As I write this, we’re now 11 months removed from the peak of the bull market (for the Nasdaq at least)—during that time we’ve seen war, inflation, repeated huge Fed rate hikes, liquidity declines, a super-strong U.S. dollar, imploding junk bonds and mortgage-backed debt and, of course, falling stocks: From high to low, the S&P 500 has dropped as much as 27%, the Nasdaq nearly 38% as investor sentiment has turned dour for stocks today.

That means two things. First … it means cash has been our largest position just about all of this year. In Cabot Growth Investor’s Model Portfolio, we’ve held a minimum of 45% cash at all times in 2022, with an average well above 60%.

However, second, all of the above also means I have my eyes peeled for a bottom—bear markets tend to end amidst a wave of pessimism and bad news, which is certainly what we have here. But I’m also seeing one other major characteristic seen at major lows, too: The average stock actually hit its nadir in the spring and early summer.

[text_ad]

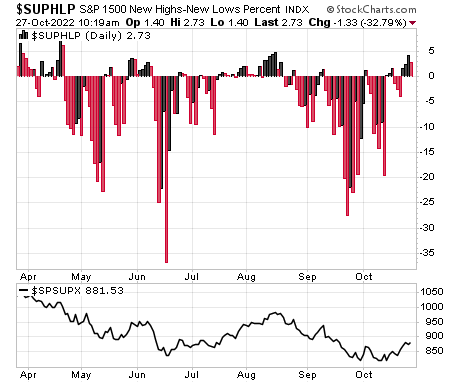

Check out this chart of the net new highs (stocks hitting new 52-week highs minus those hitting new 52-week lows every day) in the S&P 1500, an index that combines the big-cap 500, the mid-cap 400 and the small-cap 600. You can see that, at the lows in June, more than 35% of the S&P 1500 hit new lows—but even as the index sunk to lower levels in late September and earlier this month, those new low readings came in much tamer, a sign that selling pressure is easing.

And now the indexes are close to actually seeing their intermediate-term trend back up—that’s not a sign to go all-in, but if it happens, would be a step in the right direction.

Either way: Now is the time for you to have your shopping list ready should the market get up and going. I would expect some fresh leadership to show its hand during earnings season—big gaps up are always a tell—but as we stand today, here are five areas that I think can help lead the next bull run. In no particular order …

Biotech Stocks

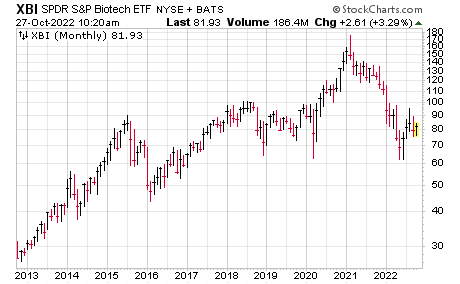

I don’t look at super long-term monthly charts very often, but I do occasionally to get a 10,000-foot view of where something has been. And doing that with biotech names is eye-opening—the S&P Biotech ETF (XBI) peaked above 90 in July 2015—today, seven-plus years later, it’s 10 points lower. That said, XBI has also shown solid relative strength since the June lows, and I think it’s increasingly likely that the group can help lead the next move.

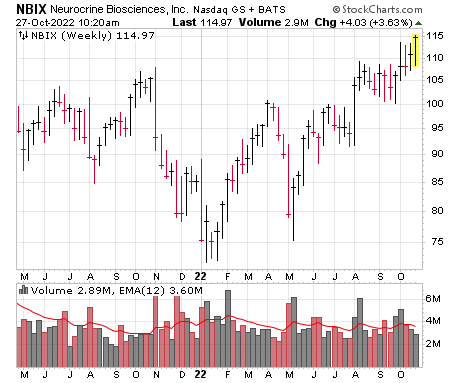

An early mover from this group that has remained resilient is Neurocrine Biosciences (NBIX), which has a leading drug for a rare condition called Tardive Dyskinesia, and it’s just scratching the surface of its potential, and there’s another drug that should be submitted for approval by year-end. Shares are nearing two-year highs; earnings are due out November 1.

Energy Services and Infrastructure Stocks

We still think many energy producers will do well going ahead, with elevated energy prices, limited CapEx and likely good-sized dividends. But it appears firms that are helping to build energy infrastructure or are generally involved in energy services (well completions, etc.), are showing more relative strength.

