. Consider the contrast between the GameStop (GME) fiasco and a more normal investing environment.

Millennial investors (probably to their detriment) learned that if they banded together tightly enough, they could force a short squeeze on the big institutional investors, regardless of the soundness or the business fundamentals of the underlying company.

That is, quite simply, not a sustainable or repeatable strategy. And we saw that play out in both AMC Entertainment (AMC) and Bed Bath & Beyond (BBBY), two other meme stocks that never quite achieved the cult status of GameStop.

Millennial investors, like all of us, saw big drops in value. And they stayed down. And as my lunch friend discovered, buying the dips didn’t work anymore.

The result is that many younger people have gained a newfound wariness of the market. Perhaps even fear. And, as Warren Buffett has said, “Be fearful when others are greedy, be greedy when others are fearful.”

So, while younger people have pulled back on putting their money into the market, older people have seen an opportunity.

These tenured investors, many of whom had experienced the heady days of the Dot-Com boom and bust, are primed to take advantage of the next bull market.

[author_ad]