Short selling research firm Citron took aim at Shopify (SHOP) last week, sending the stock lower by 16%.

Citron called Shopify a “get rich-quick” scheme, urged the Federal Trade Commission to investigate the company, and compared SHOP to hotly debated stock Herbalife (HLF).

The firm put a price target of 60 on Shopify stock, almost 50% lower than it was trading on the day the research note was released. It was NOT a great week for SHOP shareholders.

So with Shopify stock falling and uncertainty around the company picking up, how could I trade SHOP using options?

Buying Calls on Shopify Stock

Buying call options is the best risk/reward setup.

[text_ad]

That said, my experience tells me that I should would wait at least three days before buying calls.

I began my career on the floor of the Chicago Board of Options Exchange in 1999 straight out of college. For a year, I stood next to two options trading legends, soaking up all of their wisdom as their clerk. That year, the market ripped higher as virtually every dot-com stock exploded higher day after day. I learned a great deal during that bull run.

Here is a picture of a younger me (with more hair) in my trading pit on the CBOE.

Soon after I became a trader myself, the Nasdaq fell apart. The dot-com bubble burst, and valuations were reset for virtually the entire market. I learned even more during those bearish years than during the bull market years!

One rule that I took away from the bear years—and that I continue to tell subscribers to Cabot Options Trader and Cabot Options Trader Pro—is about stocks that have taken a big dive.

The old trading rule that was hammered into my brain by my two trading legend mentors was this:

If a stock takes a big fall, whether it’s on earnings or some other news event, you MUST wait at least three trading days before even thinking about putting on a bullish position.

The rationale behind The Three-Day Rule is that if a large hedge fund or institution owns millions of shares of a stock, it won’t be able to sell out of its entire position in a day or two without causing the stock to fall.

My LinkedIn (LNKD) Example

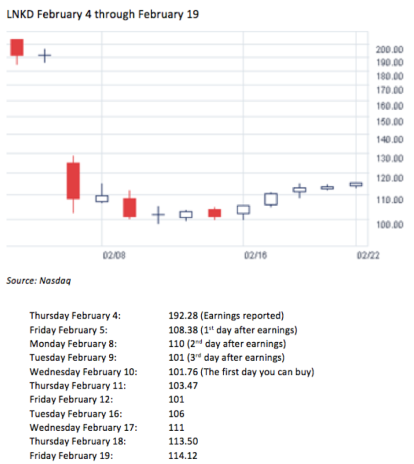

Instead, the institution will parcel out its sales over a couple of days, so they don’t depress the stock and can sell at better prices. For example, let’s take a look at LinkedIn (LNKD), which fell from 192 to 108 in one day last February 5 on a disappointing earnings release. That was a staggering fall! The next day, the downgrades came pouring in from the brokerage houses (thanks for the downgrades after the fall!).

Based on the three-day trading rule, I wouldn’t have considered adding a bullish position on Friday, February 5, Monday, February 8 or Tuesday, February 9. But on Wednesday, February 10, according to the rule, I could begin to think about adding a bullish position.

Here were LNKD’s closing prices on the day of its earnings report and the following days:

As you can see, there remained selling pressure on LNKD in the three days after the big drop. Then, slowly but surely, the stock stabilized, and buyers began to take over.

I did not buy the dip in LNKD after the three days that the rule mandated because other stocks offered much better opportunities than LNKD. But I may try to buy SHOP Calls in the coming days if my Unusual Options Screening tool tells me that big traders are stepping in and buying Shopify stock Options.

And if SHOP Option Order Flow turns bullish, with Shopify stock trading today at 92, I might look to buy the January 100 Calls for $7.

What makes buying these calls so attractive is that my downside is limited by my premium outlay on the trade: $700. This is a significant discount to paying $9,200 for 100 shares of the stock. And if SHOP stabilizes, and runs back to its old highs and beyond, my upside is unlimited!

However, if Citron is right, and SHOP is a short and the stock drops, the most I can lose on the trade is $700.

As earnings season begins this week with reports from JPMorgan (JPM), Bank of America (BAC) and Wells Fargo (WFC), there will inevitably be some big drops in stocks you have interest in buying. However, before buying the dip that first day, remember what all experienced floor traders refer to as The Three-Day Rule.

[author_ad]