Lesson Learned from the Tech Bubble and the Housing Bubble

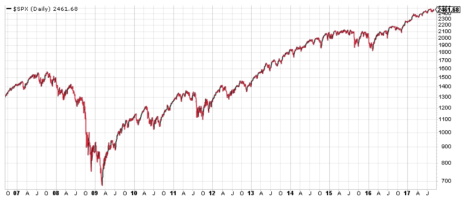

Anyone who was investing in stocks in 2008 can probably remember the deepening feeling in the pit of their stomach as the market continued the free-fall that began in earnest in January 2008 and would continue through March 2009. During that time, the S&P 500 Index fell from its October 2007 high of 1,576 to a low of 667 in March 2009. That’s a total decline of nearly 58% in the most popular broad market index in the U.S., and the most popular target for index investors who bought into the “buy and hold” philosophy. If you were holding index ETFs, you really suffered.

[text_ad use_post='129628']

Here’s what the S&P’s correction looks like, with its subsequent recovery and advances.

Today marks the ninth anniversary of the day the Federal government stepped in to take control of Fannie Mae and Freddie Mac, the two largest mortgage lenders in the U.S.

Fannie and Freddie were about $12 billion in the hole at that point—the result of years of mortgage loans that should never have been approved—and the U.S. is still feeling the effects of the fiscal crisis that resulted.

While the S&P 500 finally surpassed its old 2007 high in April 2013, the Federal Reserve Board’s massive holdings of Treasury bonds that were part of its monetary stimulus package are only now starting to be reduced.

When the crisis was at its worst, economists estimated that it would take five years for the economy to recover, and while that was about right for the stock market, digesting the mountain of toxic mortgage debt took a lot longer, as did the Fed’s return to a more “normal” yield on Federal debt.

Index ETFs Can Do Permanent Portfolio Damage

This hasn’t been an easy period for retirees and those approaching retirement. Someone who retired at age 65 this year would have lived through two of the worst market corrections in history, episodes that would have hit their conservative investors save for retirement through index ETFs hard enough to cause tears … twice.

(And just because I’m trying to be kind, I’m not pointing out that index investors who held the S&P 500 from May 2015 through November 2016 would have made precisely zero progress in the value of those holdings.)

Markets have been enjoying great results in 2017, despite a series of scary pullbacks, which should please many investors.

But the portfolios of today’s retirees will never fully recover from the twin blows of the bursting of the Tech Bubble and the Housing Bubble.

So why am I telling you this? It’s because I have a soap box that I like to stand on from time to time while I warn investors about the dangers of putting all their eggs into the index fund basket.

Yes, it’s convenient. Yes, it will provide gains over time if you are lucky enough to retire at the right time.

But even if you never even consider using one of Cabot’s growth stock advisories to help you invest, you should be aware of one major rule that guides Cabot Growth Investor and Cabot Global Stocks Explorer during good markets and bad: Always Stay in Step with the Market.

Both of these advisories adjust their approach to the market using a simple momentum technique. When markets are going up, we increase our exposure and invest in strong growth stocks.

But when markets are in a downtrend, as they were in 2008, these advisories advise subscribers to pull out of growth stocks and seek the safety of cash.

In fact, during 2008, my advisory, Cabot Global Stocks Explorer, was 100% in cash for months at a time, preserving major amounts of capital for those who followed my advice.

If you can imagine how much better your portfolio would look if you could have sheltered them from even part of the ravages of 2008, you will get an idea of how valuable this technique is.

And maybe this will lead you to investigate Cabot growth advisories for yourself. You can get started by clicking this link.

[author_ad]