Tesla stock is up 308% since last June. Luckin Coffee stock is up 103% since November. Virgin Galactic stock is up 232% since December(!).

What do these three stocks have in common, aside from the fact that all three of them are in my Cabot Stock of the Week portfolio?

They’re all what we call “story stocks,” which have an exciting story that easily captures the imagination of the investing public.

[text_ad]

Story stocks are famous for soaring to the moon when times are good and retail investors ignore concerns about valuations; you can make a lot of money fast in story stocks.

But story stocks are also famous for their ability to collapse when momentum fades and it becomes clear that there’s no institutional sponsorship to support the stocks; if you get on board late, story stocks can turn a profit into a loss in the blink of an eye.

So let’s analyze these three hot stocks today and see what they have for potential, both on the upside and the downside.

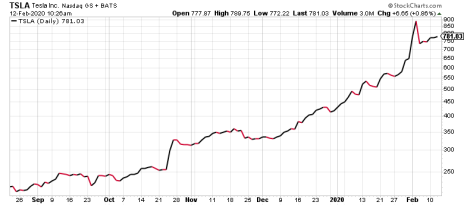

Tesla’s Story

Tesla’s (TSLA) story is fairly well known. The company makes high-performance electric cars that were originally priced out of reach of most people, but as prices have come down and volume has ramped up—especially in China—the firm has become profitable! And this is occurring at exactly the same time that traditional automakers are seeing sales shrink—with the result that Tesla’s market capitalization now exceeds those of Ford (F) and General Motors (GM), combined!

What most people don’t appreciate, though, is that Tesla’s mission is to “accelerate the world’s transition to sustainable energy.” Thus, the company also has a solar roof division, so that people can generate electricity from their own roofs. And it has a battery division that not only provides the batteries for the company’s cars but also provides batteries for backup power systems for both homes and large utilities.

It’s a good story, and fundamentally it’s working.

In the third quarter of last year, Tesla delivered 97,000 vehicles, booking revenues of $6.3 billion and earnings of $1.86 per share. In the fourth quarter, the company produced almost 105,000 vehicles and delivered almost 112,000. And for the full year, the company delivered approximately 367,500 vehicles, 50% more than the previous year.

Short term, the stock is certainly out of trend to the upside, in part because of short covering in recent months.

Technically, Tesla stock has the potential to give up half its recent gain, which could take the stock down to the 460-470 range.

Alternatively, it could give up half of the gain from its old resistance level (390), which would only take the stock down to 575. At first glance, this hardly seems deep enough, but that perception is colored by the past nearly six years of no progress, and the fact is, public perception has now changed in a big way. So maybe a retreat into the high 500s would be correction enough, given the number of investors who are looking to get in on a pullback in the stock as they look to slowly shed their Ford and GM stock.

Long term, I continue to believe that the sky’s the limit for TSLA stock. Tesla is truly changing the world, and there’s a decent possibility that its energy business will someday dwarf its automotive business!

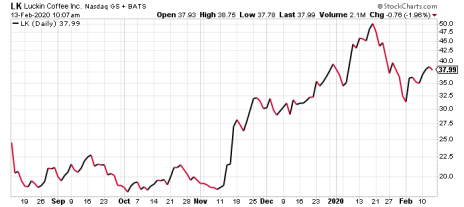

Luckin Coffee’s Story

Luckin Coffee (LK) is far less well known than Tesla, particularly in the U.S., but it has huge potential, too!

In the third quarter of 2019, revenues were $216 million, up a massive 517% from the year before—mainly from selling coffee!

In fact, Luckin is set to become the largest coffee retailer in China, surpassing Starbucks (SBUX)—because it offers a convenient and lower-cost product. We’re all familiar with Starbucks’ model, which in my experience involves a lot of waiting, but Luckin boasts a technology-driven retail pick-up model that provides coffee and other products to customers in a 100% cashier-less environment, with customers ordering online and given a time to swing by and pick up their drink.

Additionally, it’s worth noting that the Chinese coffee market remains shockingly underpenetrated by western standards—China is a nation of tea drinkers, while coffee consumption was a mere 6.2 cups per person in 2018. As that changes, Luckin should thrive.