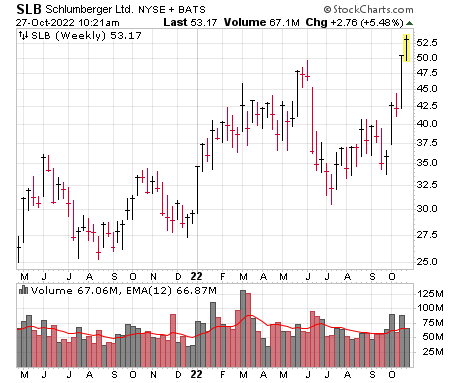

One of my favorite names in the space is Schlumberger (SLB), one of the big oilfield services firms, whose Q3 report was a barnburner—sales rose 28% from a year ago, earnings were up 75% (and were 15% above estimates) and the top brass talked about a long-term upcycle being underway in its business; analysts see the bottom line rallying to nearly $3 per share next year, up 38%. Impressively, SLB didn’t just rally on the report but has followed through on the upside to new high ground.

Lithium Stocks

So, the lithium story isn’t new, but I continue to think it has legs because the metal has effectively been legislated into scarcity—with so many subsidies for electric vehicles, it’s a good bet that, even with mine expansions planned, lithium will remain in short supply … which means elevated prices and a lot of surety for the top players in the group.

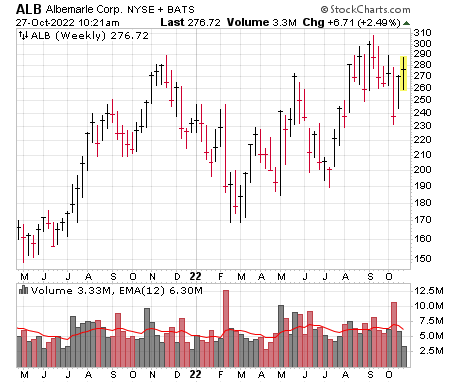

There are a few main plays, but the institutional way to play the metal is Albemarle (ALB), which has hacked around for much of the year, but net-net, it’s barely off from its peak of last year, and the sharp dip two weeks ago is looking like a shakeout. Earnings are due November 2.

New Payment Leaders

The payment space seems like it always has a stock or two in the leadership parade, but the names change with every cycle. First there was MasterCard, then Visa went public, then PayPal had a great run starting in 2017, with Square (now Block) not far behind. That said, all of those names look like they’re past their point of peak perception, so I’m hunting for new leaders in the group.

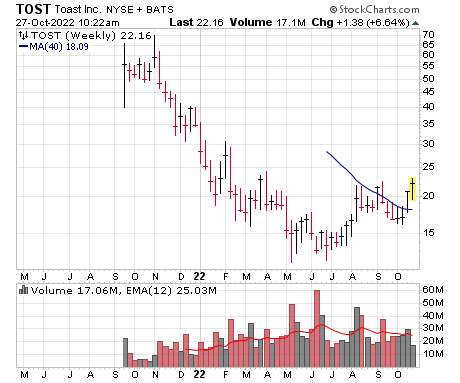

One idea, which is new but a bit of a turnaround: Toast (TOST), which has a big market cap ($11 billion!) but has a big story, too, with a solution purpose-built for the restaurant industry (north of 860,000 locations in the U.S. alone!), including payment processing and point-of-sale offerings, of course, but also marketing help, loyalty program management, operations/inventory systems and help with digital ordering and delivery. The stock came public near the market top, cratered, then found support starting in May—and now it’s etched a reasonable 11-week zone above its 40-week line. Earnings are likely due in early/mid-November.

Housing (Yes, Really)

No, I haven’t started drinking early today—while they probably won’t have the staying power to be huge winners for a couple of years, I do think they could outperform for months should mortgage rates ease up (as the Fed calls off the dogs) and if the economy/job market remains relatively resilient. Moreover, many of the big-cap plays in the group are dirt cheap, with investors pricing in a housing downturn for many months at this point.

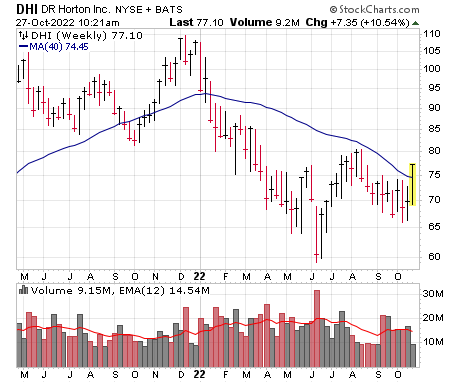

What’s interesting is that those stocks are also showing relative strength. D.R. Horton (DHI) is the largest homebuilder in the country, and shares fell 45% into their low in June—but notice how the stock has refused to retest the low (even as the market did) and is now perking up above its 40-week line for the first time in months. Shares are trading at 6x next year’s earnings estimates, which already assume a good-sized decline (26%) in 2023.

To learn more about the best-looking stocks today, subscribe to Cabot Top Ten Trader where every week I share the stocks with the best potential to maintain their momentum and become sector leaders.

[author_ad]