Extreme fear and volatility returned to the market last week as the S&P 500 fell a combined 5.35% Wednesday and Thursday. For the week, the S&P 500 lost 4.1%, the Dow tumbled 4.19% and the Nasdaq dropped 3.74%.

And this follows an ugly couple weeks as stocks like Roku (ROKU), Square (SQ) and countless more have fallen 20%-30% in the blink of an eye.

If you are nervous about the stock market crashing, you need to know how to hedge your portfolio with options. At the very end of this article are two ideas on how to do just that.

But first, let’s dive into my favorite guide for determining the market’s perception of risk, the VIX.

Retail traders often hear sophisticated traders and commentators on CNBC and Bloomberg talk about the VIX, and are confused by what it actually is. And to be honest, it is an incredibly difficult product to trade.

[text_ad]

However, by doing a simple Google search for the VIX or looking at CNN Money, Yahoo Finance or any other online financial website every couple of days, retail traders can get a feel for the fear level of the most sophisticated hedge funds in the world.

Here’s my very basic rule of thumb:

If the VIX is at 14-16, all is well.

If the VIX gets to 20 or above, it’s time to get concerned.

Last week, the VIX spiked as high as 28, though it has since retreated to 21—still a multi-month high. Hence, it’s time to be concerned, and perhaps to hedge your portfolio with options.

The Best Ways to Hedge Your Portfolio with Options

First, I strongly recommend that you do NOT trade the VIX. Instead, use the VIX as an stock market indicator. Buying puts on the indexes and your personal holdings is much easier.

A put option is an option contract that gives the owner the right, but not the obligation, to sell a stock/index at a specified price within a specified time. The buy of a put is a BEARISH position.

Here’s an excerpt from an article I found years ago on the Chicago Board of Options Exchange website that helps Calculate Index Contracts to Hedge a Portfolio. Please note that the article is using the SPX. When we trade the S&P 500 in my Cabot Options Trader advisory, we trade the SPY, which is worth 1/10th of the SPX. For example, today the SPX is trading at 2,763, while the SPY is trading at 275.

Options Education: Calculating Index Contracts to Hedge a Portfolio

Stock prices tend to move in tandem with the overall stock market as measured by the S&P 500 ETF Trust (SPY). The 500 stocks that comprise the S&P 500 Index represent almost 85% of the stock market value in the United States. Therefore, the index is an excellent reflection of the overall stock market. If an investor owns a portfolio of stocks and is concerned about a near-term downward move in the overall market, purchasing the appropriate SPX put options could be a desirable alternative to hedging each stock individually. (Please note in the example below the SPX is quoted at a price below the current price.)

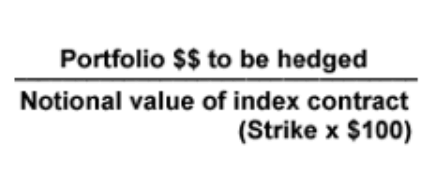

Determining the number of contracts to use to hedge a portfolio is a fairly simple process using the following formula:

Each SPX option represents $100 times the strike price. For instance, if an SPX put with a strike price of 1250 is utilized, it would represent $125,000 of market value (1250 x $100). So, an investor with a stock portfolio valued at $500,000 would purchase 4 SPX 1250 puts ($500,000 / $125,000) to hedge the portfolio.

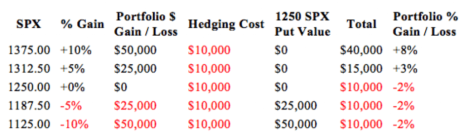

For example, consider an investor who has a diversified stock portfolio valued at $500,000 and is concerned about a market correction of 10% over the next 30 days. With the S&P 500 Index quoted at 1250, a correction of 10% would result in the S&P 500 trading at 1125.00. The investor could choose to purchase four 30-day SPX 1250 puts quoted at 25.00 ($2500 per contract) that would have a total cost of $10,000 or 2% of the value of the portfolio.

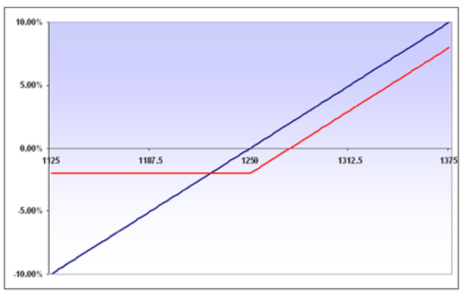

The above table shows the dollar and percent results of this strategy based on the S&P 500 index at a few levels upon option expiration. Because at-the-money SPX option contracts are used for hedging, the maximum potential loss is equal to the 2% cost of hedging. Thus, 2% of performance is sacrificed on the upside if an unanticipated market rally occurs. A payout comparison between a hedged and un-hedged portfolio appears in the payout diagram below.

Two Hedge Recommendations

If I felt that I needed a hedge today, I would look at puts in the SPY and QQQ, both of which have 3-6 months until their expiration, and are just below the current price of the index. For example, I might look at:

S&P 500 ETF (SPY) March 270 Puts

Nasdaq ETF (QQQ) March 165 Puts

Big picture, hopefully last week’s washout was just a normal pullback, and there is no need for a hedge. However, just in case things get worse, you now know how to protect your portfolio.

If you would like to start receiving more guidance on how to hedge your portfolio with options, consider becoming a member of Cabot Options Trader.

[author_ad]