The energy sector has been the best-performing sector thus far in 2024. The Energy Select Sector SPDR ETF (XLE) is up 12.8% in 2024, meanwhile, the S&P 500 is up 5.7%. But how do we identify energy stocks to buy if we’re concerned about arriving to the party late, and what has driven the strong performance?

First, we had (and continue to have) a cyclical recovery from the pandemic-driven recession. During the pandemic, wells were shut in, and oil & gas companies stopped drilling new wells.

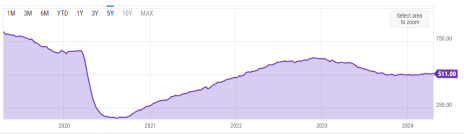

Upstream companies have started to drill new wells, but drilling is still below pre-pandemic levels despite a full recovery in demand.

Source: Ycharts

And drilling activity remains significantly below prior peak levels.

[text_ad]

There is a saying in the energy industry that “the best cure for high oil prices, is high oil prices.” This saying is correct, but it might take longer than usual for high oil prices to “cure” the market.

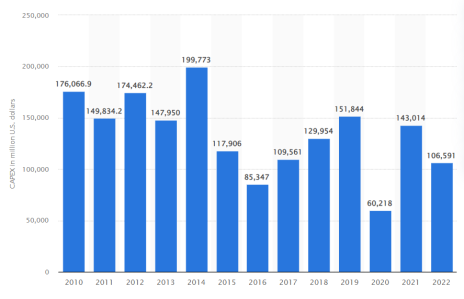

Over the last decade, the oil and gas industry has been starved of the capex that is required to find new reservoirs of oil and gas. Why? Mainly because of ESG concerns, which have forced oil and gas companies to deemphasize new discoveries in favor of generating positive free cash flow.

Source: Statista.

As a result, it could take several years of heavy investment before supply of oil and gas can catch up to demand.

Two small-cap energy stocks that should benefit from strength in energy and recent underperformance of small-caps are Dorchester Minerals (DMLP) and Epsilon Energy (EPSN).

2 Small-Cap Energy Stocks

Dorchester Minerals (DMLP)

Dorchester Minerals’ stock is up 7% so far in 2024, 10% in the last year, and over 75% in the last five, and that’s not including the generous dividend.

Dorchester Minerals is an energy royalty company. It doesn’t have to spend any money to drill new wells. It just sits back and collects royalty checks from oil and gas assets that it owns. Despite rising energy prices, it is still trading near pre-pandemic levels.

It is currently trading at 12x its trailing earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a yield of 10.2%.

Epsilon Energy (EPSN)

Epsilon Energy is a cheap, debt-free company that is using its strong cash position (and low natural gas prices) to buy back stock and make accretive acquisitions. The company also trades at only a slight premium to book value of 4.54/share.

The stock has been held back in the short term by depressed natural gas prices, which remain below their historical $2/MMbtu levels.

Epsilon currently has $32MM of cash (more than 25% of its market cap) and no debt. Epsilon is also currently paying a quarterly dividend of $0.0625 per share. This works out to a 4.7% dividend yield. In addition, the company bought back 5% of shares outstanding in 2023, and another 1%+ in the first quarter of 2024.

Given the strong performance of energy stocks so far this year, either of these stocks is worth a closer look.

Have you shifted more of your portfolio to energy stocks to take advantage of the sector strength?

[author_ad]