Today I’m going to discuss two stocks.

They are both in the same sector and have similar growth profiles.

They both are controlled by excellent capital allocators.

But one trades at a massive discount to the other.

This case study will articulate why I prefer small-cap (or micro-cap) stocks vs. large-cap stocks.

Let’s start with the large-cap stock.

[text_ad]

Large-Cap Stock: Brookfield Asset Management (BAM)

On December 12, 2022, Brookfield Corporation spun off a 25% stake in its asset management business, Brookfield Asset Management (BAM), to investors.

Investors in Brookfield Corporation received 1 share of the manager for every 4 shares they owned of the corporation.

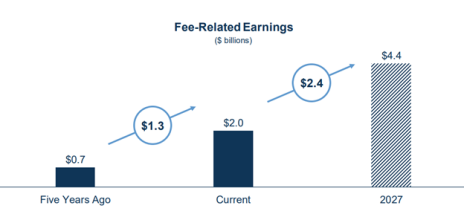

The spin-off, Brookfield Asset Management, is a pure-play alternative asset management company. The manager is retaining 100% of fee-related income and is entitled to 2/3 of gross carried interest on new funds (Brookfield Corporation retains 1/3 of gross carried interest on new funds).

It has been growing rapidly and expects to continue to do so going forward.

Brookfield Asset Management currently generates $2BN of free cash flow. With a $49BN market cap, it’s currently trading at 24.5x free cash flow.

This valuation isn’t dirt cheap, but it is attractive – I would argue – for a pure-play alternative asset manager with secular growth tailwinds.

But when I look at Brookfield Asset Management, I just can’t get that excited because I know I can invest in P10 Holdings (PX).

Small-Cap Stock: P10 Holdings (PX)

Let me introduce P10 Holdings (PX) – (disclosure: I own shares)

Back in 2020 when I originally recommended P10 Holdings at a split-adjusted price of 2.98, it traded on the OTC exchange under the symbol PIOE.

In 2021, it up-listed to the NYSE and now trades under the symbol PX.

P10 Holdings is a pure play on continued private equity industry growth because it owns several different private equity management companies.

P10 Holdings is like more well-known (and larger!) peers, Blackstone (BX) and Carlyle Group (CG).

Private equity management companies don’t invest in private equity funds, but rather manage private equity funds (and collect lots of fees!).

The thing that I love most about the private equity industry is the “stickiness” of the fees.

In the private equity world, capital is committed for a period of ten years or longer. In other words, you as an investor have a contractual obligation to pay fees for at least ten years (usually funds can “extend” for at least two years).

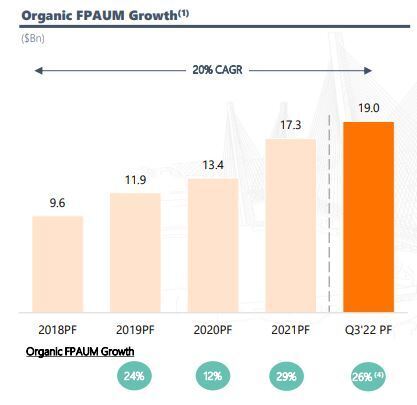

P10’s strategy is to buy stakes in private equity management companies. P10 has assembled a strong roster of diversified, high-performing private equity management companies.

Historically, assets under management have grown organically at 20% per year.

The private equity companies that P10 has acquired have excellent performance which suggests assets under management (and earnings) will continue to grow nicely.

Despite a similarly strong growth outlook, P10 Holdings trades at 15.9x annualized free cash flow, a 36% discount to Brookfield Asset Management.

Conclusion

While I like both Brookfield Asset Management (BAM) and P10 Holdings (PX), the valuation discrepancy between the two names leads me to view P10 as the superior stock.

This is often the case when looking at large-cap stocks vs. small and micro-cap stocks.

You can buy a similar quality company growth at similar weights at a large discount.

To learn which small- and micro-cap stocks I like now, subscribe to Cabot Micro-Cap Insider today.

[author_ad]