Most investors are too busy fretting over the performance of their portfolios in 2022 to bother looking at potential investment opportunities, even though we’re in the midst of a volatility bull market.

We know, through all of the extreme negative sentiment seen across the board, that investors are wary of and in some cases fleeing the market.

The word “volatility” is being used among the financial talking heads in practically every conversation about the market. But those conversations are no longer limited to just the investment industry. Volatility has now become part of the lexicon among individual investors as well. In fact, when all is said and done, there is a good chance 2022 will go down as the year of volatility. And that means a volatility bull market.

[text_ad]

According to a recent article in Barron’s, “one out of every six days has closed with a gain or loss of 2% or more for the S&P 500.” That’s a lot considering “since 1928, the median number of days each year where the S&P 500 gained or lost more than 2% was only eight out of roughly 250 trading days.” Almost five months into 2022, we’ve already seen 22 days with such volatilities.

How as investors can we take advantage of all this volatility? And how long will volatility last? I’ll get to that momentarily.

The Barron’s article ended with a quote from Matthew Tym, head of equity derivatives at Cantor Fitzgerald, stating, “There is a lot of uncertainty with what is going on, with inflation, oil, global macroeconomic events…I think we are in for some volatility going forward, probably for the whole year.” I think it’s going to be considerably longer.

It could be argued that even with a market that has seen lower prices for almost five straight months, we could be in the early stages of a bull market in volatility. Since the pandemic hit the market back in early 2020, volatility has been significantly higher than the previous nine to 10 years, one of the most complacent periods in market history, mostly due to bouts of quantitative easing and other forms of Fed relief.

Times have changed. But there’s a way to profit from the change…

A Volatility Bull Market Spells Opportunity

Volatility directly impacts options premium. As volatility increases options premium increases, and vice versa. Simply stated, the price of options is inflated.

The reason for the increase is simple: More and more investors, large and small, are buying protection, mostly through the use of puts. And with the increase in demand comes the increase in options prices.

As someone who predominantly uses options selling strategies, there is no better time to invest than right now.

Because the best way to take advantage of the inflated premium is to sell premium using a variety of options selling strategies.

Let’s do a quick comparison between options premium during normal levels of volatility and heightened levels of volatility. This will allow you to see the true benefits of using options selling strategies when volatility is above normal levels.

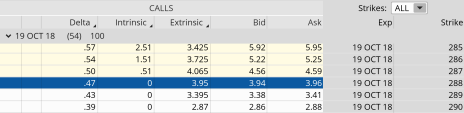

Normal Level of Volatility: August 26, 2018

The VIX was at 13.23 at the time. SPY was trading for 287.51.

SPY was much lower than it is now, but options premium was going for approximately $3.94 to $3.96. The extrinsic value, or the time value of the option, was $3.95.

If an option has time left until it expires, in this case 54 days, an options extrinsic value basically reflects “what could happen” over the life of that option. I’ve chosen 54 days for both examples, so the only factor at play here is volatility.

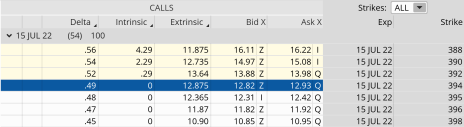

High Level of Volatility: May 20, 2022

On May 20, the VIX was trading for 29.43 (it remains elevated at 25 today), roughly two and a half times as high as the example above. SPY was trading for 389.63.

As you can clearly see, options prices are significantly higher at $12.82 to $12.93.

The extrinsic value is $12.875 … over three times as much as it was in 2018. Remember, extrinsic value increases as volatility increases.

So we are getting more than three times as much per trade now, while our probabilities on each trade remain the same. Thus, a trade with an 80% probability of success pays significantly more during volatile periods than that same 80% probability of success trade during normal times of volatility.

And that’s why now is the time to start selling options premium using risk-defined strategies!

If you’re interesting in exploring more options strategies to take advantage of this volatility bull market, I recommend signing up for our free Cabot Options Institute Daily or subscribing to one of my Cabot Options Institute advisories.

[author_ad]