Well, the holidays are upon us, so this will be my last Wealth Daily of what’s been a tough year for the bulls. And I’ll get into what growth investing lessons we can take away from this year in a minute. First and foremost, I wanted to wish you and yours a great holiday season—make sure you hug your loved ones and get some R&R.

Looking ahead, I have a free webinar in mid/late January coming up where I’ll talk about my outlook/what I’m seeing for 2023—I believe January 19 will be the date and I’m sure our marketing team will hit you up if you want to register and listen in. But today I’m getting a head start on that with a stream of consciousness of what I’m seeing and thinking right now: Some things are important, some are secondary (or tertiary) ideas, but I figure now’s a good time to give you a few things to look at and review as you’re sipping eggnog and playing with the kids (or grandkids).

Here we go, in no particular order …

[text_ad]

1. One of my main thoughts this year is, once again, how well trend-following, market-timing systems work. I started my career going down the rabbit hole, looking at all sorts of second- and third-derivative indicators, but while not perfect, a couple of simple trend models can do just as well, if not better. In particular, our Cabot Trend Lines turned negative in late January and have remained so ever since, even during the rally phases in the market—until the S&P 500 and Nasdaq can get (and stay) above their respective 35-week moving averages, it’s best to avoid becoming too bullish.

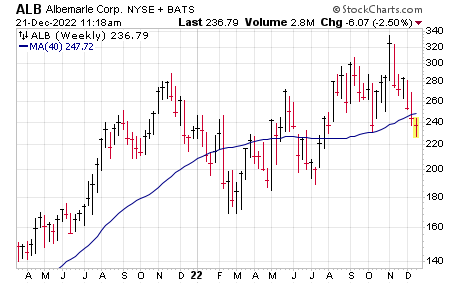

2. Besides the long-term trend, the #1 “tell” all year that the market was unhealthy was the consistent rejection of stocks that tried to lift above key resistance areas—whether major moving averages or price levels, or if they did, they were quickly sold off. There are literally hundreds of examples, but look at Albemarle (ALB) more recently—a quick, big-volume lift to virgin turf as soon as the pressure came off the market, breaking free from a year-long structure … only to implode the following week and sag 30%-plus during the ensuing month. Not sure I can build an indicator that reflects this, but this is another thing I want to see change before diving into the market in any major way.

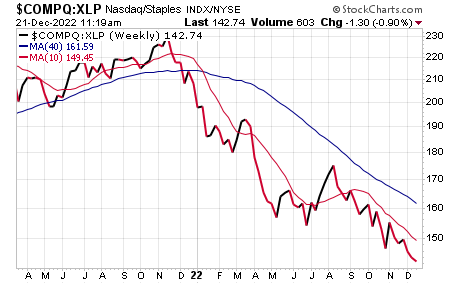

3. Then comes our Aggression Index, which measures the Nasdaq (growth) vs. the Consumer Staples Fund (XLP—defensive stocks). I’m sorry, but the whole rally that started in October and picked up in November was really led by XLP and other safer areas (even the stodgy Dow Industrials outperformed other indexes)—so much so that the Aggression Index is scraping new low ground. In most cases, you see this measure bottom ahead of the market, but going forward, I’d like to see the Index take out the 40-week line as a sign growth-oriented stocks are perking up.

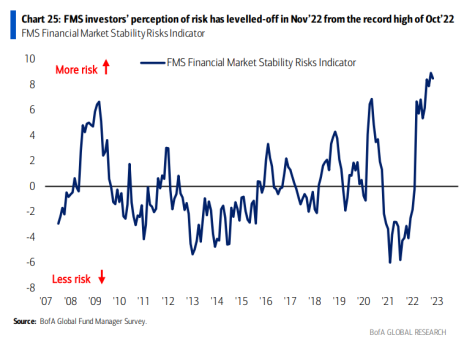

4. One thing I don’t think needs to change is sentiment. I’m reading some stuff online telling me that sentiment isn’t that bad, and people still own a ton of stocks. Maybe. But 90% of measures out there (plus my own eyes and ears) tell me people are pessimistic, expecting a recession, and few are thinking about making big money in a bull market. The Bank of America monthly survey of fund managers—who, in large part, control the market—reflects this. Doesn’t mean they’re wrong, but if everyone expects something, a lot of it is likely priced in.

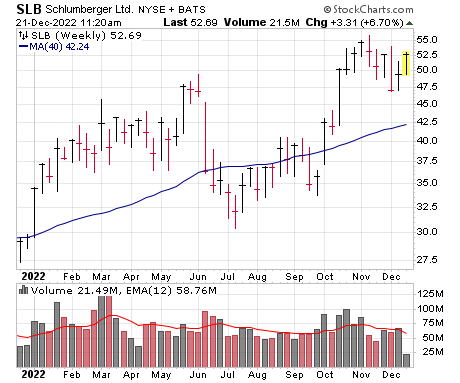

5. Moving to sectors, I’m interested in what happens to energy stocks at this point. To me, the odds favor many of them have hit tops—it makes sense given the late-stage bases most formed (came after big, prolonged runs and were sloppy), the recent selling pressure and the fact that they tend to roll over late in an economic cycle. That said, the cash flow/dividend/share buyback stories here are very real, so I’ll be interested in some resilient names in the exploration (like Chord Energy (CHRD)) and services (Schlumberger (SLB)) space hold up and get moving in the New Year.

