The following post has been partially excerpted from a previous edition of Cabot Money Club Magazine. Join Cabot Money Club today to discover more of the best personal finance tips and investing education.

I understand that parents—and their kids—are super busy today. Between two- and three-income homes, children who are involved in sports or the arts, and loads of homework, it’s not easy to find the time. And like many parental tasks, financial education has been mostly turned over to schools. However, that’s not working out so well, either. According to the Council for Economic Education, last year, just 23 states required students to take a high school class in personal finance in order to graduate. This means it largely falls to you as parents (or grandparents) to teach your kids about finances.

I was fortunate to have a mother who was financially astute. Although I didn’t receive an allowance, I always sat with my mother when she was handling money, and before I opened my first checking account, she taught me all the ins and outs. But that was only because I was interested; my brother and sisters weren’t.

When I was in school, that wasn’t even an elective class. Those classes started about 30 or so years ago, and I’ve been a guest speaker at many high school personal finance classes since then.

[text_ad]

But even if your child’s school offers such a class, it’s just not enough. If you don’t teach your kids about money, you are setting them up for some serious disappointments and hardships down the road.

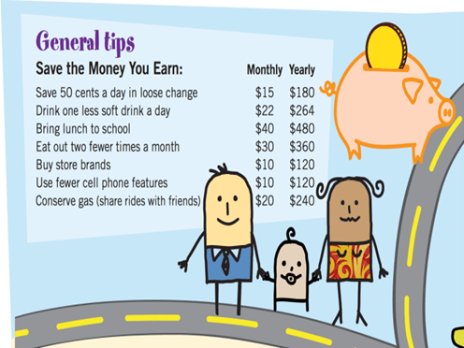

This pictorial is an easy way to begin talking about money with your children:

The good thing is that you don’t have to “reinvent the wheel.” There are amazing programs and apps in the marketplace (some are free!) that can help you with this important learning.

But first, let’s break down children’s money education needs by age, so you can see the building blocks of a great financial learning program.

6 Personal Finance Lessons for Your Kids (By Age)

3-5 Years

Your child can start learning about coins and notes. I know, from experience, that coins are not that easy to teach. I tried sorting coins with my niece when she was five. At first, nothing I did seemed to work. But once I took her to the store to show her how many coins she needed to purchase certain items, things became much easier!

The experts have a better idea, recommending a clear jar to save coins. As they add more, they can see their money grow, and explaining how much each coin adds to the total helps them visualize the coin’s value.

5-7 Years

Children should know their coins by now. You can also teach them how to create and monitor simple financial records. It’s a great period to show your children how you earn your money (e.g., Take Your Child to Work Day), and how much you earn every payday. And lastly, this is a great time to decode needs versus wants.

7-9 Years

You can introduce debit and credit cards, as well as other non-cash paying methods (which are mostly what kids use today, anyway); help them open a savings account (make it a habit to take your child when you do your banking); discuss the risk of too much debt; why they will have to have a job. Lastly, it’s important to model charitable behavior through your volunteer work and contributions, so that when your child becomes self-sufficient, he or she will value giving to those less fortunate.

9-11 Years

If a vacation is in your plans, this is a good opportunity to teach your child about budgeting and planning a trip, easy foreign exchange calculations, and safekeeping valuables during the holiday. This is also a good age range for discussing interest earned and paid, as well as taxes (you might as well depress them at an early age)!

11-14 Years

The experts say that at this age, children should be introduced to credit, insurance, risk/reward, fraud, and understanding simple financial statements. (This will come in handy as they begin to prepare for their college years).

For the previous two categories, child educators add that demonstrating opportunity cost works well with these age groups, showing the child that if they spend all their money on one item, such as the latest fashion, they may not have enough to buy that birthday present for which they’ve been saving.

These are also the right ages for paying “commissions” instead of allowances for assigned household chores.

Lastly, from ages seven to eleven is a prime time for teaching avoidance of impulse buys. Some people never learn this. I’ve known folks who love to shop and who just can’t say no. They either devote half of their lives to returning stuff they don’t need, or spend way above their means, which causes buyer’s remorse and significant long-term financial trouble.

The best way to stem impulse buying is to teach your child to wait and think about the object they want to buy; often, a day later, they won’t even remember why they were so keen to purchase it!

Teens

This age group is entranced with social media, where it seems everyone is spending a lot of money on a bunch of stuff—expensive cars, makeup, video games, or the latest fashion. Your teen needs to understand that “things” don’t bring contentment. And a good lesson to learn is that it’s a lot more fun to plan for those big expenditures; that way, they can daydream about them, work toward their goal by steadily saving, and enjoy the journey as much as the final purchase.

I remember planning and saving for a trip to Hawaii. This took place over a year and a half. There was no internet back then, so I closeted myself—for weeks and months—with AAA books, travel guides, frequent flyer information, and coupon books. I really couldn’t say which was more fun—the planning or the actual trip!

This is also the right age for thinking about and beginning financial planning and saving for those nearing college years. You’ll want to talk about jobs, how to avoid student loans (if they can), and college savings accounts.

Many parents do try to teach their children about money by helping them open their first bank account. And this is the perfect time for your teen to get their first checking account.

[author_ad]

*This post has been updated from a previously published version.