Editor’s note: Mike Cintolo and Brad Simmerman sat down for a conversation about growth stocks this week, Brad’s introduction is below and his questions are in bold.

After a quiet few weeks, there’s been a lot going on in the markets of late, from some growth stocks getting hit to volatile action in many indexes to sinking oil prices and interest rates and more.

And wouldn’t you know it: We have Mike Cintolo, Cabot’s Chief Investment Strategist (and head honcho of Cabot Growth Investor and Cabot Top Ten Trader) on the schedule for an article this week. Mike actually has a special webinar— 2024 Mid-Year Outlook: Secrets to Profits in Today’s Challenging Market—coming up on Tuesday, June 18, where Mike will go into detail on his second-half outlook, what he’s watching closely and, of course, some stocks and sectors he’s bullish on for the rest of 2024.

(You can sign up here. And if you can’t attend live, no worries: We’ll shoot you the full recording after it’s over.)

[text_ad]

All that said, I’m never one not to take advantage of an opportunity for content, so I figured why not get a head start (and maybe a sneak peek) at Mike’s thoughts on everything this week. We sat down for a quick session and here’s the good, bad, and ugly of what’s been on Mike’s mind.

Morning Mike. A lot has gone on of late in the market and I know you’ve made a handful of moves in reaction to that. So let’s just start from the top—what do you think of everything that’s happening?

Mike: Yeah, things are simply very mixed, especially when it comes to growth stocks. We had that correction in late March/early April and started to rally, which was pretty much according to the script. However, the rally never really showed much power in my view; it was more about a lack of selling, and once most stuff got up near or just above their spring highs, the sellers did show up again.

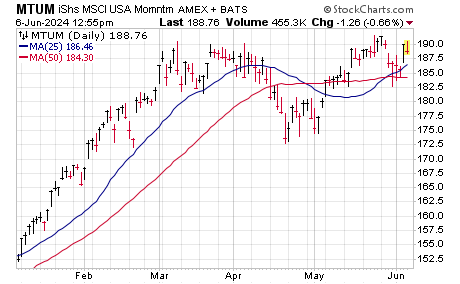

At this point, most of my key intermediate-term measures are neutral—effectively sideways in total over many weeks. As I Tweeted earlier this week, the iShares Momentum Fund (MTUM) is a good example of what’s out there—resistance at the prior highs, sloppy and choppy, trading near key moving averages, etc. But frankly, you’re seeing that among most broad or equal-weight indexes, growth or not.

With a mixed market, it’s fair to say some stuff looks bad, other stuff looks good, with other names flopping around like MTUM. Is that true? And if so, are you seeing any common themes among the good or bad areas?

Mike: Well, on the bad side, there’s no question software stocks have cracked—last week saw not just sloppy but abnormal action from the group. But the biggest commonality I’m seeing out there isn’t about sectors but about “freshness” for lack of a better word: Many stocks that blasted off last November and had big runs are acting funky, while a lot of the more resilient ideas are fresher, maybe having blasted off in the spring or even more recently, like many growth-y retail issues.

You’ve mentioned some abnormal as well as sloppy and choppy action. Is any of this changing your longer-term bullish view you talked about earlier this year?

Mike: No no—that’s a good question Brad. But the answer is no; our Cabot Trend Lines, which are our long-term trend model, remain firmly positive. And it’s not just that, as there have been numerous studies and market happenings that historically precede pretty solid gains going forward. Frankly, all of the big-picture factors that I’ve talked about before are still in place: Growth stocks spent two and a half years declining and bottoming out, then went up for a few months starting last November. Bull markets don’t usually up and die after just a few months. If everything had been up huge the past two or three years, what I am seeing now might give me more longer-term pause, but for a variety of reasons the odds still very much favor higher prices down the road.

In essence, when I talk about some of the recent hiccups, I’m talking about the short- and maybe intermediate-term—maybe the broad market and growth stocks need more time to consolidate the huge gains of November-March. But while the evidence could always change, I’m still expecting another great upmove down the road with tons of names we can sink our teeth into. But for now, it’s somewhat tricky.

OK that’s obviously good to hear. Now, I know you’re not focused on macro economy stuff, but interest rates have recently skidded in a big way—and some out there are now raising the prospects of the economy weakening and even the FDIC said many banks could be insolvent. Any thoughts?

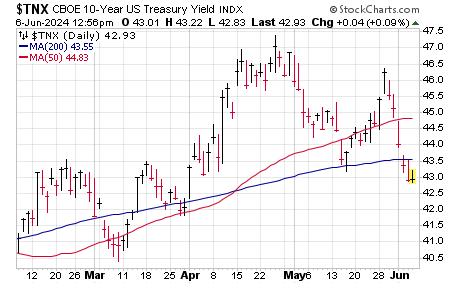

Mike: As you said, I’m not big on macroeconomic stuff; if that was the way to time the market, I’d be all for it, but it’s not. That said, I will say that rates, to me, remain the key secondary indicator out there; beyond the indexes and leading stocks, it’s the metric I make sure to take a look at every day. And if—big if—the trend in rates can turn down, it would be bullish. Maybe not right away, but eventually. If the 10-year note yield can hold below 4.35%, where its 200-day line is, I think that could be meaningful, and very bullish, for stocks.

Back to stocks, if this is still a consolidation in growth, what are you looking for in terms of a green light to pile in?

Mike: Just good old-fashioned strength, both in the indexes and individual stocks. When you look at the chart of the MTUM (shown above), it’s neutral … but a few powerful up days could make the past couple of months look like one big launching pad. It’s harder to define with individual stocks, but basically looking for growth names that have been holding decently to really pop out of there. I know that sounds simple, and it is, but essentially that sort of action, which was mostly missing during the May rally, would tell you the big mutual and hedge funds have some conviction.

Thanks for all of this Mike—I’m sure there will be much more on your webinar, but is there anything you want to mention that I missed?

Mike: The only two things I’d say Brad are, first, as mentioned above, I do remain very bullish for the months ahead, and probably longer than that given the length and depth of the prior bear, and the possibility that the Fed is finally going to turn back into a friend of the market at some point. But also, just pointing out that a lot of what we’re seeing is natural—the market tends to become more selective as it goes on, with names that are extended and that are obvious faltering, while fresher titles get moving. The opportunity there is that, if you can latch onto these new leaders, they are likely just starting multi-month moves; I’m optimistic we own at least a couple of them in Cabot Growth Investor, but my point is the last couple of months of ups and downs should be paving the way not just for another upmove in the indexes, but new leadership that can really make a huge difference in your portfolio.

Great note to end on. Thanks Mike. Looking forward to your presentation on June 18.

[author_ad]