If you lightened up on your investments ahead of the election, it’s time to start working your way back into the market. You can start by investing in one particularly beaten-down sector: biotech stocks. More on that in a minute…

Post-Election Boost Coming in this Undervalued Sector

Historically, the stock market has gained an average of 2.5% in the last two months of an election year, as a source of major uncertainty is lifted from investors’ shoulders. This year’s surge may have already started on Monday, after the FBI once again concluded its investigation into Hillary Clinton’s emails. Global stocks rallied, U.S. markets opened sharply higher, and the flow of money into safe havens like treasuries and gold slowed.

This year, the unknown election outcome has weighed particularly heavily on health care stocks. The cost of health care, and drug prices in particular, became a political football kicked about by both campaigns. Rising costs of Obamacare and a few prescription-drug pricing scandals combined to make pharmaceutical companies and drug distributors persona non grata on both Wall Street and Main Street.

In California, the fight against high drug prices made it all the way to the ballot yesterday. Voters had the chance to approve a measure that would mandate that state agencies pay the same prices for prescription drugs as the U.S. Department of Veterans Affairs. The VA is able to negotiate big discounts on most drugs because of its size.

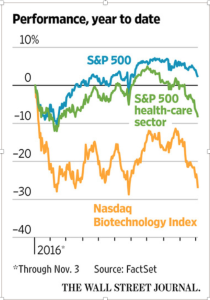

Fear of similar regulation being introduced at the Federal level has been a major contributor to health care stocks’ 8% decline year-to-date. Biotech stocks have been the worst-hit sector; biotech companies make some of the highest-priced drugs, like gene-based biologics. The Nasdaq Biotechnology Index (IBB) has fallen 26% since the start of the year.

However, research by RBC Capital Markets suggests that this year isn’t so unusual. The biotech index has pulled back before each of the last four presidential elections as well. Each time, it recovered most of the losses once the election was over, rallying 10% to 15% over the next three months.

Five Biotech Stocks That Won’t Rebound After the Election

It’s possible that the election outcome will eventually harm profits at some biotech companies, if markets decide that the new faces in Washington are more likely to pass punishing regulation. In fact, the attention on drug prices is already translating into pressure on certain biotech stocks. Amgen (AMGN) reported last week that it’s feeling significant pressure on prices from pharmacy benefit managers, who control what insurance plans pay for drugs.

I’d still recommend avoiding stocks of companies that depend heavily on raising prices to boost profits. Mylan (MYL), which was so much in the news earlier this year for raising the price of an Epi-Pen multiple times, is a prime example. Amgen is another biotech stock to avoid; the company has driven revenue growth recently largely by hiking the prices of its best-selling drugs, including the arthritis drug Enbrel and the osteoporosis treatment Prolia.

Investors should also be wary of drug distributors like AmerisourceBergen (ABC) and McKesson (MCK), which fell 23% last week after missing estimates and slashing guidance. Pharmacy benefit managers like CVS Health (CVS) are also likely to see margins squeezed by pressure to lower prices.

But price increases are just one way that biotech companies boost revenue. Investors will find plenty to like in stocks of companies that are still generating revenue growth by selling more drugs, not just charging more for them. Companies with strong pipelines of new drug candidates will also be more resistant to pricing pressure.

As Jim Tierney, a CIO at AllianceBernstein, told The Wall Street Journal in an article about the health care sector published earlier this week, “There are winners, and even the winners have been beaten down, so there is a good opportunity for those who can execute.”