Inflation continues to rise at a historical pace. Last Thursday’s consumer price index (CPI) rose 7.5% year over year, the largest increase since 1982.

Here are some price changes since January 2021:

- Nat gas +81%

- Oil +66%

- Agricultural commodities +24%

- Rent +13%

- Used car prices +44%

- Gasoline +36%

- Cattle prices +20%

- Lumber +15%

- Coffee +92%

- Hotel Prices +37%

Shortly after the CPI was released, rumors of an emergency rate hike made the rounds on trading desks as the 10-year Treasury yield pierced the 2% mark for the first time in three years. Following this development, rate-sensitive sectors and growth stocks underperformed.

[text_ad]

Now that’s all good and dandy, but as an investor, what I really want to know is how to combat an inflationary environment. Better yet, how can I make a decent return while inflation continues to be a concern?

During periods of high inflation, that being greater than 5% a year, there is an investment that has averaged 20% a year. Gold. Skeptic or not, gold has proven to mitigate losses, offering decent downside protection during periods of market stress.

The strategy below offers exposure to gold for far less than holding shares outright. It’s an alternative strategy to the covered call options trading strategy, known as a long-term diagonal debit spread. It’s also known as a poor man’s covered calls.

The Strategy

While I am a huge proponent of using covered calls, my preference, particularly when dealing with higher-priced securities, is to use something known as the poor man’s covered call strategy. And with the SPDR Gold Shares ETF (GLD) trading at 173.77 a poor man’s covered call fits the bill.

Quick Background – Poor Man’s Covered Calls

A poor man’s covered call strategy is essentially a long call diagonal debit spread that is used to imitate a covered call position, but for far less capital.

How? The strategy doesn’t require buying 100 shares of stock. In fact, no shares are needed.

Like a covered call strategy, a poor man’s covered call is an inherently bullish options strategy. But again, rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

Poor Man’s Covered Call

ProShares Gold Shares ETF (GLD) is currently trading for 173.77.

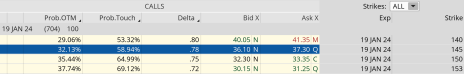

We could buy 100 shares outright and spend $17,377 or buy LEAPS as a stock alternative and spend far less. There are many different ways to approach buying LEAPS, particularly when deciding on which expiration cycle to choose. For simplicity’s sake I’m going out as far as I can in time by choosing the January 24, 2024 expiration cycle.

Let’s continue to keep it simple and choose the 145 call strike price. It’s currently trading for approximately $36.80.

So, rather than spend $17,377 for 100 shares of GLD, we only need to spend $3,680.

After we purchase our LEAPS call option at the 145 call strike, much like a traditional covered call, we begin the process of selling calls… only against LEAPS, not shares.

For our example, let’s go with the 180 call strike.

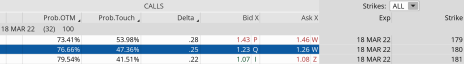

We can sell the 180 call option for roughly $1.24.

Our total outlay for the entire position now stands at $3,557 ($3,680 – $123). The premium collected is 3.3% over 31 days. Might not sound like much, but by holding the LEAPS we have the ability to potentially sell calls 11 times throughout the year for an annual return on premium of 36.8%. Certainly not a bad potential return, created solely through the process of selling call premium against our LEAPS. And if GLD pushes higher, even better—we also have the ability to generate capital return on our LEAPS position.

So, if gold lives up to its historic reliability as a safe haven during high inflationary environments, this might be the prefect strategy to consider.

Were you familiar with poor man’s covered calls prior to reading this article? If so, what trades have you made with the strategy? Tell us about them in the comments below.

[author_ad]