Against the backdrop of a bear market in stocks, it’s hard to be bullish on anything right now—let alone out-of-favor assets like gold and silver. That said, there are still some promising-looking pockets of strength within the precious metals arena. And as we’ll discuss here, once the financial market fog lifts, there are reasons for believing these precious metal assets will be among the market’s top performers.

Making the news lately was the Dow Jones Industrial Average (DJIA) entering a bear market (i.e. a 20% decline from the nearest high) for the first time since the 2020 crash. In the rush to sell stocks and raise cash, investors have also been heavy sellers of corporate and government bonds and, increasingly, commodities.

After resisting the broad financial market selling pressure of recent weeks, the Invesco Commodity Index Tracking Fund (DBC)—which tracks 14 of the most heavily traded and important physical commodities in the world—fell 6% over a two-day period in late September. This serves to underscore the dearth of safe havens for investors to run to and avoid what many see as an economic recession on the horizon.

[text_ad]

Whenever the broad market is in decline, one of the most important things an investor can do is scan the charts of individual stocks and commodities for signs of relative strength. When the DJIA or the S&P 500 index are falling, for instance, it’s imperative to look for tell-tale signs that informed investors (the so-called “smart” money) are using the cover of weakness to buy positions in assets they believe will outperform once the next market uptrend gets underway.

One of the easiest ways of isolating relative strength is to look for charts that sport decisively higher lows while the major indexes like the S&P are making lower lows. Even better, if you can spot charts of stocks or commodities that are not only refusing to decline in a weak market environment, but are rising against the current trend, you’ve likely found yourself a future winner for the next bull market.

The concept of relative strength investing is based on the observation that the small, uninformed investors who comprise the majority of participants typically aren’t interested in buying during a bear market. Instead, it’s the big institutions and well-heeled investors who have special insights into future market conditions that take advantage of bear markets to leverage into new positions. It usually pays, then, to follow in their footsteps—and this relative strength approach is a key strategy we use to identify winners.

The precious metals sector is one of the first places investors should start looking for examples of outperformance in a bear market since the metals are widely considered a prime haven. When participants are looking for a safe place to park idle funds, gold, silver and other metals are what many of them turn to since they tend to maintain purchasing power compared to other assets. With this in mind, let’s take a look at some outperforming precious metals and precious metal stocks.

2 Precious Metals Investments Showing Relative Strength

Palladium is a precious metal that happens to be a critical component in auto catalysts for gasoline-powered vehicles. This is a key consideration given the pent-up demand for vehicles in the last couple of years. And while prices for palladium haven’t yet recovered to pre-Covid levels, supplies of the metal are low while demand for it is increasing.

Also worth mentioning is that palladium’s biggest supplier—Russia—is still engaged in its war with Ukraine, which has created a tight global supply situation for the white metal due to delivery disruptions. On the futures front, moreover, data show that commercial hedgers (a.k.a. the “smart money”) have recently reached their least hedged position in palladium of the last 10 years. With commercial players in the palladium industry heavily exiting short positions, the possibility for a worthwhile short-covering rally has increased.

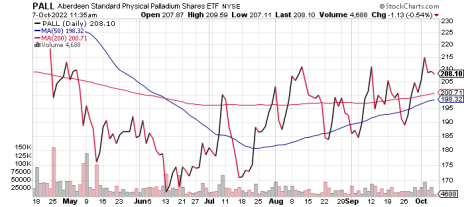

With this in mind, a good way to leverage precious metals in the current market climate is through having some conservative exposure to the Aberdeen Standard Physical Palladium Shares ETF (PALL). The fund tracks the movements in the palladium spot price, by providing focused exposure to palladium held in JPMorgan vaults in London and Zurich.

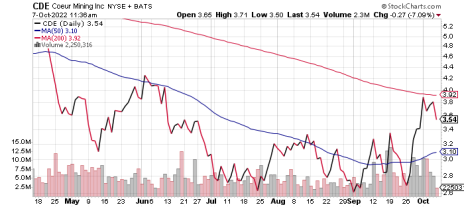

Another precious metal asset currently showing relative strength is Coeur Mining (CDE). Coeur is the world’s sixth-largest silver miner by revenue and explores, develops and operates silver and gold mining properties throughout North and South America.

Coeur is known for historically generating high levels of cash, and future cash flows are expected to be driven by the expansion of its Rochester silver-gold mine in Nevada, which management said offers “significant reserve growth and the benefits of a larger-scale expansion project.”

Coeur said its expansion should extend the mine’s life by over 10 years, with annual production expected to exceed eight million ounces of silver and 80,000 ounces of gold for the decade after the expansion is complete, with an average annual free cash flow of around $100 million expected. This in turn should place Coeur in an excellent position to pursue other opportunities to further enhance its business.

[author_ad]