After a less-than-stellar performance for gold in the past year, many investors are wondering if the shine has come off the yellow metal as a safe haven. Indeed, for much of the year market participants favored cryptocurrencies and utility stocks, among other traditional safety assets, over gold in order to hedge against risks ranging from inflation to the latest Covid variants.

That said, an argument can be made that gold nonetheless did an excellent job of shielding investors from the ravages of inflation and other financial threats this year despite its lack of forward progress. What’s more, there are reasons for believing that 2022 will provide gold with the catalysts it needs to resume a long-term upward march that began over 20 years ago. I’ll get to the reasons to own gold in a minute.

2021 was the year of the “everything rally,” which saw substantial gains in assets ranging from stocks and commodities to cryptos and real estate. Serving to keep gold prices from rallying this year despite surging inflation was a high appetite for risk among investors, as well as competition from rising Treasury bond yields.

[text_ad]

Despite these headwinds, however, gold still managed to hold its own through most of the year and is down just over 2% from a year ago, as of this writing. Given that the U.S. dollar (in which gold is priced) was up by as much as 9% this year and the U.S. Treasury Yield Index (TNX) nearly doubled at one point, that’s not a bad performance at all and even shows a measure of resilience in the face serious pressures from competing assets.

Gold also outperformed other traditional safe havens in 2021, including the Japanese yen currency (down 11%) and the Swiss franc (down 7%). And it’s worth pointing out that gold is still up nearly 20% from its level from two years ago, and up over 60% from when its latest bull market cycle began in 2016!

Aside from being a general safe-haven asset, gold is one of the best forms of protection against the vagaries of inflation. The long-term price chart shown here illustrates gold’s response to the two major inflation cycles of the last 30 years.

While the “Roaring ‘90s” were characterized by disinflation, a new inflation cycle began in the early 2000s with the Afghanistan and Iraq war era. The war-related inflation of that period witnessed a massive run-up in commodities—including crude oil prices verging on $150 a barrel (!)—before the end of the U.S. military’s involvement in the Iraq war put a major top on the gold price in 2011.

After a few years of underperformance, a revival of inflation related to the 2020 pandemic finally pushed gold back above its previous all-time high from 2011, with prices briefly exceeding the $2,000 an ounce level. And while it has since pulled back from that high, gold is within easy reach of it and has churned mostly sideways this year as consumer inflation hit its highest level in 40 years.

Aside from the threat of even more inflation in 2022, there are other reasons why gold could resume its bull market next year. If investors are scared into running to the sidelines like they did in 2020, gold would almost certainly benefit. With that said, let’s take a look at a couple of scenarios that could drive gold demand in the months ahead.

3 Reasons to Own Gold

One potential fear catalyst for 2022 would be the spread of the omicron variant of the coronavirus. Lately there has been an uptick in cases around the world, with China and several European countries responding by increasing Covid restrictions (mainly in the form of lockdowns and travel bans). These responses could have negative consequences for their respective economies, as well as on the global supply chain. If the virus threat persists, investors in those countries may end up running to the safety of gold to hedge against the possibility of a serious economic downturn.

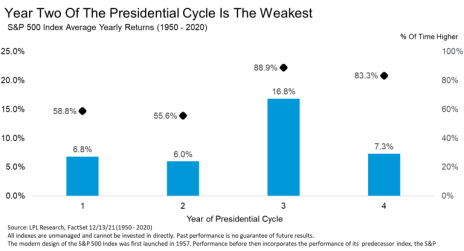

Another potential “fear factor” in gold’s favor would be a disappointing downturn in the equity market in the next few months. Addressing this scenario, LPL Financial chief market strategist Ryan Detrick observed that “the second year of the Presidential Cycle tends to be the worst of the four-year cycle and it is up the least often as well.” Although it should be noted that Detrick expects equities to perform well overall next year, he added that it “likely won’t be another run-away bull market like we saw in 2021.”

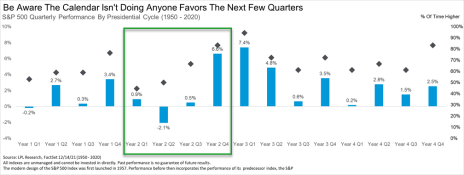

He further pointed out that from a quarterly perspective, the first three quarters of 2022 could be the worst part of the current four-year presidential cycle if the historical “rhyme” repeats this time around. It’s also worth mentioning that the last time stocks experienced a major setback (in 2018 and 2020), gold conspicuously outperformed in the months immediately following both corrections.

In summary, inflation, Covid-related worries or an equity market downturn are potential catalysts for the gold market to rally next year, which in turn would provide traders with a worthwhile opportunity for profiting in the metal. But I would hasten to add that for long-term-oriented investors, gold shouldn’t be treated as merely a trading opportunity, but as a portfolio protection. From this vantage point, gold is less an investment than an insurance policy against turbulent events like inflation or even war.

And if gold’s long history has taught us no other lesson, it’s that the shiny metal tends to hold its value (relative to inflation) in even the worst economic environments.

If you want even more ideas for the best performing precious and industrial metals stocks and ETFs right now, please consider subscribing to my Sector Xpress Gold & Metals Advisor, where I regularly provide you with some of the market’s strongest metals and mining stocks/ETFs from both a technical and a fundamental perspective.

Do you have any gold exposure in your portfolio?

[author_ad]