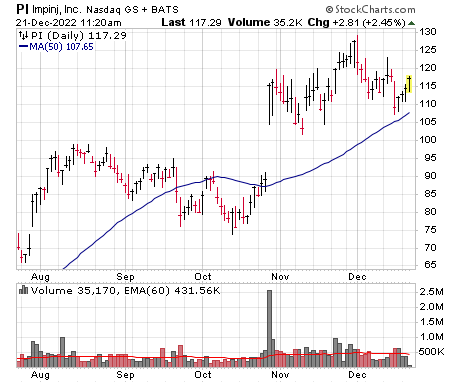

6. More recently, the market has obviously gotten hit before and after the Fed’s latest hawkishness, though so far, I’m not seeing many breakdowns among potential growth stock leaders—yes, some financials and other names have cracked, and everything has backed off, but a lot of names have respected areas of support. One of many examples is Impinj (PI), which dipped to its 50-day line and held … again, so far. Axon Enterprises (AXON) is another, holding the 10-week line. In general, the market’s post-Fed reaction has been worse for the indexes than potential leaders to this point. Worth watching—to this point, many names are still set up decently.

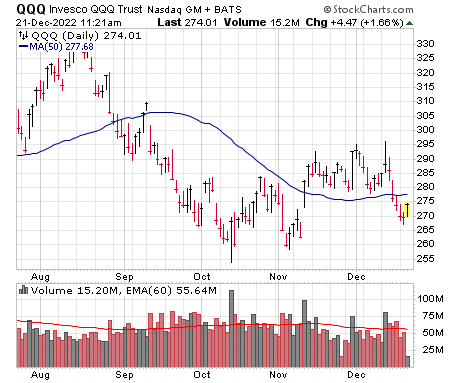

a. Backing this up is the fact that equal-weighted indexes have been outperforming their market cap-weighted cousins. For instance, check out the Nasdaq 100 (QQQ) below—then look at QQQE, which is the same stocks but equally weighted (not heavy in Apple, Amazon, Google, etc.). The average stock is at least trying to resist in recent weeks and months, and from what I see that continues to this day.

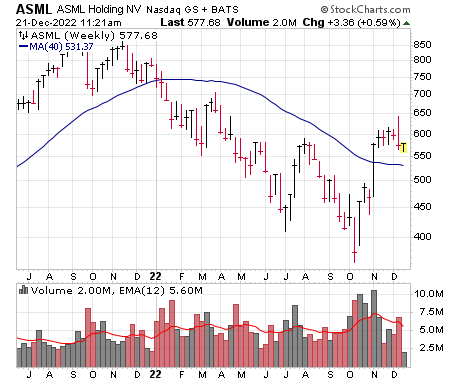

7. Most of my efforts are not focused on former leaders that went through the wringer during the bear market—yes, they can bounce, but the odds favor new leaders will emerge (and I’ll touch on a couple of favorites later on). But one name I am keeping an eye on is ASML Inc. (ASML), which is basically a monopoly when it comes to super high-end systems to etch advanced chips. Despite bad industry conditions, earnings are likely to fall just 12% this year, with analysts seeing a 30%-plus bump in 2023—and the chart is interesting, with a big shakeout in October below its summer lows, only to immediately roar back and hold firm above its 40-week line in recent weeks. I’d also note that, while not quite as strong, many chip equipment stocks are intriguingly resilient of late. ASML is on my watch list.

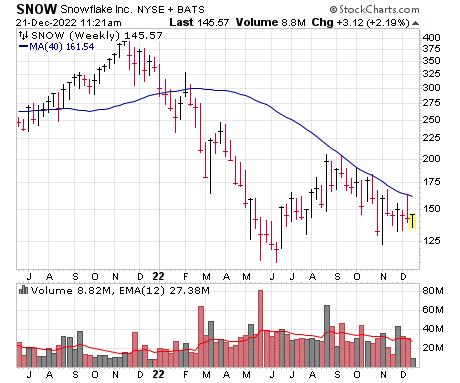

8. While I’m not eager to load up on obvious former leaders that had huge, prolonged runs, I am keeping an eye on the market’s cradle—history tells us that some IPOs of the past couple of years will be among the leaders of the next bull move. A couple of these names are on my watch list in Cabot Growth Investor, and I don’t want to give away the store here, but one name to watch (I’ve been keeping an eye on it for over a year) is Snowflake (SNOW), which has emerging blue chip written all over it: The firm is pioneering the so-called Data Cloud, allowing all departments and even different firms (suppliers, etc.) to securely share and view data. More than a quarter of the Fortune 2000 are clients, revenues and remaining performance obligations (money that’s coming down the pike) are booming (up 66% in Q3), and while earnings are in the red, free cash flow is positive ($1.25 per share during the past year). Shares aren’t strong yet, but they’ve been holding their spring lows and actually etched a couple of higher lows in recent weeks. As with everything else, I’ll wait for some decisive show of strength before taking action, but SNOW looks intriguing.

