In the wake of Covid shutdowns, global supply chain shortages are weighing on markets. Investing in precious metals is a way to hedge them.

Blame it on the lingering impacts of last year’s Covid-related shutdowns, or blame it on a series of unfortunate weather-related setbacks (like Hurricane Laura and the polar vortex). Whatever the reason, supply chains domestically and globally are in disarray. Because of the near-constant supply chain disruptions that have occurred since last year, supplies of many key commodities and consumer goods are harder to get in a timely fashion. And that means you should be investing in precious metals. More on why in a bit.

Nationwide transportation problems seem to be the major problem surrounding the shortage of goods. As a recent Barron’s article about what they call the “Everything Shortage” pointed out, “Shipping containers that carry most of the world’s goods are suddenly difficult to secure, but at the same time, Daniel Miranda, president of the Longshore and Warehouse Local 94 union that works two massive California ports, sees too many of them. ‘Your goods are on the dock, but who’s going to pick them up?’ he says. ‘If you don’t believe me, I’ll take you to L.A., Long Beach, and you can see them stacked eight high.’”

[text_ad]

Last month’s temporary Colonial Pipeline shutdown (cyber-attack related) is another case in point. While gasoline supplies remained plentiful in the southeastern part of the U.S. served by Colonial, finding trucks to distribute it to fuel stations was a problem due to transportation bottlenecks and trucker shortages. Consequently, gas prices briefly spiked well over $3/gallon in some areas of the country.

As I alluded to above, the problem of inflation can be boiled down to a case of excess money supply chasing a diminished availability of goods—emphasis on availability. For it doesn’t matter that the actual supply of certain commodities is plentiful; what does matter is how easily that supply can reach its designated market channels. Transport problems represent a limitation of the supply of goods reaching the market, which can exacerbate inflationary conditions even in the midst of a plenitude of products.

“But,” observes economist Scott Grannis in a recent blog, “it’s important to remember that supply bottlenecks and temporary labor shortages are not what create inflation: only Fed mistakes do.” And the chief problem as he sees it? “Massive government spending and an overly-accommodative Fed have introduced profound risks to the economy and to financial markets.”

Grannis further noted that the central bank isn’t reversing its quantitative easing (QE) policy in response to recent inflation signals, which means “unwanted money” is increasing. This of course can be seen in the weak U.S. dollar and rising commodity prices, not to mention accelerating house and stock price values and rising inflation expectations.

Adding pressure to the money supply aspect of the growing inflation problem, the White House envisions spending some $6 trillion in the coming year, “with trillion-dollar deficits as far as the eye can see,” as financial pundit Randall Forsyth recently observed. Economists and investors alike fear that inflation could accelerate in the coming months as a result of unrestrained fiscal spending and money supply increases, the extent of which is visible in the graph showing the runaway federal spending trend.

The explosive increase in federal expenditures shown above, coupled with shrinking tax receipts, is a recipe for future inflation. Not surprisingly, the market is already discounting the negative impacts to the economy via the inflation-index Treasury securities (TIPS) market. Based on current TIPS yields, the inflation rate is anticipated to average around 3% per year for the coming five years.

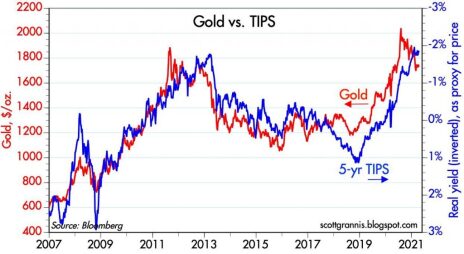

Shown here is a useful graph comparing the inverted 5-year TIPS yield with the gold price. Both tend to be positively correlated to each other since both gold and TIPS have long been used as safe havens whenever investors are worried about future economic prospects. As you can see, both the gold price and the TIPS inverted yield are near record highs, which underscores the extent to which gold’s “fear factor” is driving up the metal’s price.

As we head further into 2021, I expect to see more evidence that inflation expectations are increasing as supply-chain disruptions continue in parts of the world where Covid lockdowns continue. Importantly from an investment standpoint, investing in precious metals in general (and gold specifically) should benefit from this rising fear of inflation, much as they have for the better part of the last year.

In the short term, however, a shake-out (or “pause that refreshes”) is probably needed to cool off some of the excess heat generated by recent rallies in the key industrial and precious metals. If you are interested in investing in precious metals, but could use a nudge in the right direction, I recently launched a new investment advisory called the Sector Xpress Gold & Metals Advisor, which focuses exclusively on investment opportunities in the world of gold, silver and other precious metals.

Do you have any exposure to precious metals in your portfolio?

*Editor’s Note: This post was excerpted from the latest issue of the Sector Xpress Gold & Metals Advisor.

[author_ad]