“If it bleeds it leads” is the mantra for news producers, only partially in jest.

Violent crime has always gotten disproportionate attention in the media. It draws in viewers and readers and, thus, profits. And in the past decade or so, as many of our national cable news networks have become increasingly partisan, some have found highlighting violent crime and all crime serves their goal of increasing fear that helps to undermine the party in power.

Is it any wonder that so many Americans live in fear, buying guns and home security systems at record levels?

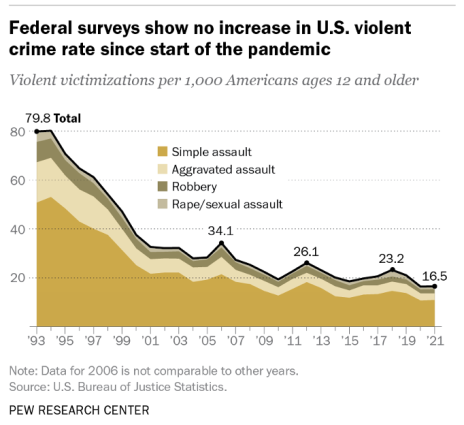

But Federal data shows violent crime is on a long-term downward trend over the past 30 years, experiencing a steep decline in the first decade and then a more gradual but still significant decline in the next two decades. (See the chart below from the Pew Research Center.)

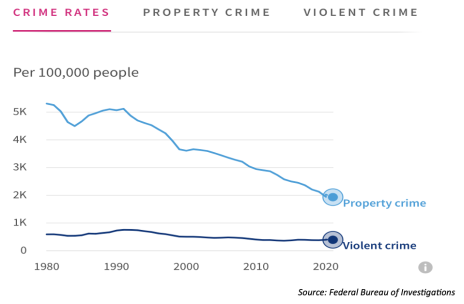

And, it’s not just violent crime. FBI data shows a far greater decline in property crime over the same period.

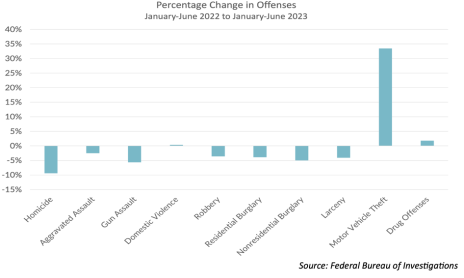

Even in the past year, when news consumers would be excused for thinking the sky is figuratively falling, almost every category of crime is down. (The notable exception is vehicle crime where the Kia/Hyundai car theft debacle is responsible for the vast majority of that uptick.)

So why do so many of us feel like crime is going up?

[text_ad]

Part of the answer is how we process information, and part lies in which information gets promoted. If we experience crime or know someone who has, we give that information far greater weight than if we read an article that provides data showing crime is trending down. Data can engage our mind, if we’re open to it, but anecdotal information engages our emotions which can be much a stronger motivator.

As for what information we receive, that can be consciously or unconsciously controlled to manipulate our emotions as well. But why would people do that?

For a clue, let’s look at who benefits from the perception that crime is up – the media industry, the gun industry, security systems companies, private (for-profit) prison industry, politicians, foreign governments, police unions, etc.

We tend to believe this stuff, in spite of data to the contrary, for a variety of reasons having to do with human cognitive biases. Notably …

Availability Bias: Greater likelihood of recalling recent, nearby, or otherwise immediately available examples, and the imputation of importance to those examples over others.

We react to the news because it is literally available to us, and when we hear it repeatedly we believe it (known as an availability cascade), whether it’s true or not. Nazi leader Joseph Goebbels, Hitler’s propaganda chief, often used the technique of repeating the same lies over and over until people started to accept them as true, although he was hardly the first, or the last, to do so.

Another issue is many people are not highly data literate. They are uncomfortable with numbers and statistics and don’t have the knowledge or tools to process them or know if they’re being manipulated. Instead, we latch on to soundbites, especially if they are soundbites we hear over and over. So the anecdotal experience is much more accessible to us than the data.

But Cabot doesn’t cover crime, we cover investing, so why am I telling you this?

As in reporting on crime, in the investing world, we suffer from availability bias. Economic indicators that are easily “available” to us get more weight than data. So gas and food prices go up and we get concerned about the health of the economy, regardless of what less visible and more complex indicators are telling us.

Those two indicators in particular are so prominent in people’s minds, and are subject to forces that aren’t necessarily coupled with the general economy that the Fed tracks inflation in energy and groceries separately from the rest of the economy.

More complicated or nuanced information is less easily digested (available) to us and so most of us don’t know how to weight it, if we’re aware of it at all.

On top of the availability bias issue, as is the case with reporting on crime, there are many, many players whose self-interest is served by making people panicky about things that are of little or no concern.

The worlds of short-selling and penny stocks have attracted more than their share of scam artists and fraudsters who are happy to be over-emphasizing, misrepresenting, or lying about developments in the news. But they’re not the only ones.

There are plenty of somewhat less nefarious players who have an incentive to make economic or financial developments seem better or worse than they really are. Politicians, as well as individual companies, industry trade groups, and of course the media, which knows the more extreme the news, the better it sells.

Plus, the third reason not to rely on the news for investing decisions is that by the time members of the media pick up on a story and broadcast or publish it, the pros have already gotten wind of it so you’re coming late to the party. The GameStop story is a prime example. People did make money on GameStop at that time but by the time most people learned about it, they were buying at inflated prices – the money had already been made and all the late-comers could do was lose.

Invest based on data, research and analysis, not emotion

Unless you’re a day trader, which is really more gambling than investing, don’t base your investing decisions on today’s news. Successful investors make informed decisions on buying and selling based on the wealth of data that is available to them.

For many years at Cabot we have used what we call SNAC analysis – story, numbers and charts – to identify strong investment opportunities and help generations of investors get better returns.

The story includes a variety of factors, including:

· The business opportunity

· Strengths and track record of the management team

· Competitive landscape

· Defensible advantages (patents, barriers to entry, etc.).

You get the numbers from a company’s financial reports, such as:

· Sales trends

· Earnings trends

· Price/earnings ratio.

And of course the charts track stock price trends, highs, lows, relative performance, moving averages, trading volume, etc.

Together story, numbers and charts – SNAC – provide a wealth of data you can use to make investing decisions. They’re what give great investors like Warren Buffett the confidence to buy when everyone else is selling as he did in the financial meltdown of 2008/2009.

Each Cabot advisory service has a Chief Analyst whose full time job is researching this data and analyzing the numbers to identify winners. You can hear their current take on the market each week on the Cabot Street Check podcast, available on our website, Apple, Spotify, YouTube and other major podcast platforms.

[author_ad]