Investor sentiment is something we pay close attention to here at Cabot. While it’s not as important as key fundamental metrics and technical tools for determining the market’s health, it’s still worth looking at since it provides clues as to how “overbought” or “oversold” the market may be.

Weekly investor sentiment polls, like the ones released by Investors’ Intelligence or AAII, are often useful. But even more significant are conspicuous news headlines that sometimes appear at critical junctures of the broad market’s dominant trend. Such headlines allow individual investors to quickly gauge the market’s pulse for signs the trend may need to be “corrected.”

[text_ad]

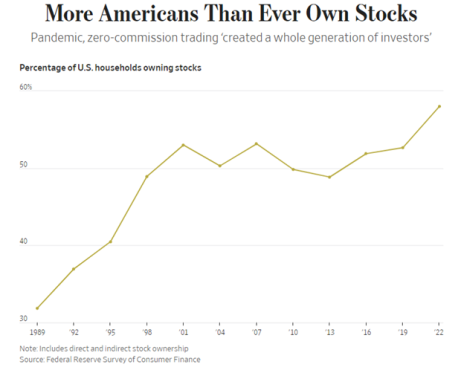

One example of this occurred last week when the Wall Street Journal drew attention to the fact that more Americans now own stocks than ever before. According to WSJ, around 60% of U.S. households owned stocks in 2022, which “marks the highest household stock-ownership rate recorded” in a recent Federal Reserve survey.

The article went on to explain how the Covid era resulted in an “explosion in investing” that “reshaped” American’s attitude toward equities—particularly among members of the Millennial cohort.

Prior to 2020, an entire generation of Americans harbored a deep aversion to the stock market in the wake of the credit crisis. Indeed, many of them saw the negative impact the 2008-2009 bear market had on their parents’ finances and vowed to avoid stocks altogether, instead gravitating to other financial assets (like Bitcoin).

But the advent of zero-commission trading, coupled with the boredom induced during Covid-era shutdowns, prompted millions of Americans to embrace stock trading. The subsequent boom in stock prices during those years did much to soften attitudes toward equities and led to the massive increase in stock ownership we’re seeing today.

A widely held tenet of contrarian investing is that whenever the crowd becomes heavy participants in the stock market, it’s time to “short” the market as a bear is likely just around the corner. You might be asking, “Does this principle apply to the present case?”

The answer is that while it’s not uncommon for a wave of buying interest among retail investors to coincide with a market top, it usually takes several years for a major top to form once public participation first begins increasing.

For instance, during the heady days of the late 1990s, contrarians constantly warned of an “imminent” market crash all through the years between 1995 and 2000, which was predicated on the public’s massive interest in and ownership of stocks. Yet it wasn’t until the end of that five-year span that the prognostication finally proved correct.

In fact, public participation typically brings a dynamism to the market that is lacking during the early stages of a secular bull market (which can take years to complete) when small investors aren’t active participants. During the accumulation phase that follows a bear market, the public is largely missing as most of the stock buying is done by institutional investors.

When the public finally enters the market—as they’ve done in the last couple of years—their growing presence tends to amplify price movements and makes for a much livelier trading environment. This is one reason why the public’s growing embracement of stocks should prove to be a boon for participants in the coming years.

It’s also worth mentioning that stocks exited a bear market just over a year ago; additionally, the S&P 500 just completed a 10% correction in October. Collectively, both events did much to clear out any oversaturation of buyers that may have built up during the prior years, in turn paving the way for higher stock prices.

If you’re a contrarian, the fact that Americans have more exposure to stocks today isn’t by itself a cause for concern. In fact, our three primary market timing indicators—the Cabot Trend Lines, the Cabot Tides and the Two-Second Indicator—are all still positive. And until we see significant and sustained deterioration in these (and other) indicators, broad public participation should be regarded as more of a help than a hindrance to the market’s overall performance.

[author_ad]