DIA Iron Condor

The emails have been rolling in as of late.

Everyone wants to know some of the best options strategies to use during high implied volatility environments, much like what we are witnessing right now.

Well, you could try bear call spreads, bull put spreads and really anything where we are selling premium.

But today, I want to talk about iron condors with a potential trade idea.

[text_ad use_post='261460']

Quick Preview

There is no doubt that volatility has increased across the board. And as volatility increases trading opportunities increase, which opens up the options playbook significantly.

Iron condors using highly liquid ETFs are one of my favorite defined risk, non-directional options strategies in a high implied volatility environment. As for the name “iron condor,” well, the name makes perfect sense when you look at the profit/loss chart below.

The strategy consists of a short call vertical spread (bear call spread) and short put vertical spread (bull put spread).

Sample Trade: Iron Condor (DIA)

The IV rank and IV percentile in DIA are hitting extremes not seen in years. As a result, now is the perfect time to start selling some premium in DIA, and most of the highly-liquid ETFs like SPY, QQQ and others.

Let’s say we decide to place a trade in the highly liquid Dow Jones ETF (DIA) going out roughly 25 days until expiration.

The expected move, also known as the expected range, is from roughly 315 to 355 for the February 18, 2022 expiration cycle.

In most cases, my goal is to place the short strikes of my iron condor outside of the expected move. Moreover, I prefer to have my probability OTM, or probability of success around 75%, if not higher, on both the call and put side.

Choosing Expiration Cycle and Strike Prices

Since I know the expected range for the February 18, 2022 expiration cycle is from 315 to 355, I can then begin the process of choosing my strike prices.

Remember, DIA is currently in a short-term oversold state so I’m going to focus on selling a bull put spread and wait to see how DIA reacts before potentially selling the other side of the iron condor, or bear call spread. I will continue to write about the trade and my intent going forward so you can follow along if you wish.

Put Side of the Iron Condor:

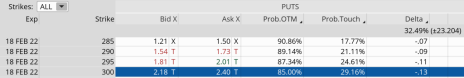

The low side of the range is, again, 315 for the February 18, 2022 expiration cycle, so I want to sell my short put strike just below the 315 strike, possibly lower.

As you can see above, the 300 strike with an 85.00% probability of success fits the bill. In fact, it is a very conservative approach to the trade.

Now, once I’ve chosen my short put strike, in this case the 300 put strike, I then begin the process of choosing my long put strike. Remember, buying the long put strike defines my risk on the downside. For this example, I am going with a 5-strike-wide iron condor, so I’m going to buy the 295 strike.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with DIA trading for 336.23, the underlying ETF can move lower roughly 10.7% over the next 25 days before the trade is in jeopardy of taking a loss.

Call Side of the Iron Condor:

The high side of the range is, again, 355 for the February 18, 2022 expiration cycle, so I want to sell the short call strike just above the 355 strike, possibly higher.

As you can see above, the 357 strike with an 86.57% probability of success fits the bill. Once I’ve chosen my short call strike, I then begin the process of choosing my long call strike. Remember, buying the long strike defines my risk on the upside of my iron condor. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 362 strike.

As a result, I am going to sell the 357/362 bear call spread for roughly $0.80. But, before I place the trade I want to choose the bull put portion of my iron condor.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with a range of $42 (315-357) and DIA trading for roughly 336.23, the underlying ETF can move higher 5.6% or lower 6.3% over the next 25 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open DIA February 18, 2022 357 calls

- Buy to open DIA February 18, 2022 362 calls

- Sell to open DIA February 18, 2022 300 puts

- Buy to open DIA February 18, 2022 295 puts

We can sell this DIA iron condor for roughly $0.80. This means our max potential profit sits at approximately 19.0%.

Again, I wanted to choose an iron condor that was outside of the expected move and has a high probability of success. This is why I sold the 357 calls and the 300 puts.

Remember, when approaching the market from a purely quantitative approach, it’s all about the probabilities. The higher the probability of success on the trade, the less premium I’m able to bring in, but again, the tradeoff is a higher win rate. And when I couple a consistent and disciplined high probability approach on each and every trade I place, I allow the law of large numbers to take over. Ultimately, that is the true path to long-term success. I’m not trying to hit home runs. I understand the true, consistent opportunities, particularly when seeking income, come with using high probability options strategies coupled with a disciplined approach to risk management—the latter being the most important.

Step Four – Managing the Trade

I typically close out my trade for a profit when I can lock in 50% to 75% of the original premium sold. So, if I sold an iron condor for $0.80, I would look to buy it back when the spread reaches roughly $0.40 to $0.20. However, since we are so close to expiration, I might ride the trade out until it expires worthless, thereby reaping a full profit. As always, the market will dictate my actions.

If the underlying moves against my position I typically adjust the untested side. Most roll the tested side, but all research states that rolling the untested side higher/lower allows me to bring in more premium and thereby decrease my overall risk on the trade. Moreover, I look to get out of the trade when it reaches 1 to 2 times my original premium. So, in our case, when the iron condor hits $1.60 to $2.40.

Of course, the aforementioned numbers will change drastically if I’m able to sell a bear call spread over the next several days. Stay tuned!

Ultimately, position size is the best way to truly manage a trade. We know prior to placing a trade what we stand to make and lose on the trade, therefore we can adjust our position size to fit our own personal guidelines. Iron condors are risk-defined, so it’s important to take advantage of their risk-defined nature by staying consistent with your position size for each and every trade you place. Remember, it’s all about the law of large numbers.