As the analyst of the Cabot Micro-cap Insider, I recommend micro-caps – naturally. But every so often I recommend a micro-cap that grows into a small-cap stock.

The definition of a micro-cap isn’t precise, but I generally define them as stocks with market caps of less than $250 million and definitely less than $500 million.

Once a stock becomes a small-cap name, I’m not going to sell it just because it’s not a micro-cap anymore.

I will sell it if the stock price has gotten ahead of its business fundamentals, but I won’t sell it just because it’s now a small-cap stock.

That would be stupid.

One of my companies has done what I just described.

[text_ad]

I recommended it a couple years ago as a micro-cap, and it has steadily grown its market cap to over the $1 billion threshold. Thus, it no longer qualifies as a micro-cap.

Nonetheless, it remains one of my favorite stocks.

Let me introduce P10 Holdings (PX) – (disclosure: I own shares).

Back in 2020 when I originally recommended P10 Holdings at a split-adjusted price of 2.98, it traded on the OTC exchange under the symbol PIOE.

Last fall, it up-listed to the NYSE and now trades under the symbol PX.

This small-cap stock is a pure play on continued private equity industry growth.

There are a couple of reasons that I think the private equity industry is going to continue to grow.

First, performance.

Historically performance has been very good and has outperformed the public markets.

Second, prestige.

Most institutions (think Yale endowment) have large allocations to private equity and real estate. It’s nice to be able to tell yourself that your investment approach is as sophisticated as large institutions.

Besides, when you’re at a cocktail party, it’s a lot more fun to be able to talk about how much money you’re making from your private equity portfolio.

Third, “lower volatility.”

This is a little “tongue-in-cheek” as in reality, private equity assets are not lower risk than public stocks (usually their business volatility is actually higher given higher leverage), but they are “marked” or valued once a quarter and this gives a false perception that volatility is lower. Nonetheless, the perceived lower volatility results in real benefits.

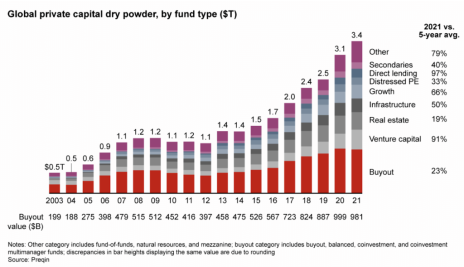

Given these three factors, growth in private assets under management has been incredible.

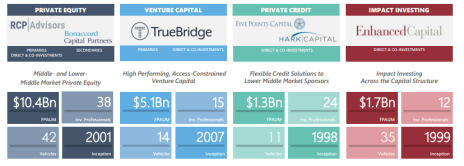

P10 Holdings is a pure play on continued private equity industry growth because it owns several different private equity management companies.

P10 Holdings is like more well-known (and larger!) peers, Blackstone (BX) and Carlyle Group (CG).

Private equity management companies don’t invest in private equity funds, but rather manage private equity funds (and collect lots of fees!).

The thing that I love most about the private equity industry is the “stickiness” of the fees.

In the private equity world, capital is committed for a period of ten years or longer. In other words, you as an investor have a contractual obligation to pay fees for at least ten years (usually funds can “extend” for at least two years).

P10’s strategy is to buy stakes in private equity management companies.

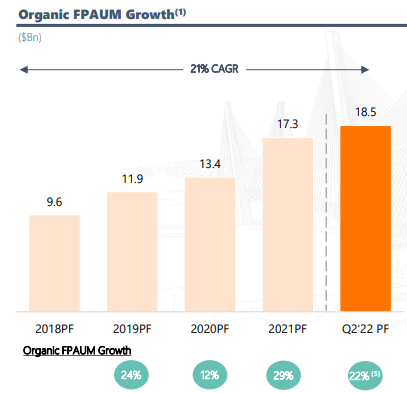

Historically, assets under management have grown organically at 21% per year.

The private equity companies that P10 has acquired have excellent performance, which suggests assets under management (and earnings) will continue to grow nicely.

Despite a rosy outlook, the stock is trading at a Price/NTM EPS of 13x, a large discount to Blackstone at 20x and Hamilton Lane (HNLE), another peer, at 23x.

One caveat is this small-cap stock is extremely illiquid. Daily average dollar trading volume is only $150,000 as insiders own most of the company.

Be sure to use limits and start by buying in small-dollar increments to make sure you don’t move the price of the stock.

[author_ad]