Growth investing is a tough business. That’s just the plain truth. The market knows a hundred ways to entice you and encourage you to buy a stock and a thousand ways to make you wish you hadn’t.

And yet, there are plenty of growth investors—those who know the rules and have the discipline to follow them—who understand that two or three winners a year is enough to add a real dose of profits to their portfolios.

But there are plenty of other stock investors who see growth investing as a ticket to the graveyard of lost ships. Their experience is that they buy a stock that’s pushing its price up the chart and then BOOM it sinks like a rock.

[text_ad]

Once that happens to you a time or two, you get a little gun-shy about investing in any stock that’s already made substantial advances. And that has made index investors (or value investors) out of a lot of people who could really benefit from the growth discipline.

Why Growth Stocks Are Smarter than You Are

Here’s one example of a great growth stock that I believe can give you hope. The company is China Lodging (HTHT), a company that is expanding its string of branded hotels across China. China Lodging has mastered the technique of finding promising local hotels and adding them to its chain by upgrading facilities and installing trained managers. They call it “manachising,” and it’s an asset-light way to expand its hotel count.

I won’t go into China Lodging’s excellent revenue, earnings, margins and projections. You can find those easily enough.

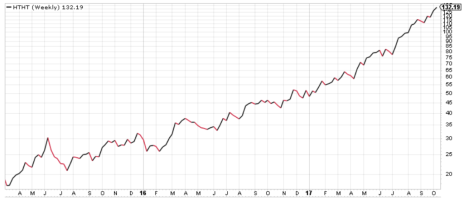

What I really want to point out is the story of HTHT’s chart. Here’s a year-to-date weekly chart of HTHT. You’ll have to admit it looks great.

Any investor would be proud to have a stock in his portfolio that opened the year at 51.8 and is now trading at 131.7. That’s a big win.

But many investors would look at that chart and say, “Well, I’ve clearly missed that one. It’s way too high to buy.”

And there’s a logic to that. The stock is up 154% already, there’s nowhere to go but down. Right?

Wrong.

Here’s a chart showing the stock’s price movement from a year earlier (the start of 2016) until now.

That’s the chart of a stock that’s gone from 30.5 to 131.7. That’s a gain of 332%!

But imagine if you had looked at the stock at the beginning of 2017 and decided that after a run from 30.5 (where it opened in January 2016) to 51.8 (where it opened in January 2017), that it had clearly run its course. After all, a 70% price increase like that is pretty impressive.

My point is that growth stocks don’t think the way you do. They don’t assign themselves arbitrary limits and stop rising when they reach them.

HTHT is an extraordinary story because China Lodging has a unique business strategy and China is a country that’s primed for growth and a business model of national consolidation. The U.S. has plenty of hotel chains battling one another; China has none, at least until now.

But while HTHT is exceptional, it’s not unprecedented, or even rare. In Cabot’s history, we have found growth stocks that have appreciated 1,000% or more. And if you discount a stock because it has already had a big run, you will shut yourself out of the gains it makes by ignoring the limits you put on it.

Growth investing is like tuna fishing; you don’t catch one on every trip, but when you do, it’s very rewarding. And if all you do is hang your hook off the end of the pier, you’re never going to hook one.

But I have one more chart for you. It’s the chart of HTHT from its low back in March 2015, when it bottomed at 15. I’m not just trying to torture you, I actually have one final point to make.

In theory, if you had bought HTHT at that brief dip to 15 in March 2015, you would now be looking at a return of 778%!

Growth Investing, In Reality

Except that that would never happen. In the first place, no responsible growth investor would buy a stock in a downtrend that had scrubbed off half of its value from the beginning of 2014. That’s because, just as there is no upper limit on how high a stock can go, there’s no limit on the downside either. That’s where the truth of the market maxim “never try to catch a falling knife” comes in.

Plus, even if you had lucked out and bought at that bottom, you would have been shaken out of the stock by the June/July 2015 correction or the long stretch with no net progress that extended into 2016.

Growth investors don’t buy at bottoms. I didn’t add HTHT to the portfolio of Cabot Global Stocks Explorer until March 2016. And I had to be patient through an April-through-June correction to hold on for the great run it resumed in late June.

The rewards from growth investing come from a tiny handful of stocks that achieve great things, and you have to be prepared to kiss a fair number of frogs to get to one prince. But stocks like HTHT make it worth it.

And I still have the stock rated Buy. I’m certainly not going to tell it that it can’t go any higher!

[author_ad]