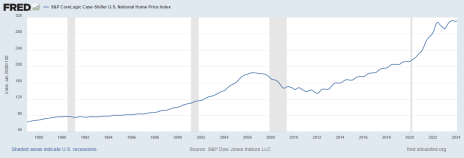

Wondering how you can profit from real estate right now? Worried it’s too late to buy real estate? Sure, prices are high, as you can see in the graph below:

But mortgage rates—while on the rise since 2020—are still historically low, as you can see below.

Those elevated prices and rates are pressuring the housing industry, making sellers reluctant to move and trade in their low rates, and preventing some buyers from purchasing their homes. But for real estate investors, those two factors are increasing their cash flow, as rental rates have continued to spike. In fact, rental prices are up from a year ago in 48 of the 50 biggest metro areas in the country, averaging $1,983 per month. The highest rental prices can be found in San Jose, California ($3,277 per month), New York City ($3,206), Boston ($3,079) and San Francisco ($3,024).

[text_ad]

Zillow reports that these areas have shown the highest rental increases in the U.S.:

1. Providence, Rhode Island: +8.2%

2. Louisville, Kentucky: +6.9%

3. Cleveland, Ohio: +6.5%

4. Hartford, Connecticut: +6.4%

5. Boston, Massachusetts: +6.1%

A recent study by lawdepot.com surveyed all 50 states to determine which states were the best for investing in real estate, based on the following criteria:

· Average home price

· Average household income

· Cost of living

· Home appreciation

· Population growth

· Job growth

· Average property tax rate

· Rental vacancy rate

· Gross domestic product (GDP)

Their results showed that Kentucky, South Carolina, Indiana, Georgia, and Delaware scored the highest.

In terms of home prices, an average home costs $196,000 in Kentucky; South Carolina, $284,000; Indiana, $228,000; Georgia, $316,000; and Delaware, $373,000.

So, as you can see, there are some areas of the country that may offer an opportunity to profit from real estate right now.

Calculating your Investment Return from Real Estate

But before you jump into investing in a rental property, you want to make sure you can create solid monthly income. There are several methods that investors use to determine if the property is going to be a good investment, including:

Investors often use the Rule of 72, which helps determine how long it will take for your investment to double in market value, based on your rate of return.

Here’s how it works: Divide 72 by the annual rate of return and that will tell you how many years to expect it will take your investment property to double in market value.

Years to Double = 72/Annual Rate of Return

Annual Rate of Return = 72/Years to Double

Simple, right? Unfortunately, it’s not. You must first estimate your rate of return. Here’s how you do that:

Net Operating Income = Rental Income – Operating Expenses

Cap Rate = Net Operating Income/Purchase Price × 100%

For example, let’s look at a home purchase for $250,000. Let’s say we could rent it for $2,500 per month. Let’s estimate your closing costs were $6,000, and you need to put about $10,000 in for renovation. Your total investment would be $266,000.

Your collected rents are estimated at $2,500 x 12 (for the year), or $30,000. But you know you will likely have maintenance, tax, and insurance expenses (pretending you don’t have a mortgage, so no interest costs). So, let’s say those are $5,000 annually.

Now, your total annual return would be $30,000 - $5,000, or $25,000.

To calculate the rental property’s ROI, divide the annual return ($25,000) by the total investment on the property, $266,000.

That gives you a Cap Rate, or total return of 9.3%.

So, using the Rule of 72, the estimated years for your property to double are: 72 divided by 9.3%, or 7.74 years. And if that happens, you can expect the property value to double, plus you’ll have the net rents you have been receiving over that 7.74 years.

The 1% Rule: That means that the gross income of your investment should equal at least 1% of the original purchase price, including taxes and fees.

Here’s a simple calculation for our above example property worth $250,000.

$250,000 x 0.01 = $2,500

So, your loan payment should be less than $2,500 (which it is!) and your expected rental should be enough to cover your expenses and make money; in this case, around $2,500 a month.

Cash-on-Cash Return (cash flow). Here’s the formula:

Gross income from the property minus your operating expenses. This does not include mortgage, taxes, HOA, insurance, etc., or emergencies. A good goal is 8% to 12%.

The 50% Rule. This rule says that to make money, you need to save 50% of your income to cover property expenses. So, if your rental property is bringing in $2,000 per month, you’ll need to save $1,000. You can use your excess to maintain the property, cover your loan costs, and bank the rest.

The 10% Rule actually involves three rules:

· Put no more than 10% down.

· Buy at least 10% under market price. After the crazy market of 2021 and 2022, when homes were selling well over listing price, price increases have stabilized somewhat. But I think it’s still difficult to buy less than listing price in this market.

· Never pay above 10% mortgage interest. Well, at least we aren’t there yet!

Or You Can Just Buy a REIT

Rental properties are one way to profit from real estate right now, but if investing in individual properties and handling the rentals sounds too intimidating to you, perhaps you may be more interested in a passive real estate investment, such as a Real Estate Investment Trust.

Like mutual funds, REITs allow individual investors to “pool” their monies to invest in properties—office buildings, housing developments, apartments, data centers, and more. And, as with mutual funds, they are professionally managed. But REITs have one tremendous selling point not shared by most mutual funds—high dividend yields.

By law, REITs must return at least 90% of their taxable income to their shareholders, annually, which generally translates into very nice yields (4.35% on average, compared to 1.35% for the S&P 500 Index) for the REIT investor, making these investment vehicles very attractive. The New York Stock Exchange currently lists 158 REITs, including equity, mortgage, and hybrid models.

Right now, many REITs are trading at undervalued levels, as high rates impacted their returns, which were -1.3% for the recent quarter. However, now trading at discounted levels—and with some great dividends—you can enjoy some nice cash flow while awaiting the REITs’ appreciation.

Here are three that have recently come up on my watch list:

3 Reits to Help You Profit from Real Estate Right Now

AvalonBay Communities Inc. (AVB) (dividend yield, 3.56%) owns or holds a direct or indirect ownership interest in 299 apartment communities containing 90,669 apartment homes in 12 states and the District of Columbia, of which 18 communities were under development. The Company is an equity REIT in the business of developing, redeveloping, acquiring, and managing apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company’s expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Equity Residential Properties Trust (EQR) (dividend yield, 4.13%) is focused on the acquisition, development and management of residential properties located in and around dynamic cities that attract affluent long-term renters. Equity Residential owns or has investments in 305 properties consisting of 80,683 apartment units, with an established presence in Boston, New York, Washington, D.C., Seattle, San Francisco and Southern California, and an expanding presence in Denver, Atlanta, Dallas/Ft. Worth and Austin.

Invitation Homes Inc. (INVH) (dividend yield, 3.24%) is the nation’s premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company’s properties are currently located in Atlanta, Carolinas, Chicago, Dallas, Orlando, Phoenix, Denver, Tampa, and Southern California.

Whether you decide to be an active or passive real estate investor, don’t get distracted by negative headlines—it’s still possible to profit from real estate right now!

[author_ad]