An article I wrote back in 2017 has continued to generate interest, so I decided to take a second look. The idea was to take seriously a hypothetical exchange-traded fund (ETF) that would invest in alcohol stocks, tobacco stocks and firearms stocks. I’ll just reprint the original (below, in italics), then take another look at how this imaginary fund would be doing in today’s market.

Here’s the original setup:

A few years ago, I wrote an April Fool’s Day post about three imaginary mutual funds that pushed the envelope a bit. One of them offered to find the best lotteries in the world and look for winning strategies. Another was essentially a money-laundering operation for the Mafia. But the other mutual fund, which was still supposed to be a joke, has turned out to be a pretty good idea. I’ll give you the results in a minute (think alcohol stocks, tobacco stocks and firearms stocks). Here is the original text.

Futurian ATF Fund In anticipating how investors will react during an economic downturn, we are relying on the truism that when times get tough, life is reduced to its essentials. This fund recognizes that for many people the essentials include alcoholic beverages, tobacco products and firearms. We see this combination of investment in America’s central nervous system depressant of choice, America’s central nervous system stimulant of choice, and America’s paranoid lifestyle accessory of choice as a perfect diversifier for uncertain times. The fund will invest primarily in brewers and distillers, tobacco products companies and gun manufacturers, and we must be prepared to depart somewhat from the conservative tone of our usual marketing materials. Tentative tag lines for this fund include: “Futurian ATF Fund: A double shot of performance,” “Futurian ATF: Smokin’!” and “Futurian ATF: Number one with a bullet!”

Ha, ha.

[text_ad]

But I recently noted that a couple of stocks were showing up in Cabot Top Ten Trader screens that made me wonder if the “ATF Fund” was such a bad idea after all.

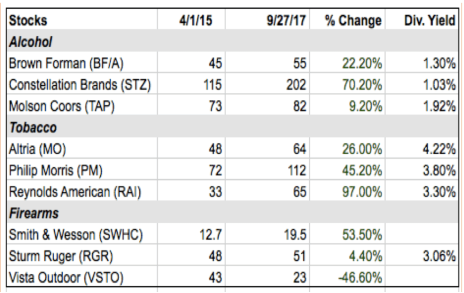

I did a little research and a little calculating, and found that an investment portfolio with three alcohol stocks, three tobacco stocks and three firearm stocks would actually have enjoyed some great returns over the two-and-a-half years since April Fool’s Day 2015.

Here’s the setup. I took the opening prices for three alcohol stocks, three tobacco stocks and three firearms stocks as of April 1, 2015. Then I grabbed their prices as of September 27, 2017 and I figured out the average appreciation of all nine over the two years. (I also noted the annual dividend yields for the seven stocks that pay them, but I didn’t add that into the final performance calculations, because my Excel skills aren’t that good.)

Here’s the result.

Of the nine, only Vista Outdoor has had a rough go. Molson Coors (+9.2%) and Sturm Ruger (+4.4%) were the only other stocks that failed to beat the S&P 500 (+20.5%) over that span. Average return? 28.1%!

Here’s the point: It’s always possible to construct a fabulous portfolio in the rear-view mirror. If I ever learn how to buy or sell a stock yesterday, I will quickly become a rich man.

The ATF portfolio worked for this one period of time only. You could have held Philip Morris (PM) from April 2012 through August 2015 and not gotten a dime from price appreciation. The same applies to Smith & Wesson (SWHC) from July 2012 through the end of 2014 and alcohol stock Molson Coors (TAP) from June 2014 through September 2015.

Sometimes joke portfolios work. Usually they don’t. Try putting together a portfolio using your family’s initials as stock symbols and see how well that works out for you. I’m lucky, because PG (for Paul Goodwin) gives me Procter & Gamble, a company that pays a nice 2.9% annual dividend. But PG is still recovering from a correction that began in late 2014 that dropped the stock from 90 to 64 in just under eight months. Timing is everything.

Lasting success in the stock market comes from finding a system that makes sense to you and following its rules. You may be a value investor, a growth investor, an options investor, an income investor, a trader or a small-cap stock specialist. Or, especially if you’re pretty new to handling your own investing, you may not know yourself.

I can’t give you the kind of exposure to the various investing styles that you will need to find your own preferences. But I can give you a question that will get you started: Which would cause you more distress, being in an aggressive portfolio and watching it go down, or being in a defensive portfolio and watching the market go up without you?

Alcohol Stocks, Tobacco Stocks and Firearms Stocks Today

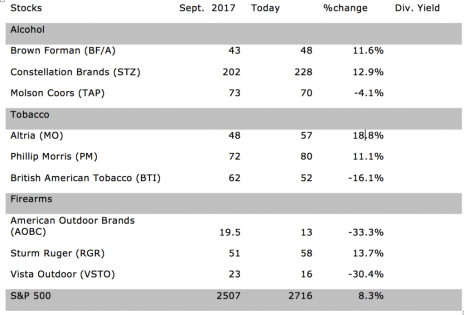

And here’s the update, featuring results right up to June 25. My, how times have changed!

In general, alcohol stocks have done the best, with two of the three companies up since September 2017. Tobacco stocks have generally gone down and two of the three firearms stocks have also declined in value.

I’ll just reproduce the performance table to give you the overall picture. This is based on simple price appreciation/depreciation since the other table ended. I’ve added the S&P 500 for comparison purposes.

As a strategy, the Futurian ATF Fund (which doesn’t exist, remember) has taken some lumps since the last time we checked in. The alcohol group and tobacco group have two components each in the green, although BTI has been dinged pretty hard.

But it’s the firearms group that has taken the biggest hit, with two of its components down over 30%, declines that many analysts ascribe to a lack of threats to gun ownership under the current administration. It would be interesting to see how the purest firearm play (RGR) was able to avoid the big drawdowns that hit the two companies that worked to diversify away from their reliance on firearm sales.

Final notes: AOBC has been in an uptrend since the beginning of March, soaring from 8.3 on March 2 to 13 in recent trading. In the same period, RGR is up from 43 to 58, even after a stiff correction after peaking at 64 in late May. VSTO, not so much.

BF/A is down sharply from its high above 57 in late May, and has fallen through its support that has sustained it all year. STZ is in a rough uptrend, but is still trading right about where it started 2018. TAP has been a mess all year, but after a free-fall decline on May 2, it has been working its way higher (and ignoring the recent crap-storm in the market).

MO has been in a downtrend since late December, and its mild bounce since May isn’t very convincing as an argument that the bottom is in. PM is equally flabby, although its bottom didn’t come until earlier this month. BTI changed character on January 25 and hasn’t been able to sustain a rally since.

The bigger lesson is that proposition bets in the stock market are inherently risky. Industries, sectors and geographies can all decline, and even if you own a diversified assortment of stocks within the group, you can get hit by poor performance from its laggards.

My solution would be to do your own stock selection and manage your own portfolio based on what stocks are actually doing. That’s what Cabot’s growth investing advisories help subscribers do.

If you’d like a competent ally in navigating the rock-strewn waters of individual stocks, Cabot will put almost 200 years of total analyst experience on your side. To learn more, click here.

Do you invest in alcohol stocks, tobacco stocks, or firearms stocks?

[author_ad]