Before I get started I wanted to let everyone know that I will be holding a year-end webinar on December 14, 2023, to go over my favorite investing strategy for 2024. A little-known strategy that has performed incredibly well during bullish, bearish and sideways markets. I’ll touch on the strategy in the article below, but I’ll be going into great detail in my upcoming webinar including a few trades, etc. The link to sign up will be on our free webinars page soon, so keep your eyes peeled. And, if you’re subscribed to the Cabot Wealth Daily, be on the lookout for a sign-up email there as well.

What’s my favorite bullish options investing strategy for a low-volatility market?

This has been by far the most popular question I’ve received over the past several weeks and the answer isn’t as straightforward as one would think. While many options strategies qualify (buying calls, debit spreads, long straddles, etc.) my preference is to use a lesser-known strategy, and my favorite investment strategy for 2024 … the poor man’s covered call. A poor man’s covered call, also known as a long call diagonal debit spread, is used when a trader is bullish on an underlying stock or ETF and the implied volatility is low.

But those are just a few of the benefits. Not only is the poor man’s covered call one of the least risky options strategies, but it also allows you to participate in all of the benefits of a covered call without the excessive capital requirements. In fact, by using a poor man’s covered call, your capital outlay is typically 60% to 85% less than a standard covered call.

[text_ad]

Low Implied Volatility Market Environment

Volatility is the lowest it has been in years.

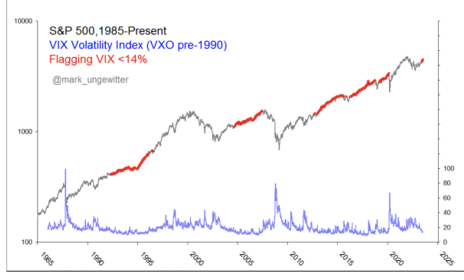

If you take a quick look at the chart of the VIX below, you will immediately notice that the VIX, also known as the investor’s fear gauge, is the lowest it has been in years, currently trading below 13, at 12.46.

And while some contrarians will tell you that a low VIX signals complacency, and they are mostly correct, it doesn’t necessarily mean that volatility is going to immediately pop higher.

In fact, if you look at the chart below you will notice that when the VIX has ongoing readings below 14 the market reacts in a bullish manner. So complacency, and in turn a low VIX, could be here for a while.

How to Initiate Your First Trade Using the #1 Investment Strategy for 2024

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration. Let’s focus on the step-by-step mechanics of the trade. Below is one of the Dogs of the Dow trades I placed at the onset of 2023 and should give you great insight into how we initiate a trade using a poor man’s covered call strategy.

· For example, let’s take a look at one of the Small Dogs of the Dow stocks, Intel (INTC). So far, our INTC position is up 128.6%, while the stock is only up 58.4%.

The stock is currently trading for 43.81.

Now, if we followed the route of the traditional covered call, we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $4,381. Certainly not a crazy amount of money. But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Apple (AAPL), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards … and that’s unfortunate.

So, it’s worth repeating, with a poor man’s covered call strategy you can typically save 60% to 85% of the cost of a covered call strategy. Again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date of around two years. Some options professionals prefer to only go out 12-16 months, some even less, but I prefer the flexibility the two-year LEAPS offers.

Again, per my approach, I want to go out roughly two years in time, if not more. The January 16, 2026, expiration cycle with 781 days left until expiration is the longest-dated expiration cycle and would be my choice.

And when my LEAPS reach 10-12 months left until expiration, I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

Now, once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at INTC’s option chain I quickly noticed that the 33 call strike has a delta of 0.80. The call is currently trading for approximately $17.20. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $18.50.

So, rather than spend $4,381 for 100 shares of INTC, we only needed to spend $1,720. As a result, we saved $2,661 or 60.8%. Now we have the ability to use the capital saved to diversify our premium amongst other securities if we so choose.

After we purchase our LEAPS call option at the 33 strike, we then begin the process of selling calls against our LEAPS.

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40.

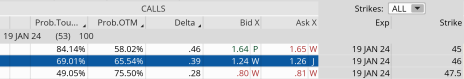

As you can see in the options chain below (highlighted in blue), the 46 call strike with a delta of 0.39 falls within my preferred range.

We could sell the 46 call option for roughly $1.24. The premium collected is 7.2% over 53 days or approximately 50.4% in premium collected annually. If we were to use a traditional covered call our potential return on capital would be less than half, or 2.8%.

And remember, the 7.2% is just the premium return; it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 12 to 16 months, thereby generating additional income or lowering our cost basis even further. And of course, we have the ability to get out of the position, for any reason, if we so choose.

Quick Aside: An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your INTC LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital allowing you to diversify your portfolio or income stream far more effectively and efficiently.

Again, so far in 2023 shares of INTC are up 58.4%, while our poor man’s covered call approach is higher by 128.6%. In fact, the entire Small Dogs of Dow portfolio (using our poor man’s covered call strategy) is up over 30% since the beginning of 2023 with several positions besides INTC exceeding 40%.

In Summary

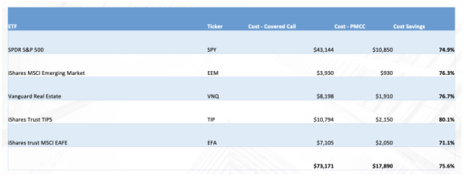

We can use poor man’s covered calls (PMCC) in a variety of ways for a variety of different reasons…but cost is certainly the number one factor for choosing the strategy. Just look at the difference in cost if one were to use, say, David Swensen’s Yale Endowment portfolio. Another portfolio that we offer that has proven to perform well in bull, bear or sideways markets. And the cost difference is staggering!

So again, with the significant reduction in capital that using poor man’s covered calls provide, I’m again able to realistically diversify my income approach over a wide range of strategies such as David Swensen’s Yale Endowment Portfolio, Ray Dalio’s All-Weather Portfolio, James O’Shaughnessy’s Growth/Value Portfolio, Warren Buffett’s Patient Investor Portfolio, Dogs and Small Dogs of the Dow and several other tried and true investment strategies.

To learn about all my favorite strategies and see the system in action, consider subscribing to a Cabot Options Institute advisory today.

[author_ad]