Before we get into signs of insider buying, let’s check in with the market.

The S&P 500 continues to rip and is up 20% YTD.

And it makes sense. Inflation readings are coming in below expectations and there is growing consensus that the Fed will hike rates one more time before pausing.

Blackstone Chief Operating Officer, Jonathan Gray, summed it up well on a recent earnings call:

“I think they’re going to raise rates, it sounds like, one more time and then they’re going to hold them here for a longer period of time to try to slow the economy...we’re getting through this. And I think that’s one of the reasons why we see some enthusiasm in the market.”

As a result, it looks like the Fed has threaded the needle (at least for now) of raising rates without tipping the economy into a recession.

But there is one sector that has been left behind…

[text_ad]

The Energy Select ETF (XLE) is flat on the year.

The chart below shows that energy is out of favor despite a strong 2021 and 2022.

But with a stable economy and growing demand for energy, energy stocks are poised to outperform.

One other trend that I’m noticing in the market is energy company insider buying.

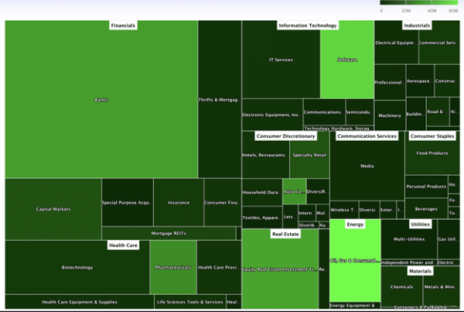

Insidearbitrage.com recently analyzed the past 90 days of insider buying and created the heat map below.

As you can tell, energy executives are buying their own stock hand over fist.

It’s not hard to understand why.

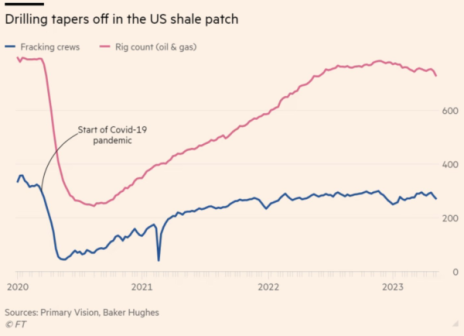

Usually, when energy prices spike as they did last year, energy companies rush to drill new wells to pump more oil and gas.

But that didn’t happen in this cycle.

This chart shows that drilling is below pre-pandemic levels.

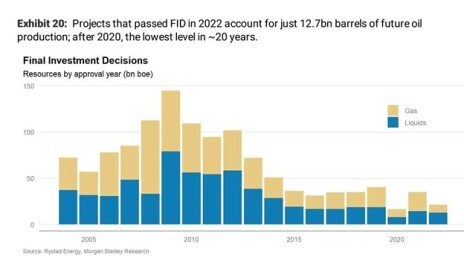

Even more importantly, there has been a dearth of new capital investment as energy companies have grown increasingly cautious about investing in new projects and have opted to return cash to shareholders.

This chart shows the dramatic fall in oil and gas capex projects. “FID” stands for “Final Investment Decisions” which translates to long-term capex projects.

Recent commentary from oil and gas service providers suggests an attractive outlook.

Schlumberger’s CEO said the following during a recent conference call:

“We continue to see positive upstream investment momentum in the international and offshore markets. These markets are being driven by resilient long-cycle offshore developments, production capacity expansions, the return of global exploration and appraisal, and the recognition of gas as a critical fuel source for energy security and the energy transition.”

Halliburton CEO said the following:

“Oil and gas continues to demonstrate its critical role in the global economy and meeting long-term demand requires sustained capital investment…Customers are settling in for a long duration up cycle. Overall, I expect upstream spending to grow in 2023 and beyond.”

My favorite way to play the coming oil and gas bull market?

Buy Unit Corp (UNTC), a micro-cap that trades over the counter.

I own a ton of the stock and below it is poised to outperform.

It’s paid $12 per share in dividends YTD and will continue to return cash to shareholders through dividends (regular and special) as well as share buybacks.

Meanwhile, the stock is dirt cheap, trading at a 4.9x free cash flow.

Finally, the downside is protected as it has no debt and 38% of its market cap in cash.

Want more energy ideas?

Join Cabot Micro-Cap Insider to get my other two highest-conviction energy ideas.

[author_ad]