My two specialties are micro-caps and special situations (usually spin-offs!) so it may come as some surprise that I’m writing about LEAPS Options. And usually, my best ideas are when I find a micro-cap spin-off.

I usually focus on micro-caps, because returns in micro-cap land are usually a lot more attractive than returns in large-cap land.

But every so often I find a compelling large-cap idea.

Warner Bros. Discovery (WBD) is one such idea.

It is a large-cap media company trading at a 100%+ discount to fair value. Usually, I look for obscure, hidden opportunities, but this large cap is too cheap to ignore.

The company was formed when AT&T (T) merged its Warner Bros. business with Discovery and then spun the business off to its shareholders.

[text_ad]

For many years (prior to its merger with Warner Brothers), I was always tempted to buy Discovery’s stock. The company looked extremely cheap, and John Malone, one of the best capital allocators of all time, was the second largest shareholder in the company.

But I always struggled with assigning a terminal value to the company.

Discovery was heavily tied to “linear” TV – basically the cable bundle or “traditional TV.”

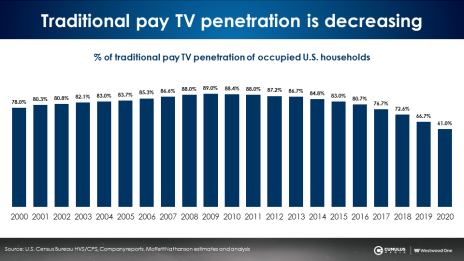

And we all know that traditional TV is continuing to decline as more and more consumers ditch cable.

Prior to its merger with Warner Bros., Discovery revenue was almost 100% tied to paid TV (whether cable or satellite).

Thus, I was concerned with Discovery’s long-term viability and terminal value.

This all changed with the recent Warner Bros. merger.

The company now has only ~51% exposure to Linear TV. The balance of revenue is generated by direct-to-consumer (23% of revenue) and Content (34%). Content refers to licensing feature films, television programs, and other content.

I personally don’t think Pay TV is going away. I cut the cord years ago but subscribe to YouTube TV on and off (for example during the NBA playoffs or during the NFL football season).

I think the world will morph to some steady state of Pay TV and DTC content.

In that world, Warner Bros. Discovery is as well positioned as any of its media peers given its iconic content library and balanced exposure to both DTC and Pay TV.

Not only is the company well-positioned fundamentally, but its valuation is attractive on an absolute basis and relative basis.

Currently, the stock trades at 6.2x 2023 free cash flow and 7.3x 2023 EBITDA. Peer companies Paramount (PARA) and Netflix (NFLX) trade at 10.5x and 16.2x respectively.

I think Warner Bros. Discovery (WBD) is worth at least $25.

OK, we’ve established that Warner Bros. Discovery (WBD) is an attractive stock.

Not let me explain how you can buy it for less than half of its price ...

How to Use LEAPS Options to Buy at a Discount

Warner Bros Discovery has options contracts called LEAPS.

Long-term Equity Anticipation Securities (LEAPS) are options contracts with expirations of more than one year.

If you are bullish on a Warner Bros Discovery like I am, buying LEAPS options can be a great way to express your view.

Today, we can buy WBD June 10 Calls (expiring 6/21/2024) for $5.40 (disclosure: I’m long).

So instead of paying $13 to buy the stock, you can buy the LEAPs for $5.40.

This strategy will allow you to spend less capital up front but enable you to participate in the same upside as if you owned the stock outright.

As mentioned above, I think WBD is worth at least $25.

If I am right, the calls will eventually be worth at least $15 ($25 minus $10 strike price).

LEAPS options can be viewed as a cheap source of leverage.

Of course, leverage works both ways. If WBD is worth 10 at expiration, our call will expire worthless.

But I do have confidence that the stock is significantly undervalued.

There’s a lot to like about Warner Bros. Discovery in the next year-plus. And that makes it a prime candidate for LEAPS.

[author_ad]