In light of the shrinking value of the U.S. dollar, let’s break down two of its best, highest-flying hedges: bitcoin vs. silver.

Powerful moves in silver and bitcoin prices have lately stolen the spotlight from stocks. Though the reasons behind the rallies in both assets differ, there are some shared traits that we’ll examine here. More importantly, we’ll look at evidence that should provide answers to two questions many participants are now asking, namely: Do silver and bitcoin have any meaningful long-term appreciation potential? And if so, which is the better investment of bitcoin vs. silver?

It’s not often that the high-flying equity bull market is eclipsed, but earlier this week, the cryptocurrency market stole the thunder from stocks. Bitcoin prices shot up on February 8 after it was revealed in an SEC filing that Tesla’s Elon Musk purchased $1.5 billion worth of the cryptocurrency.

The revelation of Musk’s investment in bitcoin shocked the Street, as did the news that Tesla plans to accept it as a form of payment for its electric vehicles. (At the latest price, it would take 0.8 bitcoins to purchase the company’s entry-level Model 3.) The news also provided the catalyst for a 20% rally in bitcoin.

[text_ad]

Below is a graph of my favorite bitcoin tracking fund, the Grayscale Bitcoin Trust (GBTC). As its performance in the past year reflects, bitcoin has had a stellar run since bottoming out during the post-pandemic crash in March 2020.

The real action, however, started later in the year when demand for bitcoin and other cryptocurrencies was stimulated by a conspicuous increase in hedge funds and public companies entering the crypto market as buyers. For instance, business intelligence firm MicroStrategy unveiled a $250 million bitcoin purchase in September, while merchant services company Square Inc. (SQ) put 1% of its total assets ($50 million) in bitcoins.

Clearly, bitcoin is rising in reputation and has gone from being a hyper-speculative vehicle with limited appeal to a more of a mainstream investment vehicle. And as the coronavirus-related stimulus spending by the U.S. Congress reaches runaway proportions, it’s widely feared that inflation will rear its ugly head in the coming year. This in turn has inspired a search for alternative safe-haven assets beyond the traditional ones like gold and U.S. Treasuries.

By virtue of bitcoin’s inverse (albeit loose) correlation with the U.S. dollar index, it has accordingly garnered a growing share of capital from safety-conscious investors looking to hedge against the greenback’s eroding value. The following chart puts the dollar’s losses since last year in perspective.

Bitcoin vs. Silver: Tale of the Tape

It should also be added that the supply of bitcoins is fixed, which is written into the cryptocurrency’s code. As one analyst observed, “We can verify with certainty how many exist now and how many will exist in the future.” This provides yet another key support for bitcoin’s long-term bull market.

Moreover, even as its reputation as a legitimate store-of-value asset increases, bitcoin still offers nonpareil profit potential for the risk-minded trader (indeed, few actively traded assets can compete with the enormity of its short-to-intermediate-term percentage moves).

Meanwhile, the stodgy silver market has also captured its fair share of attention lately. After lying dormant for several months after hitting a long-term peak in August, the white metal achieved an eight-year price high on a single day on February 1. A Reddit-fueled raid on bearish positions in the metal was the catalyst behind silver’s 20% rally, which is visible in the following chart of the iShares Silver Trust (SLV)—a leading silver ETF.

While many analysts have characterized the event as a “one-day wonder,” there are several fundamental reasons for believing that silver prices will maintain their long-term bull market, which began over two years ago.

One such reason is that, like bitcoin, silver’s value is strongly impacted by the U.S. dollar. Since the metal is priced in the currency, dollar weakness tends to exert a lifting effect on it, while sustained currency weakness also enhances silver’s attraction as a safe-haven investment.

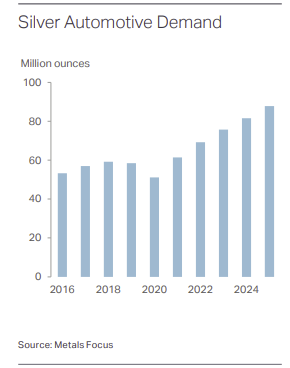

But silver is more than just an inflation trade. It’s also an indirect play on the ongoing explosive growth of the tech sector. The burgeoning solar industry, for instance, is a major consumer of silver since solar cells require the metal (an average solar panel requires around 20 grams of silver). And in the booming automotive sector, global consumption of silver is expected to reach 90 million ounces by 2025, according to The Silver Institute. The ongoing rollout of 5G technology, moreover, will also be a major benefit for the metal.

And unlike other assets, silver is experiencing a significant supply shortage due to a voracious appetite from global investors. Manufacturers and miners were faced with ever-rising demand for bullion coins and fabricated bars even before last year’s pandemic hit, and shortages of physical silver continue to be reported by dealers around the nation.

A case in point is the U.S. Mint’s inability to meet the explosive demand for its gold and silver bullion coins in 2020 and into January 2021. The Mint attributes this shortfall to “pandemic-driven demand and plant capacity issues.” The Mint added that sales of U.S. gold bullion coins were up 258% in 2020, while silver bullion coin demand rose 28%, adding that “heavy buying” has continued into the new year. In view of the inflationary pressures resulting from a stimulus-weakened dollar, this onerous situation isn’t likely to abate anytime soon.

Which Dollar Hedge Should You Buy Now?

The bitcoin vs. silver verdict? Both silver and bitcoin are poised to benefit from the major forces mentioned here in the coming year. These include a weak dollar, supply constraints and rising safety demand. Both assets are supported by increasing institutional demand, and both have significant upside potential as well as safe-haven attraction.

Silver is by far the more conservative of the two assets while its volatility factor is lower; consequently, its percentage gains will almost certainly be eclipsed by the far more volatile bitcoin. However, its many industrial uses give it an advantage over bitcoin as both a practical asset and a store of value.

By contrast, bitcoin’s increasing acceptance as an alternative payment and speculative vehicle should ensure the continuance of its bull market. All told, investors should consider owning conservative positions in both assets as a long-term investment.

Now, if you’d prefer to stick to stocks, and want the best performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week Chief Analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]