Gold has been one of 2024’s top-performing assets with the yellow metal gaining nearly 20% year to date. It has also been one of this year’s biggest mysteries, and it’s safe to wonder whether you should buy gold. Analysts are at a loss to explain its outsized price performance in the face of so many obstacles.

Let’s take a look at some of them:

[text_ad]

1. The CBOE Volatility Index (VIX), which is arguably Wall Street’s favorite “fear gauge,” has spent the better part of this year at historically low levels. Normally, gold prospers in a climate of high fear where VIX levels are rising. But this is one of those rare instances where investor fear is apparently not a factor behind the yellow metal’s strength.

2. Institutional buying, which more often than not serves as a major impulse behind gold rallies, doesn’t appear to be a meaningful force at this time. For much of this year, gold-backed ETFs actually saw more redemptions than inflows—and this despite gold’s remarkably sold performance since late 2022.

Indeed, April witnessed the 10th consecutive month of global gold ETF outflows (mainly in Europe), with ETF holdings falling to the lowest amount since February 2020. It should be noted, however, that gold ETF prices also reached record highs during this period of net outflows.

3. Demand for physical gold in recent months, whether in bullion or numismatic (coin) form, also hasn’t been in evidence. According to Ross Norman of the Metals Daily website, “German dealers have been swamped by metal being sold back and a number of dealers have been caught with large stocks they cannot sell and hence apparently selling these at a discount to the spot price to reduce their cost of holding inventory.”

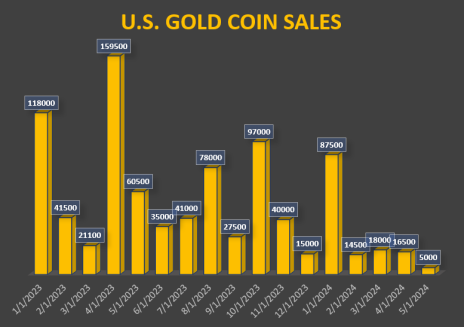

Elsewhere, online gold buying platform BullionVault recently saw sellers outnumbering buyers, while sales of U.S. Mint gold bullion coins have plunged from levels seen in 2021 and 2022.

4. Speculative (non-commercial) buying among commodity traders (based on CFTC data) continues a downward trend since peaking back in 2020, which marked the height of fear-induced buying during the Covid era (below). Speculators apparently aren’t sufficiently impressed with gold’s prospects and instead are focusing their attention elsewhere.

Each of these four factors, which are normally in favor when gold prices are up, are strangely not supportive of gold right now. Which begs the question: where exactly is the gold demand coming from?

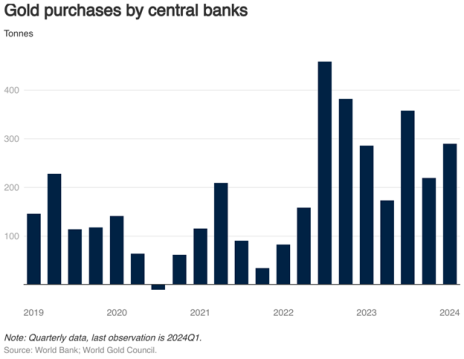

While analysts are uncertain, it appears that public sources of demand account for most of the recent market strength. In the last couple of years, central bank gold demand has exceeded 1,000 tons, which is double the rate of the previous five years. And the bulk of the central bank purchases have centered on China, India and Turkey, with the former accounting for most it.

Of note, China’s central bank extended its gold purchases for the 18th consecutive month in April, breaking the record for the longest-ever streak of monthly bank purchases, while accounting for 5% of its total reserves—the highest ever.

However, central banks normally buy gold through the official benchmark, which means the recent buying hasn’t been on the so-called “fix.” In the words of Ross Norman, this “has a degree of motivation and conviction that is not a hallmark of the rather more nuanced buying we expect from this quarter.” That’s another way of saying that possibly central bank buying is coming through non-traditional routes.

Meanwhile, Chinese gold ETFs have lately seen a big acceleration of gold buying, including a fifth consecutive month of net inflows in April. Chinese gold ETF buying is normally of little consequence but has accelerated with 29 tons of gold buying in the last four weeks. As a result, China’s gold ETFs have set new records for both holdings and total assets under management (AUM).

Regardless of the identity of the gold buyers, the strong demand for the metal is clear. And given the sustainability of the gold rally, the buying can be assumed to be “high quality” in nature. With that in mind, here are two ideas that stand to benefit from the persistence of gold market strength.

2 Stocks to Benefit from Gold Market Strength

Barrick Gold (GOLD) is one of the world’s lowest-cost gold miners and the largest by production (along with joint-venture partner Newmont Mines). Management believes the company is “the most undervalued major gold and copper mining company in the industry,” and there are reasons supporting that claim.

What’s more, analysts believe Barrick could generate over $1 billion in free cash flow (FCF) this year which, if realized, would equate to an 80% improvement from last year’s FCF. Moreover, the company is expected to generate upwards of $2.5 billion in FCF next year. And as Barrick’s cash position improves, expectations are strong for higher dividends going forward (current yield 2.3%). Wall Street sees 30%-ish earnings growth this year and next.

IAMGOLD (IAG) is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa. The company is building the large-scale, long-life Cote Gold mine in Ontario, which just poured its first gold bar in April.

When fully operational, Cote is expected to produce around half a billion ounces in its first six years with all-in sustaining costs (AISC, a key metric) below $1,000 an ounce. This is far below the current gold price of $2,400 and is one of the best AISC metrics in the industry. What’s more, Cote is expected by analysts to help IAMGOLD generate approximately $240 million in free cash flow in 2025—a huge improvement from recent years.

Cote is also expected to be one of Canada’s largest operating gold mines with an expected mine life of nearly 20 years, paving the way for huge growth opportunities for the company.

Here at Cabot, we can help you navigate the market by selecting the most promising candidates in retail and many other sectors via Mike Cintolo’s weekly Top Ten Trader. Expert stock picking is paramount for navigating the market’s current challenges, which is why Top Ten Trader is ideal for participants who want to focus mainly on the strongest companies with the best short-to-intermediate-term growth potential.

[author_ad]