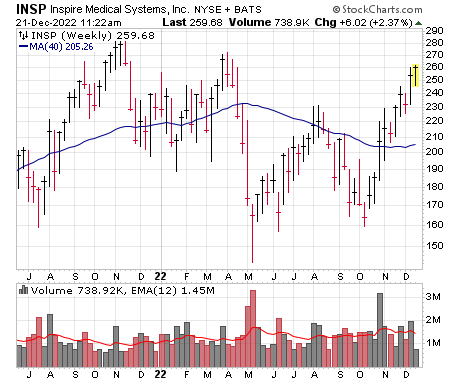

9. In terms of groups, nothing much has changed my thinking that the broad medical arena—devices, biotech, etc.—has a good shot at being the next leading growth group, because (a) many stocks haven’t done anything (net-net) for years, but (b) many are acting resiliently in recent months and (c) their growth stories are basically independent of the economy. There are many names I like, including Inspire Medical (INSP), which has a revolutionary treatment for sleep apnea (three tiny devices are implanted that keep the airway open at night) that works like a charm, is implanted via a two-hour outpatient procedure, is compatible with full body MRIs and eliminates the problem with non-compliance (as is seen with CPAP machines). Earnings are in the red, but revenues have grown north of 70% each of the past five quarters and the stock has changed character since earnings in early November, attacking its all-time highs. INSP probably needs a rest, but I think it has great potential when the market gets going.

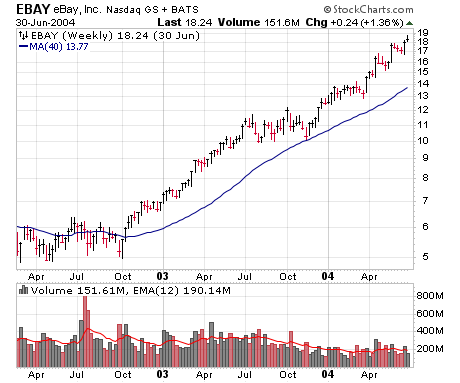

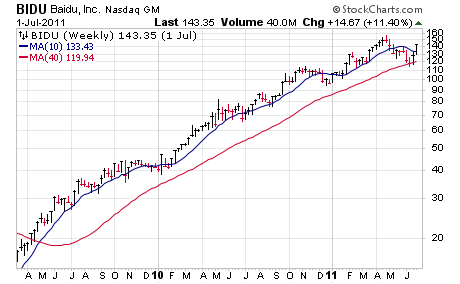

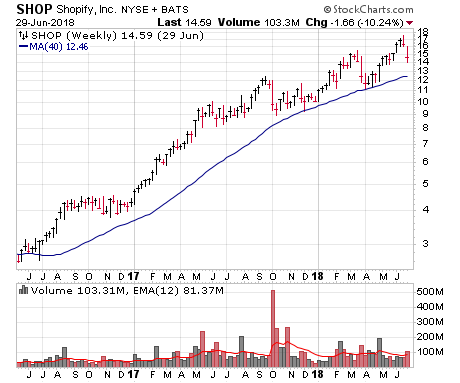

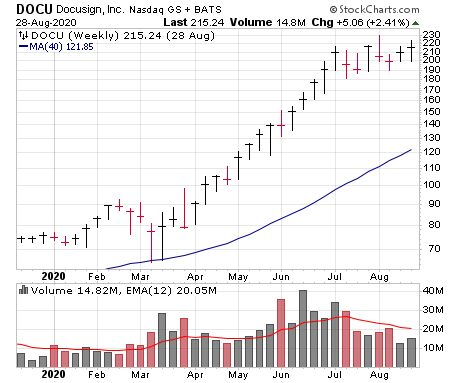

10. Last but not least, I wanted to end my (Wealth Daily) year with a simple but possibly surprising message for 2023: Keep your head up and think big, because whenever the market does turn, it’s going to launch stocks that don’t just break out, but break out and run up quickly, digest for a couple of weeks, and then rally further on their way to huge gains. I’ve been at Cabot for 23 years and have been investing longer than that and have seen my share of crashes, panics, bears, you name it—and every time, the market comes out of it, there’s a new bull phase and the new leaders put on ridiculous performances. Below are examples from the 2003 kickoff (EBAY), the 2009 bottom (BIDU), the 2017 takeoff in growth stocks post-election (SHOP) and of course the 2020 crash (DOCU)—obviously, most stocks won’t post these types of gains, but many leaders will, and this bear is laying the groundwork for these types of moves. Stay engaged, and you’ll likely land one or two of the monsters when the bears finish up.

OK that’s all for me in 2022 – have a great holiday season, and I hope to see/hear from you at my webinar next month.

[author_ad]