You can’t get in too early on recent IPOs; they often stumble out of the gates. But the buying volume can announce big changes in character.

One of the trickiest things about IPOs is that many (especially high-profile ones) will endure what we call the “IPO droop” for a few weeks or months after coming public. That’s why we rarely advise going after recent IPOs during the first two or three weeks after they come out—without some chart action, it’s impossible to really know what the Fidelitys and T. Rowe Prices of the world think of the stock.

Sometimes this droop lasts a couple of months and other times it can last years, it just depends on the stock and market environment. What’s interesting is that, unlike more established stocks, sometimes it takes just two or three weeks to turn the corner—we’re still studying it, but there are some major examples where two or three volume clusters (two or three weeks in a row of big buying volume) have served to turn the tide on what turned out to be huge winners.

[text_ad]

3 Past Post-IPO Bumps

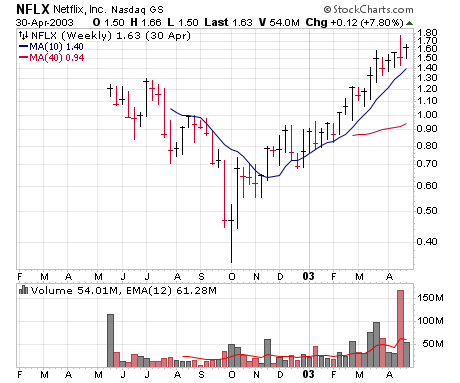

The initial example was Netflix (NFLX), back when it was growing fast as a DVD-by-mail outfit and putting firms like Blockbuster out of business. It came public May 2002, in the midst of the horrid bear market, and proceeded to plunge into the market’s October low. While it’s hard to see on the chart, the two weeks at the start of October brought gigantic upmoves in both price (nearly doubled!) and volume (by far the two largest volume weeks since the IPO). That was pretty much it for the downturn, with the stock enjoying a 10-fold move higher to its peak in 2004 (not shown).

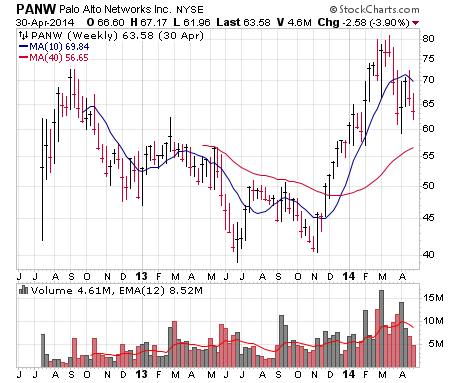

Moving ahead a decade, we have Palo Alto Networks (PANW), which back then was the new-age cybersecurity provider of its day. After the mid-2012 IPO got off to a good start, the name fizzled for more than a year. But in November 2013, something changed—the stock flashed four straight big-volume buying weeks right off the low, kicking off not just a good intermediate-term run (went from 55 to 80 in just a few weeks) but after a correction, a huge longer-term upmove, too (to 200 in mid-2015).

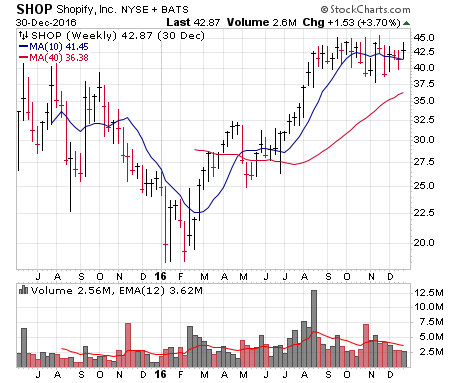

Most recently, look at Shopify (SHOP), which has been one of the largest winners of recent years. The IPO in mid-2015 led to some wild swings before it was cut in half by early 2016. But similar to PANW, Shopify then had four straight above-average volume buying weeks right off the low (three came on very big volume), which was the start of what turned into a ridiculous advance.

One Recent IPO with Increasing Volume

Why write about this now? Because so many of this year’s hot IPOs went splat sometime in the first five months of the year. One that caught our eye: Snowflake (SNOW), which seems to be completely upending the data management space—the firm’s data cloud platform doesn’t just allow firms big and small seamless access to and the power to mine their data, but also offers the ability for safe data sharing inside and outside an organization (setting up powerful network effects). Just about all data types are allowed, there’s no compute limitations, it’s all in a single programming language and—importantly—Snowflake charges based on consumption (not subscription), which (a) makes it cheap enough for small fries and (b) leverages it to greater data usage and sharing among its clients. Analysts think it’s playing in a $75 billion market.

The numbers are impressive to say the least: Revenues have been growing at triple-digit rates for many quarters (up 110% in Q1), and perhaps more eye opening is the firm’s remaining performance obligations (RPOs—basically all money under contract that it’s set to earn going forward). At the end of Q1, it had $1.43 billion of RPOs, more than triple that of the year before. Moreover, while earnings are negative, free cash flow was in the black in Q1.

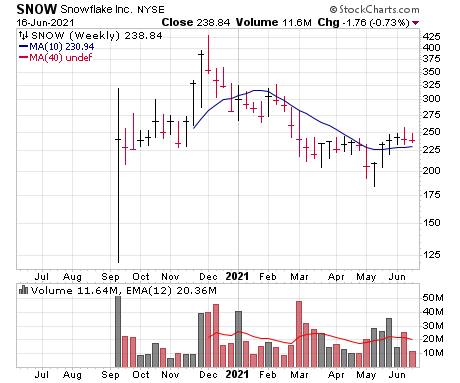

The trick since SNOW’s IPO last September has been valuation. It’s massive! Even today, sitting well off its prior high, the market cap is north of $70 billion! However, this is clearly a unique growth story that big investors are favoring (852 funds own shares already), and it might be following the pattern of the above-mentioned winners—after being more than cut in half from its peak and hitting lifetime lows in May, SNOW saw a volume cluster of three weeks in a row, which including very nice supporting action after earnings.

Of course, just looking at the chart, it’s hard to conclude it’s completely out of the woods—there’s plenty of overhead to chew through, including a decent amount just above here. But it does look like SNOW has changed character (five weeks up in a row; first time it’s been up more than three in a row since the IPO), and the volume cluster has us intrigued. Officially we want to see more strength, but if you wanted to start with a token position here, we wouldn’t argue with it.

Have you invested in any recent IPOs? How did they turn out?

Editor’s Note: This post was excerpted from a recent issue of Cabot Growth Investor. To read more, click here.

[author_ad]