Healthcare IPOs are on the Rise, and Several Small-Cap Biotechs Look Particularly Appealing.

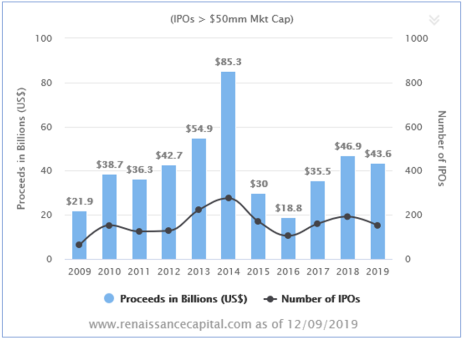

According to Renaissance Capital there have been 152 IPOs so far in 2019, with total proceeds of $43.6 billion raised.

The pace, and collective amount raised, are both a tad shy of 2018 (192 IPOs and $46.9 million raised) but on pace to be in the ballpark of the trailing four-year average in terms of quantity (157 IPOs), and well above the average amount raised ($32.8 million).

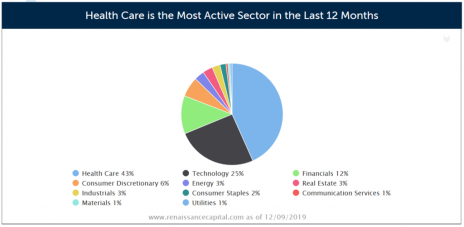

By far, the greatest number of IPOs have come from the Healthcare sector, which has spit out 69 IPOs so far this year. That’s 45% of the total.

I went through the list and scooped out four small-cap biotech IPOs from the last two months that are posting standout performance. Here’s the deal on these companies.

Four Small-Cap Biotech IPOs Surging Now

Small-Cap Biotech IPO #1: Innate Pharma (IPHA)

Innate Pharma went public at 5.5 on October 24, raising $130 million. The Marseille, France based company was founded in 1999 and specializes in therapeutic antibodies that use the immune system to fight cancer. The company has one FDA approved treatment, Lumoxiti (Hairy Cell Leukemia), which was in-licensed from AstraZeneca and should be launching in the U.S. right now. The company, in partnership with AstraZeneca, is also advancing monalizumab into a Phase 2 trial for recurrent or metastatic squamous cell carcinoma of the head and neck (SCCHN). There are also several pre-clinical Phase 1 and Phase 2 trials ongoing for various treatment candidates, many of which are in partnership with AstraZeneca.

[text_ad]

One of the strong selling points for the stock is that with the launch of Lumoxiti in the U.S. Innate should have a commercial organization in place here, along with one to follow in the E.U. in 2020. This would help grease the wheels for future commercial launches, assuming more pipeline success. While the stock is up roughly 10% from its IPO price, there is no trend to speak of. The company has a market cap of $472 million.

Small-Cap Biotech IPO #2: Progyny (PGNY)

Progyny went public at 13 on October 24, raising $130 million. The company is based in New York City, was founded in 2016, and after rising 117% it currently has a market cap of $2.32 billion. It’s more healthcare than biotech but I included it anyway because of the interesting and valuable services it provides. Progyny provides fertility benefits management solutions for 1.4 million members in the U.S. Customers are typically employers, and it had 84 of them at the end of September 2019. Patients get education and guidance from a dedicated Patient Care Advocate, which gives them access to a network of fertility specialists.

Growth is impressive. Revenue was up 120% in 2017, 117% in 2018 and is on pace to rise 118% (to $230 million) in 2019, when earnings should turn positive for the first time (EPS of $0.09 expected). Most growth is coming from fertility benefit services (82% of revenue in Q3) with some help coming from pharmacy benefit services, which is just beginning to ramp up after being launched in 2018. The stock has been mostly trending higher since it went public, leading me to believe there is still an extended period of weakness to come in the near future.

Small-Cap Biotech IPO #3: Phathom Pharmaceuticals (PHAT)

Phathom went public at 19 on October 24, raising $182 million. The company is based in Illinois and develops novel treatments for gastrointestinal disorders. The most advanced drug candidate is vonoprazan, an oral potassium-competitive acid blocker intended to treat gastroesophageal reflux disease, Helicobacter pylori infection and other acid-related diseases. Vonoprazan was developed by Takeda Pharmaceuticals and is approved in nine countries. It generated $500 million in net sales in its fourth full year of sales in Japan and was in-licensed by Phathom for distribution in the U.S., Canada and Europe.

The company intends to expand vonoprazan to other indications and is currently launching two Phase 3 trials, one for gastroesophageal reflux disease (GERD) and the second for H. pylori infection (has received Fast Track designation from the FDA). Trial results won’t be available until 2021 so while overseas historical sales are encouraging it will be a little while before Phathom starts cashing in on its investment. With the IPO proceeds, plus $75 million in cash the company already had (offset a bit by $25 million in debt), there shouldn’t be any immediate need for another capital raise. Phathom has a market cap of $570 million and is trading roughly 20% above its IPO price, with no trend to speak of.

Small-Cap Biotech IPO #4: 89bio (ETNB)

89bio is up 76% since it raised $85 million in its November 11 IPO, which was priced at 16. The San Francisco, California-based company has a market cap of $358 million and is developing treatments for liver and cardio-metabolic diseases. The most advanced asset is BIO89-100 (Phase 2), which is intended to treat non-alcoholic steatohepatitis (NASH). NASH is a severe form of non-alcoholic fatty liver disease (NAFLD) accompanied by inflammation and fibrosis in the liver that can lead to complications. NAFLD affects around 25% of the global population, and NASH develops in around 20% to 25% of NAFLD patients.

89bio is also planning a Phase 1 trial for hypertriglyceridemia, a condition that occurs when triglyceride levels get above a certain threshold. The target population is around 2.5 million to 4 million, including a lot of people with Type 2 diabetes. There is no revenue expectation in the near future but with proceeds from the IPO, 89bio should be set for a little while. The stock spiked as high as 46 in the weeks after the IPO and appears to be settling down into the mid to high 20s.

Where To Find More IPO Research

Clearly, small-cap biotech IPOs are doing well this year. But it’s a fickle business, and the fortunes of these companies will rise, and fall, based on FDA approvals. That makes them risky bets.

Still, we’ll roll the dice on some of these names in Cabot Early Opportunities, which currently includes coverage of one biotech company that’s surging because of success developing drug candidates to fight solid tumors.

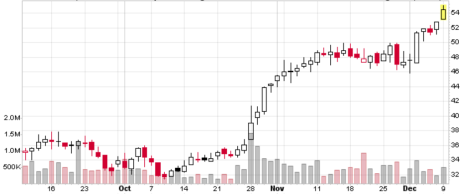

This is what the chart looks like. We’re up around 57% since we jumped into it in October.

For more information on this stock, recent IPOs from other sectors, and a wide variety of other rapid-growth early-stage stocks, consider grabbing a subscription to Cabot Early Opportunities here.

[author_ad]