Obviously, the big story of late is the market itself, with the selling pressures in glamour stocks bleeding into the rest of the market. Thus, I figure now’s a good time to basically do a subscriber Q&A, culled from the many emails I’ve been getting and heard asked to others of late. One of them asks whether there are any stocks to buy in this environment. Let’s get right into it.

Answering Your Questions about this Scary Market

Q: After the recent plunge, are you seeing any signs that we’re near a low? Or do you instead see this as another 2008 or 2000-2003, i.e., a major bear phase?

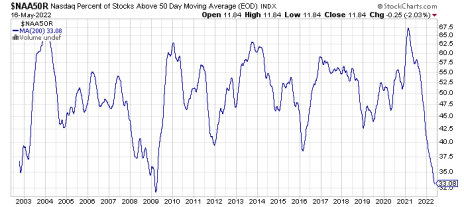

A: So, yes, there are signs that the market is near a low, with many measures (sentiment or otherwise) at extremes seen near market bottoms. For instance, last Monday the NYSE saw north of 1,000 stocks hit new lows (it can get larger but that type of washout is rarely seen). Plus, longer-term, check out the following chart: On average during the past 200 days, under 34% of stocks on the Nasdaq have been above their 50-day lines, which is worse than what was seen in 2002 and not far off from the early-2009 reading.

[text_ad]

Now, to be clear, none of this means the market is at a low or can’t fall further. I remain very defensive (north of 80% cash!) in my Cabot Growth Investor portfolio—but I don’t think there’s any question that the conditions are in place for a meaningful low. Even so, we have to see the market actually go up for more than a few hours to take action on it.

Q: So you don’t think there’s a chance this is the start of another humongous bear like 2008?

Well, there’s always the chance, and really I never rule anything out. Maybe the Federal Reserve goes off its rocker and crushes the economy, or maybe the European war gets worse. Frankly, while everyone wants to know what will happen in a month or two or six, more important is really gearing your portfolio for what you’re actually seeing out there. Hence, my defensive posture while I look for stocks to buy.

That said, I do think the odds are against another 2008—the fact that we had two “once-in-a-generation” bear markets within eight years of each other makes another one extremely unlikely. Plus, the fact that we’re already seeing some “long-term” oversold-type measures and very pessimistic sentiment make it less likely. Anything is possible, but I’d simply say the odds are against another 12 months of punishing action.

Q: Besides the market itself going up, what would be some signs of life for the market?

The primary evidence—the major indexes and potential leading stocks rallying—will be key. We’ve seen many secondary-type indicators look good for the past few weeks, but obviously to no positive result.

However, if there is something to watch, I continue to think the “obvious” theme right now is that (a) growth stocks are terrible, and (b) big investors are hiding in defensive stocks. Thus, I’m keeping a close eye on our Aggression Index, which simply compares the Nasdaq to the consumer staples fund (XLP). Beyond getting an actual green light (that might take a while), I simply would like to see some outsized selling in XLP at the same time the Nasdaq perks up—that would at least represent a short-term change in character and could be the tip-off that the sellers are moving on. (A crack in XLU or XLV also wouldn’t hurt the cause.)

Q: What about the former leaders like Shopify (SHOP), Block (SQ), Cloudflare (NET) and the like? Is there any hope for them?

I’m not breaking any news here, but my first thought with these names is that they topped out for good—their point of peak perception has passed, so what I’d really be focusing on is new leadership. That’s where the big money will be made down the road.

As for the here and now, I’d say that if you still own some of these dogs (don’t beat yourself up if you do—it happens to most investors), you don’t have to sell wholesale, but I also wouldn’t hold and hope—consider pruning some shares to take a step in the direction of the evidence. Then, ideally, we get a bounce and you can let more go.

As for buying, look, some names like SHOP could easily bounce 25% to 50%. In fact, as I write this, SHOP could rally 50% tomorrow and only be back to its 50-day line! (See chart below.) Thus, if at some point you want to try to trade a few of these things (preferably after they show some real support), I can see that—but I doubt you’re going to look back in four years and say “my portfolio did great because I traded all those broken stocks perfectly!” No, the big money will be made in fresh leaders during the next bull phase, so if you play these, treat them carefully.

Q: Even commodity stocks have begun to get hit, especially last week. Should those be sold?

A: My thoughts on the commodity space have a few different angles. First off, a few areas within the sector topped a few weeks back—things like copper and (more recently) steel have cracked, at least in the intermediate term. So I’m wary of those.

As for energy and coal, I’m more sanguine in general—the cash flow/dividend/share buyback stories remain very big for many leaders, even if energy prices come down 20%. Moreover, remember that these stocks were out of favor for years and years, so big picture, I don’t believe the run is over.

That said, you also can’t forget that a lot of these stocks have had huge runs during the past few months or longer. If you own some with good-sized profits and reasonably sized positions, I think they’re OK to hold, and while some buying could be OK, I’d keep new positions small and use a reasonable loss limit.

3 Stocks to Buy Now

Q: On that note, is there anything in the market you actually think can be bought here?

Well, frankly, I do still see some stocks to buy in the commodity space, though again, I wouldn’t go hog wild. First, there’s Arch Coal (ARCH), which is enjoying soaring demand both for its thermal coal (for electricity) and met coal (to make steel). Surely coal prices will come down, but what’s interesting is that the firm’s incredible Q1 results (nearly $13 of earnings per share, leading to an $8-plus dividend!) were actually hampered by rail traffic being crimped. That should be alleviated in Q2, providing an extra boost. The stock is still seeing higher highs and lows.

Then there’s StarBulk Carriers (SBLK), a dry bulk shipper that’s paying out massive dividends as it has little CapEx starting in the second half of this year. Shares have chopped sideways for the past couple of months, resulting in a good-looking setup—though be aware earnings and the dividend announcement are due May 24.

On the growth side of the equation, it’s very slim pickings of course, but Lantheus (LNTH) remains one of the few that’s acting well. The firm isn’t well known, but is a leading provider of diagnostic imaging agents—and it has a new one for certain prostate cancer screens that’s being adopted en masse, leading to a step-function increase in earnings this year ($3 per share vs. 50 cents or so beforehand). The stock has just shaken out to the 50-day line, its first test since breaking out in February.

Q: Those are well and good but it seems like the market and growth stocks in particular just have no bottom. Is there hope?

There’s always hope. In fact, beyond any indicators or insight into some slice of market action, my main message is simply: I personally, and Cabot overall, have been through this before—we’ve seen it all, and have been through declines much worse than this, and survived and thrived on the other end. Really, the good news from this mess is that this represents a real wipeout—a “re-set” if you will, that is washing away, and will continue to wash away, the weak hands and pave the way for a real, sustained uptrend with fresh leaders and new stocks to buy.

The year or two after the next bull phase begins is where the big money will be made—new stocks that the (wo)man-on-the-street has never heard of that will not just get going for a couple of months but likely a year or two as big investors reposition their portfolios into these new leaders. Since I started at Cabot, I’ve seen it before in 2003 (eResearch, XM Satellite Radio, NetEase), 2009-2010 (Green Mountain Coffee, Baidu, Las Vegas Sands), 2017 (Shopify, Celgene) and 2019-2021 (Twilio, Okta, DocuSign, Teladoc), and I’m sure it will happen once this mess is over.

The key, as always, is to get from here to there with as much capital and confidence as you can. Thus, play defense for now, but don’t stick your head in the sand.

Do you have any other questions? Any other recommendations on stocks to buy now? Leave a comment below!

[author_ad]