Takeovers the last year have been few and far between. However, last week it was announced that Take-Two Interactive (TTWO) would be acquiring Zynga (ZNGA), and this week Microsoft (MSFT) would buy Activision Blizzard (ATVI). And while these two takeovers in the gaming space are compelling, what really raises my interest are the two suspect weekly options trades made in the days ahead of both of these announcements.

Let’s start with TTWO/ZNGA. While this is not a big enough deal to move the market, it did come just TWO days after a trader bought 39,000 ZNGA Calls expiring days later. Here are those trades:

2 Suspect Weekly Options Trades

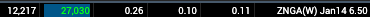

Thursday – Buy of 12,000 ZNGA January 6.5 Calls for $0.08 – Stock at 6

Friday – Buyer of 27,000 ZNGA January 6.5 Calls for $0.10 – Stock at 6

To be honest, I think the brazenness/stupidity of this call buy is more infuriating than the cheating itself. How does that trader not know that calls bought Thursday and Friday before the deal will be announced, and a buy of WEEKLY options, would raise some yellow flags?!!!

[text_ad]

Regardless, I hope this trader enjoys his $8.5 million profit for a couple days, before the SEC comes knocking on his/her door.

Next up is ATVI/MSFT. On Friday, January 14 a trader bought calls expiring in a week, and by some “luck” the takeover was announced the following Tuesday, January 18. Here is that trade:

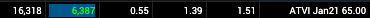

Friday – Buyer of 6,300 Activision Blizzard (ATVI) January 65 Calls for $0.97 – Stock at 65

Following the takeover report, ATVI traded as high as 90, which meant these calls purchased for $0.97 one trading day before, exploded to $25, or a total profit on the 6,300 calls of over $15 million.

Much like the ZNGA trades above, I suspect the ATVI call buyer may be answering some tough questions in the days ahead.

More Legitimate Activity in Ford Stock

Unfortunately, I did not jump in on these weekly options trades as I had my eye on other trade opportunities. However, following unusual option activity is one of the most important components of my trading system for my Cabot Options Trader subscribers, and part of the reason we own a big winning position in Ford (F) following unusual call buying from December. Here were those trades:

December 3 – Buyer of 5,000 Ford (F) September 30 Calls for $0.86 – Stock at 20

December 2 – Buyer of 28,000 Ford (F) June 24 Calls for $1.40 – Stock at 20

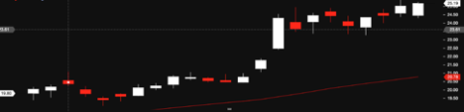

And as you can see, those call buys were well timed as F stock has taken off since December:

Cabot Options Traders’ F calls are now at a potential profit of more than 100%. However, I’m not yet selling as this call buying activity in Ford stock has not slowed down at all, as seen by these trades made last week:

January 13 - Buyer of 10,000 Ford (F) February 26 Calls for $1.13 – Stock at 25.1

January 12 - Buyer of 20,000 Ford (F) February 27.5 Calls (exp. 2/4) for $0.40 – Stock at 24.7

January 12 - Buyer of 30,000 Ford (F) March 26/31 Bull Call Spread for $1 – Stock at 24.75

Do I think Ford will be taken over like ZNGA and ATVI? I seriously doubt that will happen. However, it is possible the company and stock are in the midst of a major turnaround, and until bullish option activity cools off, I will continue to hold my position looking for greater gains.

Do you track options activity? Have you made weekly options trades before? If you have an options-related question, post it in the comments below.

[author_ad]