I used to dread having to write these Cabot Wealth Daily columns, because, after writing so much for Cabot Growth Investor and Cabot Top Ten Trader, it’s not easy to come up with fresh topics to write about. But that’s not a problem today! I figured now would be a good time to touch on a few things that are going on in the markets (including some clear signs of a potential market breakout), my take on them and how I suggest reacting to them, if at all.

Saudi Arabia and Oil

[text_ad]

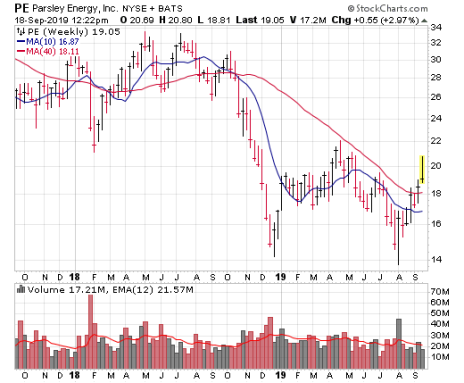

The biggest news this week was the spike in the price of oil and oil stocks after the strike on a key pipeline and refinery in Saudi Arabia. My biggest thought here is to keep some perspective—even with the spike, oil prices are no higher now than they were in mid-May, while oil stocks are still below their longer-term 40-week line. (See chart below.)

That doesn’t necessarily mean the upmoves are fakeouts, per se. But to me, if oil stocks are going to make a sustained move, they’ll likely set up first by etching some launching pads above their longer-term moving averages. In the meantime, I’ll keep a distant eye on some producers that are showing relative strength—Diamondback Energy (FANG) and Parsley Energy (PE) are probably my favorite names in the group, though both still have plenty of work to do.

The Fed

I’ll leave the analysis regarding the Fed and their statement this week to others, but my (very) old trading rule that used to be popular (and worked wonders up until 2000) was called “Two Tumbles and a Jump.” Popularized by Norm Fosback (his 1970s book Stock Market Logic is a classic if you’re into various market timing studies), it simply said that the second time the Federal Reserve loosened monetary policy in a row represented a buy signal—from 1913 through 2000, it happened 18 times, and the market was higher a year later 17 times, by an average of 30%!

Of course, the system hasn’t worked during the last couple of easing cycles as first the Internet Bubble burst and, second, the Great Recession took hold. Nothing is perfect in life, and certainly not in the markets! But I do wonder now, with the Fed having eased twice and with the market being in a relatively “normal” state, whether this second tumble will produce solid gains for the market going forward.

Growth Stocks

The rotation seen in the market during the past couple of weeks is about as vicious as I can remember; it’s right up there with the wild action following the 2016 Presidential Election. This rotation brought many of the market’s highest fliers—especially cloud software stocks and cybersecurity stocks—back down to earth. For many, it dug a hole and threw them in it.

My overly general take on these stocks is simple: Most are broken in the intermediate-term, and given that most originally broke out back in February 2018 (19 months ago) and rallied four- to eight-fold since then, these mega-volume breakdowns could mark some meaningful tops in a bunch of them. Twilio (TWLO) is one of many examples.

That doesn’t mean none are worth hanging onto if you have a good profit (we own a position in one cloud software stock, albeit with a tight leash), but the odds favor that most won’t be the leaders they were for the next few months, if not longer.

Market Breakout Coming?

The dip in growth stocks (really, anything that’s had a sustained run this year) wasn’t fun for an investor like me last week. But I have to say, now that some of the dust has settled, I’m very impressed with the action of the broad market.

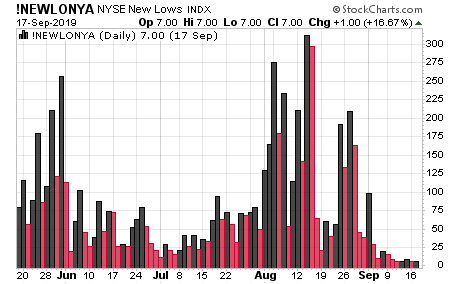

For instance, take a look at this chart, which shows the number of stocks hitting new lows on the NYSE every day. Despite the strength in the major indexes, a bunch of stocks were actually hitting fresh lows for much of this year. But not now, as we’ve seen many single-digit readings in a row, a clear sign the broad market is in good shape.

