After shunning risk assets for more than a year, small investors are returning to stocks as the realization sinks in that the bull is back.

The resulting rush to make up for lost time by putting money to work in equities has lately resulted in some strong rallies in the major indexes, led mainly by the tech sector. But with an increasing number of industry groups becoming overstretched, many participants now wonder if there are any worthwhile opportunities left.

While the number of S&P sectors that haven’t yet fully participated in the broad rally is admittedly few, there are a couple of notable standouts. And one of them happens to be in a sector that should benefit from the recent surge in the Consumer Confidence Index (which hit a two-year high in January), namely consumer discretionary stocks.

[text_ad]

At this point in the bull market’s trajectory, it’s probably a good strategy to focus on sectors and industry groups that haven’t yet broken out to new highs but are within reach of doing so. And many of the leading retail stocks happen to fall neatly into that category.

Shown here is the chart of the Consumer Discretionary Select Sector SPDR ETF (XLY), which hasn’t kept pace with the major large-cap indexes in recent weeks—but which is clearly within reach of its old high and, more importantly, is showing signs of returning to a position of strength.

The fund’s holdings as of the latest quarter include U.S. major hotels, restaurants and leisure companies (by far its biggest single component at 22% of total holdings). The latter is also an industry group that’s notably picking up forward momentum right now and should help XLY overcome its prior high.

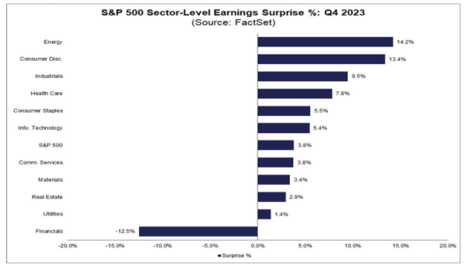

Regarding the overall group, FactSet’s chief earnings analyst John Butters reports that the consumer discretionary sector (along with the Utilities sector) is reporting the second-highest yearly earnings growth rate of all 11 S&P sectors at 33%. According to Butters:

“At the industry level, four of the nine industries in the sector are reporting year-over-year earnings growth. Two of these four industries are reporting a year-over-year increase in earnings of more than 100%: Broadline Retail (1,014%) and Hotels, Restaurants, & Leisure (125%).”

What’s more, consumer discretionary is the second-leading group among all S&P sectors during the latest earnings season to date in terms of posting both earnings and revenue surprises.

Amazon (AMZN) was the largest contributor to earnings growth for the discretionary retail sector in Q4 and accounts for much of the strength in XLY. But even putting this retail juggernaut aside, other companies within the sector look attractive and are set to contribute to the sector’s continued growth in the coming months. These include apparel makers, luxury fashion and accessories, home goods retailers and building material suppliers.

Here at Cabot, we can help you navigate the market by selecting the most promising candidates in retail and many other sectors via Mike Cintolo’s weekly Top Ten Trader. Expert stock picking is paramount for navigating the market’s current challenges, which is why Top Ten Trader is ideal for participants who want to focus mainly on the strongest companies with the best short-to-intermediate-term growth potential.

[author_ad]