Two weeks ago, Fed Chairman Jerome Powell shook the stock market when he said, “while higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” Since then, the S&P 500 has fallen 7%, and traders are again asking how to hedge your portfolio using options.

Let’s start with a touch of options education on the most basic of hedging strategies, which is a purchase of a put option (please note, there will be real-world examples of puts/hedges after the options education).

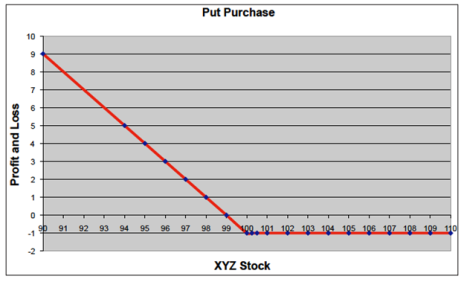

A put purchase is used when a decline in the price of the underlying asset is expected. This is a bearish options trading strategy.

This strategy is the purchase of a put at a specific strike price with unlimited potential for profits.

The maximum loss on this trade is the amount of premium paid.

[text_ad]

For example, the purchase of the XYZ 100 put for $1 would only risk the $1 paid.

If the stock were to close at 100 or above at expiration, the put would expire worthless.

If the stock were to go below 99, the holder of this put would make $100 per contract purchased per point below 99.

Here is the profit and loss graph of that trade:

A Real-World Example of How to Hedge Your Portfolio Using Options

Now let’s take a look at a put purchase using the S&P 500 ETF (SPY) and the Nasdaq ETF (QQQ). Though of note, please do not get tied to the prices in this article, as the indexes are moving violently, and these prices could be stale in the blink of an eye.

Let’s start with the SPY, which is trading at 390 at the time of writing.

My rule of thumb when looking for a hedge/put to buy is to target a put that has three to eight months until its expiration and is trading near the current stock price.

So in this case, as this is September, I might target a put in the March expiration cycle, as this bearish trade would have nearly seven months until its expiration.

Next, because the SPY is trading at 390, I might target a put on the 385 strike.

With these two inputs in mind, I would Buy to Open the SPY March 385 Put for $22.50 (approximately).

Should the SPY close above 385 on March expiration, I would lose $2,250 per put purchased as this option would expire worthless.

Conversely, should the SPY close below 385, my put would have unlimited downside profit potential (until the SPY hit zero).

Now let’s take a look at a similar trade in the QQQ, which is trading today at 291.

Again, I would look for a put that expires in 3-8 months, and in this case let’s theoretically target a January put option.

Next because the QQQ is trading at 291, let’s buy a 285 put.

This hedge/bearish trade would be a buy of the January 285 put for $17 (approximately).

Should the QQQ close above 285 on January expiration, I would lose $1,700 per put purchased as this option would expire worthless.

However, should the QQQ close below 285 on January expiration my put would have unlimited downside profit potential (until the QQQ hit zero).

Stepping back to the market and my portfolio; unless we are in a raging bull market, I almost always have a SPY or QQQ hedge in my portfolio, as that put option allows me to sleep at night. And as the old trading saying goes, “Buy puts when you can, not when you have to.”

[author_ad]