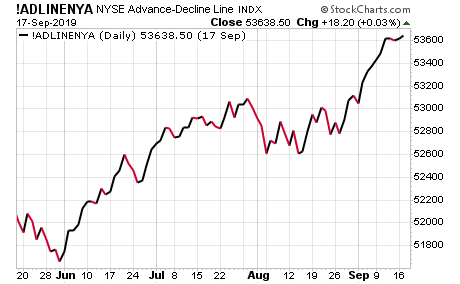

Furthermore, look at the NYSE advance-decline line below—it’s zoomed to new highs ahead of the S&P 500, which bodes well going forward. According to Quantifiable Edges (@QuantEdges on Twitter), this situation in the past has led to the S&P 500 gaining about 5.8% on average over the next five months or so, with 86% of occurrences leading to some sort of market breakout.

Beyond these breadth measures, I’m also encouraged that my trend-following indicators are both positive, and anecdotally, this weekly chart of the S&P 600 Small Cap Index looks excellent, with three waves down over many months and a big-volume spike last week.

I’m still going slow in this environment due to the crosscurrents—last week’s sector rotation was so severe that any number of uncertainties that are out there could cause money to slosh back and forth for a while. But the key right now isn’t to focus on yesterday’s leaders, but to look for some solid setups among high-potential stocks that look ready to run on any market breakout after long rests this year.

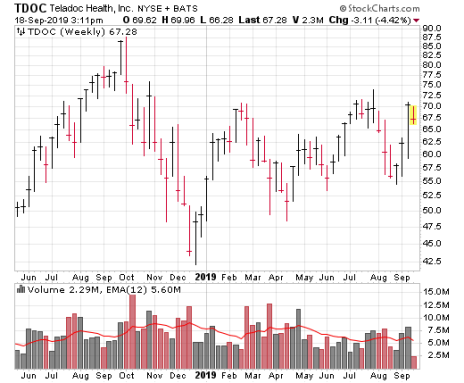

Happily, there are many names to consider. One is Teladoc (TDOC), a stock we owned last year (got out around breakeven when the market began falling apart in October) and have kept an eye on ever since. Now, though, after seven months of base-building, it’s perked up near resistance on big volume. Here’s what I wrote this week about TDOC in Cabot Top Ten Trader:

“You won’t find many stories bigger than Teladoc’s: The company is the clear leader in virtual care (often called telemedicine), allowing millions of people to get medical advice (and often run-of-the-mill prescriptions) over the phone or videoconference in a variety of fields. All told, clients can access 50,000 experts across 450-plus specialties along with 7,000 clinicians—and those clients include 40% of the Fortune 500 and thousands of small businesses (including 30,000 small businesses in Canada that recently signed up) along with many public health plan users (Medicare Advantage has 20 million members and is a new opportunity for Teladoc next year) and 300 hospital health systems. (At the end of Q2, the firm had 26.8 million paid U.S. members, up 19% from a year ago.) There are a lot of moving parts and costs (the bottom line is drenched in red), but it’s a simple, powerful concept that’s working. Not only are revenues cranking ahead (up 38% from a year ago; subscription access fees, which make up 85% of revenues, were up 39%), but the sub-metrics look great, too, with total visits expected to rise 66% this year (up 70% in Q2), while utilization continues to rise (9.1% of members used the service in Q2, up from 8.0% a year ago), with 40% of U.S. members accessing at least two products. The biggest recent news is of an expanded relationship with United Health, which could bring in an addition five million paid members and 10 million fee-only members, with further upside beyond that. This remains a big idea with plenty of potential if management continues to execute.”

There’s always the chance that TDOC’s move back up toward the 70 level brings out the sellers, but a couple weeks of calm trading and buying on the possibility of a decisive breakout would be tempting.

[author_ad]