This year got you down? The five best-performing overseas stocks of 2020 will make you feel a bit better about the world.

We’ve spent so much of 2020 dwelling on the bad. In the midst (worst?) of the deadliest global pandemic in more than a century, it’s hard not to. But as we mercifully inch toward a new year, and likely a vaccine, it’s time to reflect on some of the good things 2020 brought. In the U.S. stock market at least, there was a lot of good. Though many other global stock markets lagged, there were still plenty of big winning stocks from all over this virus-stricken planet. Which brings me to my list of the best-performing overseas stocks of 2020.

Each of the five stocks I’m about to list has more than tripled this year, with three weeks still to go. I call them overseas stocks, because they were all an ocean or two away; no Canadian stocks here. The point is to highlight the growth that’s happening around the globe, despite the historically bad circumstances.

These companies hail from emerging markets such as China and Singapore, to more developed European markets such as Germany and the U.K. And they’re all large caps—no small- or mid-cap stocks here.

[text_ad]

The common thread binding these five mostly disparate companies together is progress. Whether they’re capitalizing on the shift in consumer shopping habits from stores to online, the strides toward lowering carbon emissions, or the efforts to develop a COVID-19 vaccine in record time, these companies scratched people where they itched in 2020. And for that reason, big institutions snatched up shares of their stocks in droves.

Here they are, in descending order of stock performance…

The 5 Best-Performing Overseas Stocks of 2020

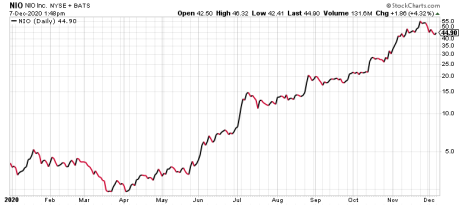

Nio Limited (NIO)

Country: China

2020 Returns: 1,035%

This Chinese electric vehicle maker is the runaway winner as the best-performing overseas stock of 2020, more than doubling the return of any other stock on this list. It’s not profitable yet, but the sales growth is through the roof—analysts expect 114% top-line growth this year, up from 51% in 2019. China’s swift work in stamping out (or at least lessening the blow from) coronavirus back in the early spring helped supply chains get back to business for the remaining eight to nine months of the year, and thus Nio was able to meet considerable demand for its cars, delivering 12,206 vehicles in the third quarter, up from 4,799 vehicles in the third quarter of 2019. The only real slowdown came in the first quarter (3,838 deliveries); second-quarter deliveries were 10,331, up from 3,553 in Q2 2019.

All of it has added up to a banner year for NIO stock.

Farfetch (FTCH)

Country: United Kingdom

2020 Returns: 453%

An online luxury fashion retail platform that sells products from over 700 boutiques and brands from around the world, shares of this British-Portuguese company took flight this year. With fewer people around the world going to buy luxury clothes and accessories in person, Farfetch’s sales continued their upward trajectory uninterrupted — analysts anticipate a 60% revenue bump for the year, roughly in line with the company’s average in the prior three years. The company is nowhere near profitable, and it, in fact, fell well short of EPS estimates in three of the last four quarters. No matter: FTCH stock more than quintupled anyway and is just hitting fresh highs in the last week.

Sea Limited (SE)

Country: Singapore

2020 Returns: 388%

Sea Limited is a favorite of our Carl Delfeld, who recommended the stock to his Cabot Global Stocks Explorer subscribers way back in February 2019. Those who got in immediately have a return of 1,164%!

So I’ll let Carl tell you a bit about Sea Limited. Here’s a snippet of what he had to say about SE in his latest Global Stocks Explorer issue:

“Sea is Southeast Asia’s biggest internet platform, with 40 million daily active users. The stock has benefited from strong tailwinds during the COVID-19 pandemic, rising 4x in the last six months. Sea’s business operations are in the e-commerce, gaming, and payments space, which have seen strong user adoption over the last few years. Given the macroeconomic factors (such as the rise of the middle class and increased smartphone penetration) and demographic shifts (young population) in Southeast Asia, SE will continue to see strong growth over the next few years.”

Pinduoduo (PDD)

Country: China

2020 Returns: 292%

Speaking of e-commerce companies: Pinduoduo is the largest interactive e-commerce platform in the world, despite being just five years old! Waging war against the likes of Alibaba (BABA) and JD.com (JD), Pinduoduo is making both Chinese e-commerce powers sweat even in a crowded market by selling items at deeper discounts and allowing users to interact on their platform. And now the company is profitable, reporting $69 million in profits on an adjusted basis in the third quarter.

Smaller and growing much faster, Pinduoduo’s stock is outpacing BABA (up 24% in 2020) and JD shares (up 136%) by a long shot this year. And now the stock is approaching new highs again.

BioNTech (BNTX)

Country: Germany

2020 Returns: 266%

A year ago, few people around the world had likely heard of this German biotech. Now they have. BioNTech is the company whose COVID-19 vaccine candidate, developed with a larger, more well-known headliner in Pfizer (PFE), is on the cusp of being distributed to a global population that desperately needs it.

In 2020, that’s the thing that matters most to people. And it’s why BNTX’s chart looks like this…

[author_ad]