Investor sentiment polls are a useful way of gauging how the stock market might behave in the foreseeable future based on the contrarian principle. The idea here is that when too many retail investors are optimistic, stock prices typically underperform as the long side of the market is overcrowded. By contrast, excess pessimism among investors usually signifies a big short-interest buildup, which in turn can serve as fuel for a major rally (especially in the face of unexpectedly good news).

Putting aside the latest uptick in stock market volatility, a collection of historically reliable sentiment-based indicators suggests a new long-term bull market was born last October. Here we’ll examine the latest in investor sentiment for clues as to what investors can likely expect in the coming 12 months.

[text_ad]

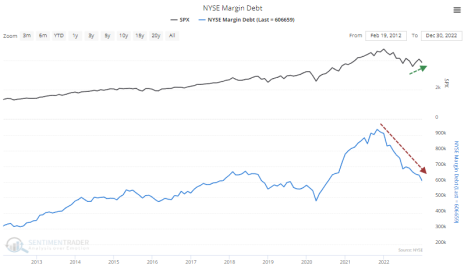

One indication of how the contrarian principle is flashing a bullish signal for the longer-term outlook is found in the fact that, despite a significant rally in stock prices during the past four months, NYSE margin debt (loans using equities as collateral) has been in a steep and steady decline.

Whenever this has happened in the past, it has typically served as a harbinger for above-normal returns in the S&P 500 over the longer term, as noted by market statistician Jason Goepfert.

An additional piece of evidence pointing to a significant bottom being established is found in a February 12 article from the Wall Street Journal, which noted that investors have recently exited U.S. equity mutual funds and ETFs in record numbers in favor of international funds. According to WSJ:

“Investors have pulled a net $31 billion from U.S. equity mutual funds and exchange-traded funds in the past six weeks, according to Refinitv Lipper data…That marks the longest streak of weekly net outflows since last summer and the most money pulled in aggregate from domestic equity funds to start a year since 2016.”

As with declining margin debt, heavy investment fund outflows among small investors normally precede long periods of outperformance for equities. Indeed, the reluctance of retail investors to commit to the bullish argument for U.S. stocks is a further argument—from a contrarian perspective—that the crowd is likely wrong and the uptrend in stocks has legs.

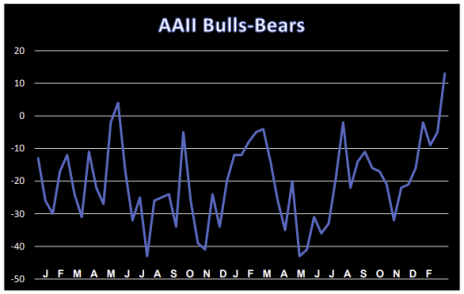

Providing additional support for the bulls’ case is the recent trend in investor sentiment as measured by the American Association of Individual Investors (AAII) weekly polls. As shown in the chart below, the trend in AAII bulls minus bears has entered positive territory for just the second time since last March, and has accelerated above 10% net bullish for the first time since 2021 (when bull market conditions still prevailed).

Normally, whenever this indicator thrusts strongly positive after spending several months in negative territory, higher stock prices follow over the following 12 months or longer.

It should be noted by way of caveat, however, that while the above indicator can be viewed as a bullish omen for the longer term, the near-term stock trading environment could be choppier and possibly indecisive (i.e., rangebound) following such a dramatic shift in sentiment.

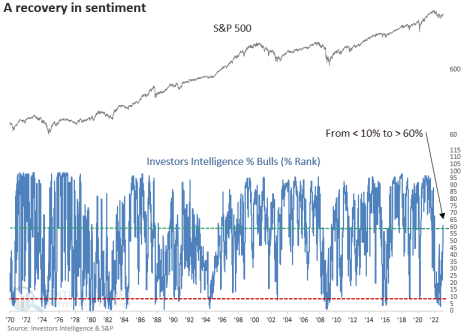

Dean Christians of SentimenTrader alluded to this in a recent missive when he pointed out that the Investors Intelligence (II) sentiment survey released earlier this month showed the percentage of bullish investment advisories has climbed to its highest level in over a year. He observed the Investors Intelligence recovery occurred from a level normally associated with “significant stock market lows.” Christians also cautioned:

“When the [percentage] rank for the II [percentage] bulls survey cycles from greater than 10% to less than 60%, the S&P 500 tends to see some follow-through in the near term. However, the 2-month window suggests the market could consolidate its recent gains” and “could be bumpy.”

The good news, however, is that the longer-term (12-month) outlook “looks excellent” according to Christians, with only two false signals over a period of several years.

Viewing the pieces of the investor sentiment puzzle collectively, it appears that most investors aren’t buying into the recovery rally of the last four months. And from a contrarian perspective, that’s welcome news since it increases the odds the recovery has legs.

Bear market rallies (which tend to be short-lived) often see an increase in enthusiasm among participants, while legitimately bullish rallies tend to be greeted with skepticism, hence the old Wall Street saying: “Stocks climb a wall of worry but descend a slope of hope.”

With this in mind, investors should be careful of focusing too much on short-term periods of heightened volatility and succumbing to pessimism. Instead, remember to focus on the longer-term investment horizon, which looks increasingly sunny after last year’s stormy skies.

[author_ad]