Earlier this week, one of my colleagues and esteemed micro-cap analyst, Rich Howe, recommended a few inflationary plays.

And given that the Consumer Price Index (CPI) has surged 6.4% year-over-year through November, the largest year-over-year increase since June 1982, and that the Producer Price Index (PPI) rose a staggering 9.6% year-over-year in November, the largest gain since November 2010, well, you can see why an inflation play or two might not be a bad idea.

As Rich stated, “The most attractive stocks in an inflationary environment are asset-light companies with high returns on capital and high margins.” His pick? Facebook, now known as Meta Platforms (FB).

But, as an options trader, I have an alternative way to approach Rich’s suggestion.

There is a way to get into FB stock at the price of your choosing. Best of all, you can collect premium (income) while waiting for FB to hit your preferred price. It’s with a Facebook options trade.

[text_ad]

By using cash-secured puts on FB, you can produce a steady stream of premium that can be used as a potential source of income or to simply lower your cost basis on the position.

I take this approach every time I wish to purchase stock. Oftentimes, once I am put shares of the stock, I simply sell covered calls against my newly acquired shares. In the options world they call this the “Wheel Strategy.”

Why would you ever approach buying a security any other way? In my opinion, it almost seems silly to have any other approach.

Let’s go over a quick example.

A Low-Risk Facebook Options Trade

So, let’s say you are interested in buying FB, but not at the current price of 333.74.

You prefer to buy FB for, say, 310.

Now, most investors would simply set a buy limit at 310 and move on, right? But that approach is archaic. Because you can sell one put for every 100 shares of FB and essentially create your own return on capital (depending on the strike you choose).

Some say it’s like creating your own dividend and, in a way, I kind of agree.

A short put, or selling puts, is a bullish options strategy with undefined risk and limited profit potential. Short puts have the same risk and reward as covered calls. Shorting or selling a put means you are promising to buy a stock at the put strike of your choice. In our example, that’s the 310 strike.

If the stock price seems high, you can always look towards lower-cost stocks that thrive during inflationary periods. My goal is to show you how to use a strategy that allows you to collect a return while waiting for your stock to hit the price of your choice.

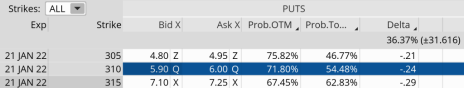

If you look at the options chains for FB below you will quickly notice that for every 100 FB shares we want to purchase at 310, we are able to bring in roughly $5.90, or $590 per put contract sold, every three days.

The trade itself is simple: Sell to open January 21, 2022 FB 35 puts for a limit price of $5.90.

So, by selling the 310 put options in January, you can bring in $590 per put contract, for a return of a conservative 1.9% over 38 days. That’s $5,310, or 17.1% annually. You can use the premium collected from selling the 310 puts either as a source of income or to lower your cost basis.

If you wish to bring in more premium, you could always opt for the 315 put strike. By doing so, you could bring in roughly $715 over 38 days for a 2.3% return. That’s $6,435, or 20.7% annually.

Just think about that for a second.

You want to buy Facebook stock at 310. It’s currently trading for 333.74. By selling cash-secured puts at the 310 strike you can lower your cost basis to 256.90. That’s 23% below where the stock is currently trading. And you can continue to sell cash-secured puts on FB over and over, lowering your cost basis even further, until your price target is hit.

You could try this Facebook options trade out. Or, like most investors, you could just sit idly by and wait for FB to hit your target price of 310–losing out on all that opportunity cost.

To review, by selling cash-secured puts at the 310 strike we receive $590 in cash. The maximum profit is the $590 per put contract sold. The maximum risk is that the short 310 put is assigned and you have to buy the stock for 310 per share. But you still get to keep $590 collected at the start of the trade, so the actual cost basis of the FB position is $310 – $5.90 = $304.10 per share. The 304.10 per share level is our breakeven point. A move below that level and the position would begin to take a loss.

But remember, most investors would have purchased the stock at its current price, unaware there was a better way to buy a security. We rarely take that approach. We know better. We understand we can purchase stocks at our own stated price and collect cash until our price target is hit. It’s a no-brainer.

[author_ad]