Until now, marketing costs for new store openings and customer promotions exceeded revenue, but the company expects to generate positive free cash flow by the fourth quarter of 2020. And revenue is projected to quickly expand from $732 million in 2019 to $2.0 billion in 2020.

Most recently, the company announced that it ended 2019 with about 4,500 outlets, a number that exceeds the total Starbucks stores in China. And it announced Luckin Coffee Express – a vending machine for brewed coffee and snacks.

Here’s the Luckin Coffee stock chart.

Not surprisingly, LK is in the midst of a short-term pullback, dipping as low as 31 after topping out at 50 less than a month ago. But long term, I believe Luckin Coffee stock can climb much higher—if management makes the right decisions. Fundamentally, the company has the potential to be as successful as McDonald’s has been, first in its native country and then globally.

Virgin Galactic’s Story

Sir Richard Branson’s Virgin empire encompasses dozens of companies, including Virgin Atlantic, Virgin Books, Virgin Hotels, Virgin Cruises, Virgin Mobile, Virgin Money, Virgin Radio and Virgin Wines—as well as dozens that have been sold or folded—but the star of the moment is Virgin Galactic.

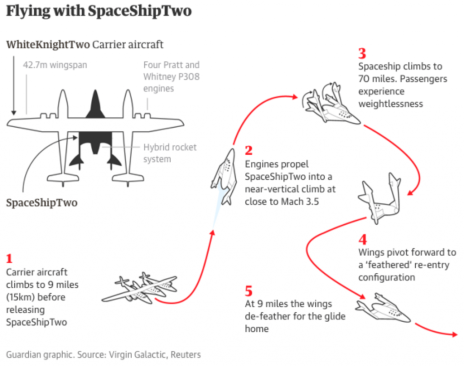

Virgin Galactic (SPCE) has developed the reusable SpaceShipTwo spaceflight system, which consists of WhiteKnightTwo, a custom-built carrier aircraft, and SpaceShipTwo, the world’s first passenger carrying spaceship to be built by a private company and operated in commercial service.

Commercial flights lasting 90 minutes, which will escape the Earth’s atmosphere and allow passengers to experience weightlessness and see the planet’s rim from space, are planned to begin this year. Already, more than 600 people from 60 countries have secured a spot by making a deposit by putting down half the $250,000 total fare. Richard Branson himself plans to be on the first flight (with five other passengers), and Virgin has an additional 2,500 people on the waiting list.

Credit Suisse recently concluded that Virgin would have a “near-term monopoly” on the space tourism market once SpaceshipTwo begins operations, but the real goal is the transcontinental airline market, where hypersonic point-to-point travel would cut the travel time of a L.A.-Tokyo flight (for example) from 11 hours to two hours—barely time for a movie.

The company has adequate cash reserves. It has top-notch management; CEO George Whiteside left NASA to join the team. And it projects 70% Google-like profit margins as it plans to incrementally lower prices as volume scales upward (just as Tesla has).

Of course, if the first flight fails, that would be a big setback. But the odds of success are good—and as the story has spread, investors have grown excited about Virgin Galactic stock.

As I write, SPCE stock is extended to the upside, but the continued high volume of buying tells us the trend may continue. Eventually, however, a correction will develop, and we could easily see the stock fall to 12.

Long term, this stock has enormous potential—though obviously it will take time. TSLA, for example, spent nearly six years making no progress between its 2013 blastoff and its 2020 surge higher, and SPCE, too, will certainly suffer delays and setbacks. (The original target date for the first space tourism flight was 2008!)

Personal Note: Back in 1996, I heard Sir Richard Branson speak when he was inducted into the Academy of Distinguished Entrepreneurs at Babson College, my brother’s alma mater. In the Q&A that followed, someone in the audience asked Mr. Branson (he wasn’t knighted until 2000) what his favorite business books were. He answered, “I don’t read books.” As a book-lover, I found that shocking, but for him, imagination and ambition have clearly been more important than received wisdom.

[author_ad]

This post has been updated from an original version.