One of the biggest disappointments of the “everything bull market” of late has been the oil patch. While metals and other commodities have seen huge gains, oil, and to some extent oil stocks, have underperformed. But even though crude oil prices are slumping, there are reasons to believe oil and oil stocks will soon present a worthwhile opportunity for bargain hunters.

After a promising start to the year which saw the price of WTI crude oil rise 20% between January and early April, the rally peaked at $87 a barrel and began a correction. As of late May, oil prices are down more than 10% while oil stock prices, as measured by the NYSE Arca Oil Index (XOI), are down by around the same amount. Higher than anticipated Russian oil output, combined with a strengthening U.S. dollar, have been blamed for the downward pressure on prices.

Record Gold Price = Hope for Oil Stocks?

In contrast to the oil market, prices for gold and other metals have soared in the last few months, reaching record highs (in the case of gold and copper) or multi-year highs (in silver’s case). Gold rallied 20% from January through May, recently hitting an all-time peak of $2,425 on the back of central bank demand.

[text_ad]

What, you might be asking, has gold to do with oil? As it turns out, there’s a close price connection between the two commodities. Indeed, according to a 2017 research paper by energy economist Muhammad Shahbaz, there has been a positive correlation between gold and oil prices more than 80% of the time over the last half century.

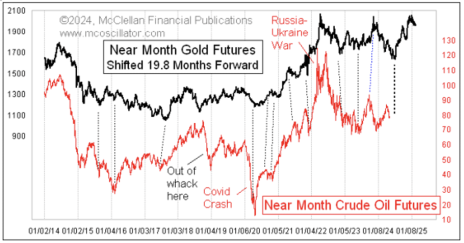

What’s more, the established relationship between the two commodities is led by gold, which has historically predicted the direction of oil prices (albeit with a typically long lead time). Well-known market technician Tom McClellan recently drew attention to this when he noted gold’s price movements are normally echoed in oil prices after a lead time of around 20 months on average. Writes McClellan:

“This isn’t a perfect model, just a really good one. Occasionally, it gets out of whack, most recently when Russia invaded Ukraine and disrupted the oil market. But after every episode of the correlation getting weird, [oil] prices work extra-hard to get back on track again.”

Based on this established correlation, McClellan sees a bottom likely ahead in the oil market by the middle of this year. This bottom in turn should be followed by an extended rally into year-end, which should be further augmented if the rally in gold prices continues.

As for the reason why gold has proven so reliable in predicting oil prices, there’s no clear explanation other than that the yellow metal is one of the most historically reliable inflation barometers. And with crude oil also being highly inflation sensitive, it’s not a stretch to assume the two commodities are correlated. In McClellan’s words, “I don’t know how to explain why gold knows what oil prices are going to do. But gold is a leading indicator for lots of things…somehow the magic works and it has been working for years.”

Oil Bottom a Month Away?

An additional consideration is that with the Memorial Day holiday begins the traditional “driving season” in the U.S. when petroleum markets tend to tighten up. Moreover, oil’s seasonality tends to start strengthening with the onset of the summer months, with autumn historically seeing the biggest upside potential of the year.

Finally, taking into account the gold/oil relationship, the projected crude price bottom should occur at some point in the June-July time frame. By way of disclaimer, an allowance should be made for a potentially late arrival to the anticipated price low. But if the relationship holds, investors should be on the lookout for bargains in energy production and exploration stocks in the next couple of months ahead of what could be exceptional second-half strength in the oil patch.

Here at Cabot, we can help you navigate the market by selecting the most promising candidates in retail and many other sectors via Mike Cintolo’s weekly Top Ten Trader advisory. Expert stock picking is paramount for navigating the market’s current challenges, which is why Top Ten Trader is ideal for participants who want to focus mainly on the strongest companies with the best short-to-intermediate-term growth potential.

To learn more, click here.

[author_ad]