Editor’s Note: The following article has been partially excerpted from the most recent edition of Cabot Money Club Magazine. If you enjoy what you read, consider subscribing today!

Historically, when home ownership becomes pricy, folks begin renting instead of buying. But in this last real estate cycle, not only did home prices rise 29% from COVID to the beginning of 2022 (and even higher through last spring) but so did rental costs.

Here are just a few statistics from ipropertymanagement.com:

- The current asking rent is 77.1% higher than the nationwide median gross rent of 2020.

- The current asking rent is 12.95% lower than the average monthly mortgage payment.

- 35% of households live in rental properties.

- Rental rates increased 31% over 10 years.

- 41% of renters spend more than 35% of their income on rent.

[text_ad]

The current national average apartment rent was $2,016 per month as of the end of the second quarter of 2022.

The following table shows you how fast rents have risen since the pandemic began:

National Average Asking Monthly Rent Prices

| Quarter | Average Monthly Rental ($) | Year Over Year Change (%) |

| Jun-22 | 2,016 | 14.09 |

| Mar-22 | 1,940 | 16.66 |

| Dec-21 | 1,878 | 15.57 |

| Sep-21 | 1,852 | 12.38 |

| Jun-21 | 1,767 | 5.68 |

| Mar-21 | 1,663 | 3.81 |

| Dec-20 | 1,625 | 1.88 |

| Sep-20 | 1,648 | 1.48 |

| Jun-20 | 1,672 | 3.27 |

| Mar-20 | 1,602 | -0.12 |

Those are some major price increases! You could buy a $350,000 home with 20% down for a monthly payment of $1,841. Which do you think is better?

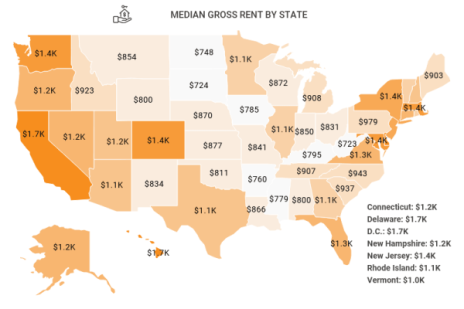

The following is a chart depicting the average rental rates in each state. I’m not sure about this information, as our rental rates in my local area of Tennessee are right around $2,000 per month!

However, price is just one consideration as to whether to buy or rent. Let’s look at the pros and cons of each:

Pros and Cons of Buying vs. Renting

Buy

Pros: build equity, provide tax deductions (for mortgage interest, insurance, and taxes), and you can get fixed payments (if you have a fixed mortgage)

Cons: you are responsible for maintenance and repairs, taxes, insurance, etc.

Rent

Pros: fewer homeowner responsibilities, just one monthly payment

Cons: no control over rising rents or the property

If you want to do a quick, breakeven calculation, try this, the 5% Rule:

First, add up the three major expenses of buying a home:

1. Property taxes, which are generally around 1% of the home’s value

2. Maintenance costs, also around 1% of the home’s value

3. Cost of capital, which is assumed to be around 3% of the home’s value. This is the cost of carrying your debt.

When you add up these three costs, they come to around 5% of your home’s value.

Next, multiply the value of your property by 5%, then divide by 12. That is your breakeven point for what you pay each month to own your property.

Finally, compare that point to the average rent you would pay in your area.

Let’s use our previous example, buying a $350,000 home with a $280,000 loan that costs $1,841 per month.

Property tax: 1% x $350,000 = $3,500

Maintenance costs: the same, $3,500

Cost of capital: 3% x $350,000 = $10,500.

Add those three costs together and you get $17,000. Now, divide that by 12 and the answer is $1,458. That’s your break-even cost. And that means that if the average rental in your area is $2,016, it’s definitely cheaper to own than rent.

However, to be more precise, you can use the real cost of capital. At a 6.884% interest rate, the first year’s interest will be about $18,500 ($270,000 x 6.884%). Yes, I know this isn’t totally accurate, but it should be close!

Now, add those three costs together and you get $25,500. Now, divide by 12, and the answer is $2,125. That’s your break-even cost. And that means that if the average rental in your area is $2,016, it’s slightly cheaper to rent vs. own.

[author_ad]