Today, I want to introduce you to one of my most successful recent recommendations: P10 Holdings stock. But first, let me tell you about my experience working in the private equity industry.

I spent five years of my career working at Citi Private Bank, most recently as a Senior Vice President.

My job was to help our team identify the most attractive private equity opportunities to Citi Private Bank clients.

Clients at Citi Private Bank had an insatiable appetite for private equity and real estate in their portfolios.

Why?

First, performance.

[text_ad]

Historically, the firm’s performance has been very good and has outperformed the public markets.

Second, prestige.

Most institutions (think Yale’s endowment) have large allocations to private equity and real estate. It’s nice to be able to tell yourself that your investment approach is as sophisticated as large institutions’.

Besides, when you’re at a cocktail party, it’s a lot more fun to be able to talk about how much money you’re making from your pre-IPO private equity fund that invested in Airbnb (ABNB), Affirm (AFRM) and Stripe prior to their IPOs.

Third, “lower volatility.”

This is a little tongue-in-cheek, as in reality private equity assets are not lower-risk than public stocks (usually their business volatility is actually higher given the higher leverage), but they are “marked” or valued once a quarter and this gives a false perception that volatility is lower. Nonetheless, the perceived lower volatility results in real benefits.

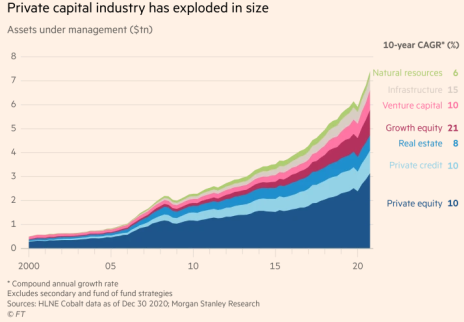

Given these three factors, growth in private assets under management has been incredible.

But the even better thing about the private equity industry is that revenue is very sticky. In the mutual fund or ETF world, assets can come in the door one day and go out the door the next.

In the hedge fund world, investor capital is a little stickier, but investors usually have an opportunity to redeem their investments quarterly or annually.

By contrast, in the private equity world, capital is committed for a period of 10 years or longer. In other words, you as an investor have a contractual obligation to pay fees for at least 10 years (usually funds can “extend” for at least two years).

P10 Holdings Stock: A Mini-Blackstone

The world’s most famous private equity manager is Blackstone (BX), and its stock has been an amazing investment over the past 10 years.

And I think the outlook for Blackstone looks great for the next 10 years.

But there is a better way to play the continued growth of the private equity industry.

Let me introduce you to P10 Holdings (PIOE) (disclosure: I own shares).

When I first recommended P10 Holdings to Cabot Micro-Cap Insider subscribers, it was a micro-cap with a market cap of $177MM.

It’s up over 300% since then but still looks very attractive.

P10’s strategy is to buy stakes in private equity management companies.

Today, it owns four equity stakes in private management companies.

- RCP Advisors (middle market buyout)

- True Bridge Capital Partners (venture capital)

- Five Points Credit (private credit)

- Enhanced Capital (ESG private equity)

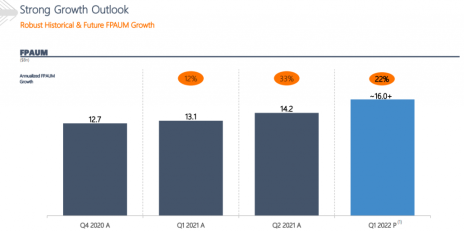

The company has historically grown very well and will continue to do so.

Despite its rosy outlook and 300% run-up, the stock is trading at an EV/annualized EBITDA of 14.5x, a large discount to Blackstone at 20.3x and Hamilton Lane (HLNE), another peer, at 26.7x.

Finally, news recently broke that P10 is looking to up-list from the OTC markets to the New York Stock Exchange.

This should increase its valuation.

One caveat is this stock is extremely illiquid. Daily average dollar trading volume is only $150,000 as insiders own most of the company.

So be sure to use limits and start by buying in small dollar increments to make sure you don’t move the price of the stock.

And it you want to know what else besides P10 Holdings stock I’m currently recommending in my Cabot Micro-Cap Insider advisory, click here.

Do you own any micro-cap stocks? Tell us about them in the comments below.

[author_ad]