One of the unspoken advantages of using a mechanical options strategy is that it can help take emotions out of the equation.

The strategy we’ll be discussing today, “The Wheel,” is one such strategy that’s particularly useful for producing income.

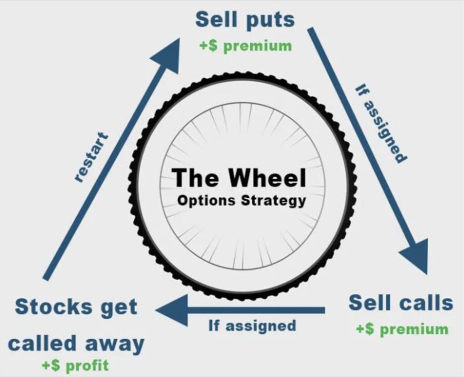

One of the benefits of using this approach is that you can use it indefinitely, “wheeling” in and out of the same position (depending on what happens with the share price) while consistently capturing options premium.

The goal of the strategy is to bring in options premium on a continual basis. This allows investors to use the premium for income or to simply lower the cost basis of their position. How you choose to use the premium is ultimately up to you.

The Income-Producing Options Strategy: The Wheel

The wheel options strategy is an inherently bullish, mechanical, options income strategy known by various names. The covered call wheel strategy, the income cycle, and the options wheel strategy are just a few of the many names that investors use. But one thing is certain: The systematic approach remains the same.

[text_ad]

More and more investors are choosing to use the wheel options strategy over a buy-and-hold approach because it allows you to create a steady stream of income on stocks you want to or already own.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

Basically, find a highly liquid stock that you are bullish on and have no problem holding over the long term. Once you find a stock that you’re comfortable holding, sell out-of-the-money puts at a price where you don’t mind owning the stock.

Keep selling puts, collecting even more premium, until eventually you are assigned shares of the stock, again, at the strike price of your choice. Once you have shares of the stock in your possession begin the process of selling calls against your newly issued shares. Basically, you are just following a covered call strategy, collecting more and more premium, until the stock pushes above your call strike at expiration. Once that occurs, your stock will be called away, thereby locking in any capital gains, plus the credit you’ve collected.

Let’s go through an example to show you exactly how this options income strategy works.

Wheel Options Strategy – Step One

DraftKings (DKNG)

DKNG is currently trading for 36.82.

Let’s say we are comfortable owning shares of DraftKings approximately 10% below where the stock is currently trading.

As a result, we decide to sell puts at the 33 put strike, 10.4% below the current stock price. The stock has already pulled back over 24% from its 2024 highs, so we are choosing a strike that is over 30% below the recent highs.

Plus, DKNG is sitting right on top of its 50-day moving average in a range it traded in this summer.

We can sell to open the December 20, 2024, 33 puts for roughly $1.50.

But before I go any further, I want to point out an important aspect of placing a trade. Never sell at the bid price and never use a market order. Always use a limit order. All research shows that taking this approach will tack on a significant percentage to your account over the long haul. Be efficient and don’t give up easy returns; work your orders!

By selling the 33 puts for $1.50 our return is 4.5%, cash secured. Our breakeven stands at 31.50 per share and will continue to decline every time we sell premium.

If DKNG stays above our 33 put strike at expiration we begin the process of selling puts again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in 4.5% every 60 days or so, and we can sell puts roughly six times over the course of a year (if the stock stays above our chosen short put strike) our annual return is 27% on a cash-secured basis. Again, it bears repeating, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position. In our case, we are selling premium to lower the cost basis of a stock that we want to own.

But what if DKNG closes below our put strike?

No biggie. We are issued or assigned shares at the price where we wanted to buy the stock. Think about it for a sec. We collect a premium to wait for a stock to hit our chosen price.

Wheel Options Strategy – Step Two

So, let’s say DKNG closes below our 33 put strike at expiration. If so, we are issued 100 shares at $33 for every put contract we’ve sold. (Remember though, our net price is $31.50, $33 minus the $1.50 per share we received in premium).

Once we have shares in our possession, we begin the process of selling out-of-the-money calls against our shares, which begins the covered call portion of the wheel options strategy on DKNG.

Now the question is which call strike to choose. Again, ultimately it just comes down to preference. My preference is to focus on call strikes that have a delta between 0.20 to 0.40.

Let’s say we decide on selling the 39 calls against our newly issued DKNG shares.

A comparable contract right now ($6 out of the money with 60 days to expiration) would sell for roughly $1.20 per call contract with a delta of .27.

That’s a 3.2% covered return in 60 days.

Of course, that assumes that the shares close below but near our short put strike. Once shares are actually assigned, a good rule of thumb is to look around 60 days out for contracts in the delta range specified above.

If DKNG stays below our 39 call strike at expiration we begin the process of selling calls again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in 3.2% every 60 days, and we can sell calls roughly six times over the course of a year (if the stock stays below our chosen short call strike) our annual return is 19.2%. Again, it bears repeating, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position.

But what if DKNG closes above our short call strike?

Again, no big deal. Our shares are called away, so of course, we keep our $120 ($1.20 covered call premium per share x 100 shares) per call contract, plus we are able to reap any capital gains from our stock. In this case, our capital gains would be 18.2%, for a total return of 21.4% if DKNG rose to our strike price and shares were called away.

Once our shares are called away, the wheel options strategy cycle ends, and the decision has to be made whether or not to continue using the strategy with the same stock.

The wheel options strategy is one of several wonderful options income strategies for those wanting to generate steady income, with lower risk compared to most options strategies. It also gives investors an opportunity to lower the overall cost basis of a position.

The strategy isn’t a get-rich-quick strategy; rather, it’s a methodical, systematic approach to trading options that generate consistent returns, month after month, on stocks or ETFs that you want to hold in your portfolio over the long term.

[author_ad]