With the stock market performing well and a few rate cuts expected later in the year, both underwriter and investor appetite for new IPOs is improving.

At the same time, the performance of companies from the IPO classes of 2021, 2022 and 2023 is picking up. And there are more than a handful of these stocks that have come unleashed and seem to be rising every day.

[text_ad]

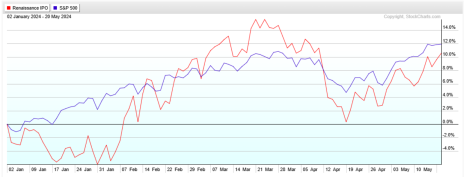

Check out the chart below of the Renaissance IPO ETF (IPO). It includes companies with an average age of just over two years. While the IPO ETF (red line) has virtually zero overlap with the S&P 500 (blue line) it is about even in terms of year-to-date gains.

That’s saying something given just how depressed many IPO stocks were over the last two years, and even into the beginning of 2024.

My message to risk-tolerant investors is simple. A recovering asset class chock full of relatively young stocks that’s gaining momentum right now is something to take note of.

2024 IPO Market Is Heating Up

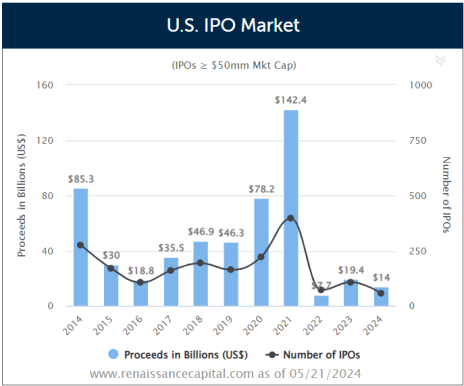

A quick and dirty look at the IPO market over the last decade or so.

From 2015 through 2021 IPOs raised more than $30 billion each year. The last two years of that stretch were exceptionally strong, with $78 billion (2020) and $142 billion (2021) raised.

But the IPO market locked up in 2022. A pitiful $7.7 billion was raised by the 71 companies that came public. It was a little better in 2023 when 108 new companies came public, raising $19.4 billion.

But still, in the context of the last decade, those are some pretty bad years.

As we approach the halfway point of 2024, the IPO market looks a HECK of a lot better.

We’ve seen 57 IPOs price this year raising a total of $14 billion. That’s 36% more IPOs than at this same time last year, and more than 107% more capital raised.

Moreover, things have accelerated significantly since mid-March. Roughly half of the year’s IPOs and funds raised have come in the last two months.

2 Fresh IPOs to Monitor Now

Readers of my advisory services know I don’t like to jump into a super fresh IPO. They are just too volatile.

That volatility tends to smooth out over time, and especially after lockup expiration passes (usually 90 to 180 days after the IPO date). That’s when insiders are free to sell and we get a better feel for what the real demand for shares is.

That said, here are two recent IPOs I suggest keeping an eye on for potential purchase down the road.

Rubrik (RBRK)

Rubrik (RBRK) came public four weeks ago on April 25 at 32. Shares traded as high as 40 that day and are currently trading in the mid-30s, giving Rubrik a market cap of roughly $6.4 billion.

It’s a cybersecurity company that’s been financially backed and working with Microsoft (MSFT) for years. Rubrik’s Zero Trust approach essentially means that no person or data is to be trusted and that data breaches should be assumed. That philosophy means customers are better positioned to recover data after an attack and avoid paying a ransom.

As has been the norm with other security companies, revenue has decelerated lately (+19% two years ago and +5% last year) but is seen picking back up again in the current fiscal year (+29% to $807 million is the consensus estimate).

Viking Holdings (VIK)

Viking Holdings (VIK) just came public on May 1 at 24 a share. It has traded as high as 30 this week and has a market cap of roughly $12 billion.

This is the Viking cruise ship operator you’ve likely seen ads for. They seem to be all over the place. The company has a fleet of 92 small, state-of-the-art ships (with 18 new river vessels and six ocean ships on order) and offers tours all over the world.

Revenue was up 48% to $4.7 billion in 2023.

2 Upcoming IPOs to Watch

There are a number of enticing offerings on the schedule. But here are two in particular that I think should be on the top of your list to keep an eye on.

Bowhead Specialty Holdings (BOW)

Bowhead Specialty Holdings (BOW) is looking to go public today, May 23rd. The company is a specialty property & casualty insurer expecting to raise $100 million at a $473 million market cap. The upcoming offering caught my eye because there’s been a number of high-performing insurance stocks operating in different areas of the market.

At the larger end of the spectrum are Progressive (PGR) and Allstate (ALL), while at the smaller end are Root (ROOT) and Skyward Specialty (SKWD). For its part, Bowhead specializes in casualty, professional liability, and healthcare. Products are typically written on an excess and surplus basis. Everything is written through American Family.

Novelis (NVL)

For the materials stock enthusiasts there’s Novelis (NVL). It is an industrial aluminum company specializing in flat-rolled aluminum and recyclable aluminum.

Customers come from the beverage packaging, automotive and aerospace markets. The company is working with Morgan Stanley, Bank of America and Citigroup and is looking to raise $1.2 billion at a $18 billion valuation, potentially sometime in June.

Novelis is owned by India’s Hindalco and operates on four continents.

Seasoned IPOs to Buy Now

If you’d like to know more about which IPOs you should consider buying, when to buy, and why shares should do well, consider a subscription to Cabot Early Opportunities.

We currently have two new positions from the IPO class of 2023, both showing gains of around 30% with ample potential to go higher.

We also have a new position from the IPO class of 2024 trading near our entry price, and two additional stocks from the IPO classes of 2020 and 2021 that are on our Watch List.

[author_ad]