Gold and gold stocks have done very well since the beginning of March.

Even after a little pullback, the price of gold is up 12% while the VanEck Gold Miners ETF (GDX) is up 19%. The Junior Gold Miners ETF (GDXJ) is up 21%.

Over the same time frame, the S&P 500 is down 2%.

The reasons why, and the relationship between the price of gold and gold stocks, can be a little tough to understand.

[text_ad]

But a quick look into the dynamics of gold mining operations and the two major drivers of gold demand helps to take some of the mystery out of it.

Why Gold Stocks Move More Than the Price of Gold

Why do large and small-cap gold stocks move so much more than gold, both to the upside and the downside?

I dug deep into this dynamic in 2012 when I was the Chief Analyst of a commodity-focused newsletter.

The simple reason is leverage.

Miners gain leverage when a fixed asset base generates more profit per ounce of gold mined. This typically happens when the price of gold rises, when more material can be processed at a given plant (with no extra capital spending) and/or when higher-grade material (i.e., more ounces of gold per ton of material) is run through the plant.

In other words, when the price of gold rises faster than the costs to mine and produce gold, mining companies see profits expand. That’s great for stock prices, especially for companies with a lot of leverage to the price of gold.

However, the inverse is also true.

Miners have a lot of operational risk. Equipment breaks, production facilities go down, high-grade gold veins run out, etc. Any number of unexpected events can dent leverage, especially when mining capital costs rise, as they did during the pandemic (thanks inflation).

In short, when capital costs go up and/or the price of gold is either flat or falling, mining profit margins get compressed quickly. That can be very damaging for gold stock prices, especially for smaller operators and pure gold explorers with no/limited production.

Why Do Some Investors Want Physical Gold to Begin With?

There are two powerful forces that tend to push the price of gold higher. The love trade and the fear trade.

The love trade is simple. In some countries, gold is the “it” thing for gifting at celebrations (birthdays, weddings) and cultural events. China and India are major drivers of gold’s love trade.

The fear trade is more complex. It’s powered by demand for financial protection and capital preservation. It gets very strong when fear of bad macro events goes up. Things like negative real interest rates, ballooning government debt, war, etc.

The thinking goes that in troubled times gold is like an insurance policy, purchased to protect against future calamity.

For example, the gold investor sees fiat currencies – the dollar, euro, yen, etc. – falling in value relative to gold and decides to limit the loss of purchasing power by buying gold as a form of long-term savings.

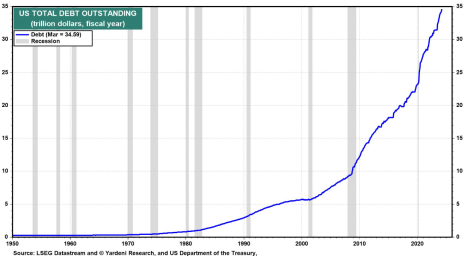

Charts like this one from Yardeni Research of the U.S. total debt outstanding help (for good reason) to support the fear trade.

Lastly, it’s typical to see the value of gold rise as the value of the U.S. dollar declines.

In the short term, this isn’t always true (and it hasn’t been over the last couple of weeks), but generally speaking, the inverse correlation holds true over time.

Here is a 10-year chart plotting the price of gold (gold line) and the value of the dollar (green line). Keep in mind this chart spans the pandemic and there was some weird stuff going on heading into, during and after that.

In short, most of the time gold and gold stocks go up when bad things happen. That’s the fear trade.

How to Invest

The bottom line is this: If you’re contemplating an investment in gold, think big. Macro stuff like interest rates, debt, the dollar, etc.

I won’t pretend to know where the dollar or gold is headed in the next week or month. But over the long haul, the price of gold has trended higher.

If you’ve decided you like gold and want to take a chance on some gold miners, I say think small. Stocks of smaller operators are going to move higher, faster, than shares of larger companies.

Naturally, these companies also carry more risk than their larger counterparts. But you can diversify some of that away with the GDXJ. It’s chock full of small and mid-cap gold miners.

You can also go with individual mining stocks where the potential risks, and rewards, are higher.

To be 100% clear, I’m personally not a fan of “buy and hold” for mining stocks. Remember the operational risk discussion! But that’s not to say they don’t work at times, for extended periods.

In fact, I recently added a smallish mining company to Cabot Early Opportunities. The company operates in low-risk countries and is enjoying leverage as the price of gold goes up and it consolidates production from a few mines at one, centralized processing plant.

You can get all the details on this company in the latest Issue by snagging a subscription. Just click here for more details.

[author_ad]